Decoding ‘State of Avalanche Q4’ report for long-term AVAX holders

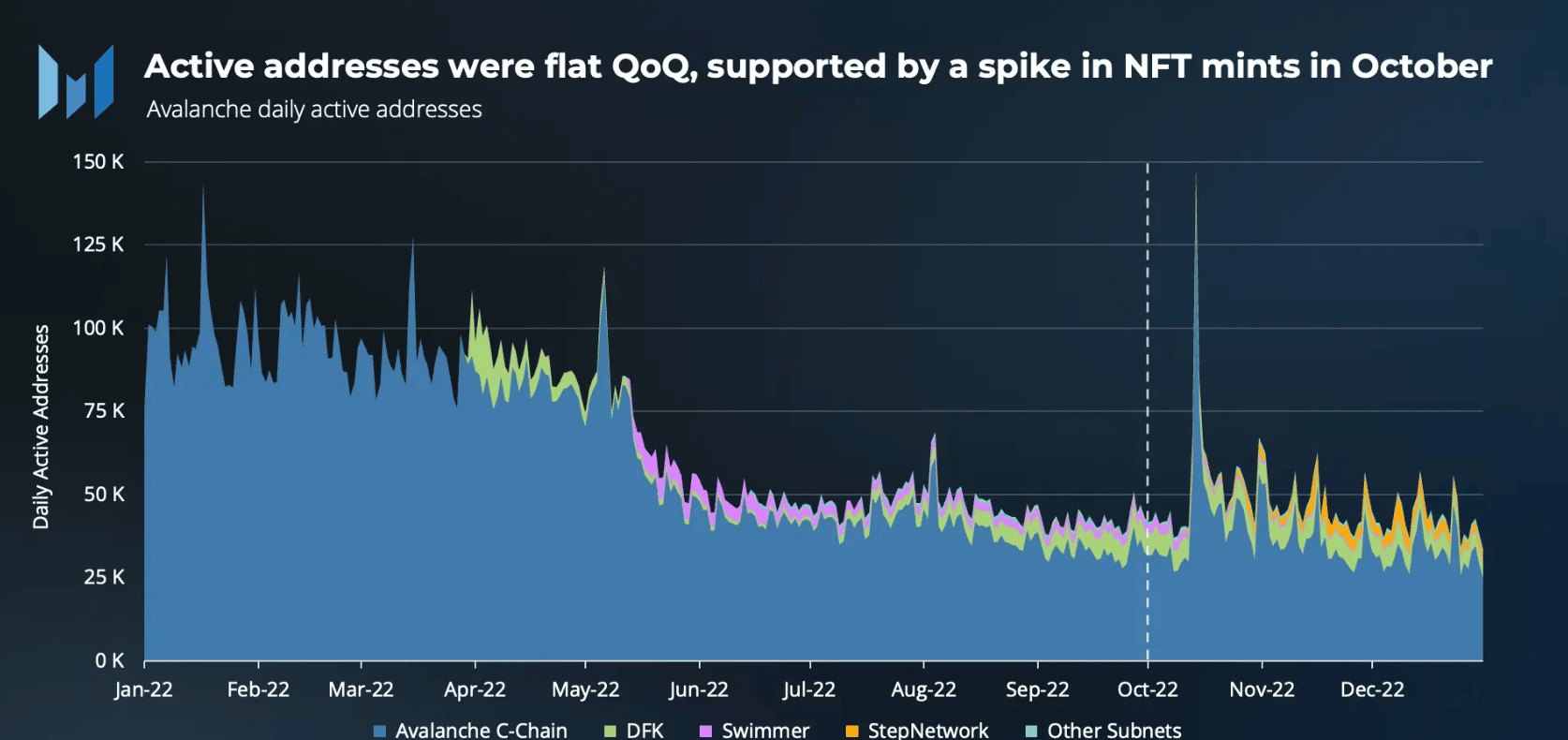

- Avalanche’s daily activity was impacted by native projects.

- The NFT market underperformed.

According to a report provided by Messari, projects on Avalanche observed significant improvements in Q4 of the previous year.

These improvements had a significant impact on the daily activity of Avalanche, leading to a rise in overall interest in the protocol.

One of the major contributors to this increase in interest was the launch of projects such as Trader Joe and GMX.

Both of these projects leveraged Avalanche’s fast, secure, and decentralized infrastructure to provide their users with a range of innovative and highly demanded services.

Realistic or not, here’s AVAX’s market cap in BTC’s terms

NFTs provide some relief

Despite the growth of these protocols, the number of active addresses on the Avalanche network showed a decrease. However, there were a few spikes observed during this time, which were attributed to increased interest in the NFT market.

The spike in NFT interest was reflected in the growing number of NFT transactions on the Avalanche network.

However, at press time, the state of Avalanche’s NFT market was not as strong as it had been previously.

Data provided by AVAX NFT stats showed that the NFT volume for blue-chip Avax NFTs had declined significantly over the past few weeks.

The decline in activity on Avalanche has had a number of knock-on effects on the overall state of the protocol. For example, fees collected by Avalanche and the number of transactions on the network dwindled.

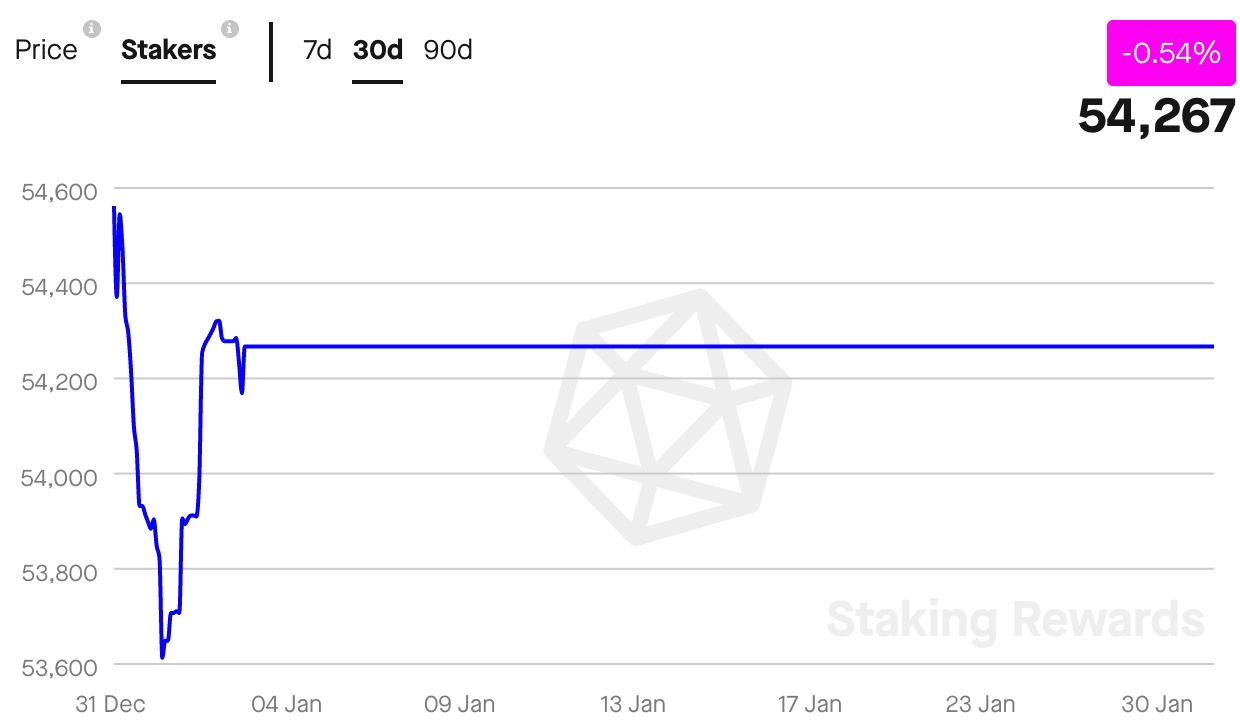

The declining fees and subsequent decline in the revenue generated by Avalanche could be a factor that affected the state of stakers on the Avalanche protocol.

According to data provided by Staking Rewards, the number of stakers on the Avalanche protocol decreased materially over the last 30 days. At the time of writing, it was 54,267.

Signs of hope

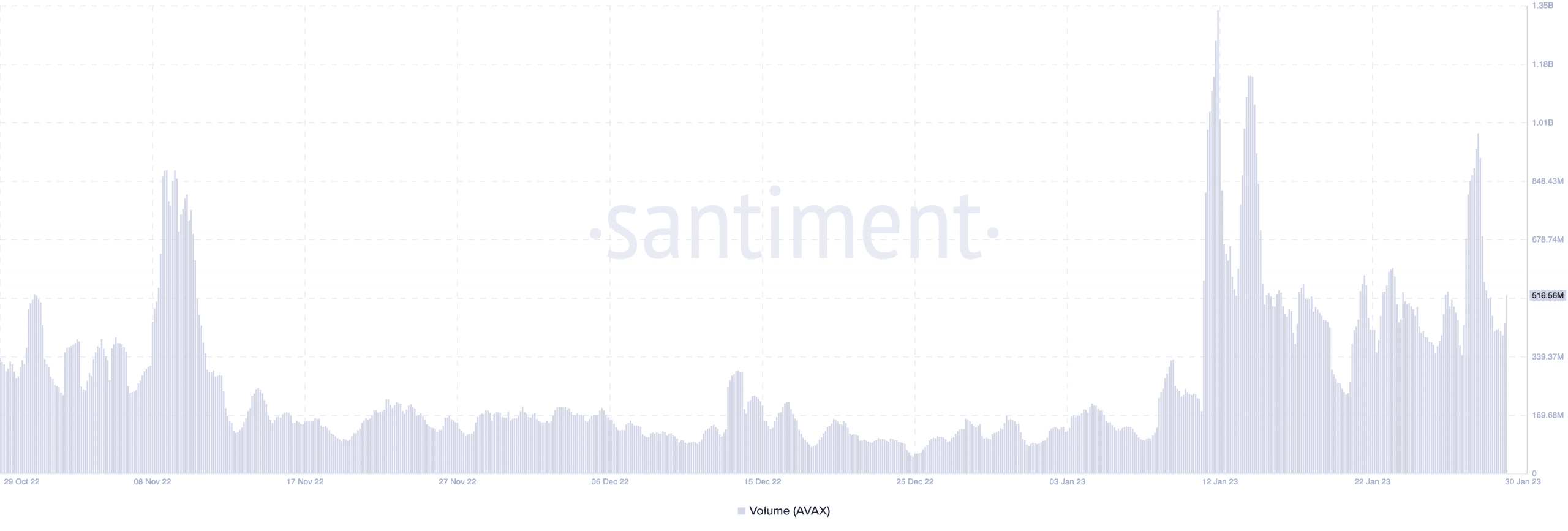

Furthermore, over the last few days, the volume on Avalanche saw massive growth. It went from 98.4 million to 516.7 million during this period.

This spike in trading volume coupled with growing gas usage could be a sign of optimism for AVAX token holders.

Read Avalanche’s Price Prediction 2023-2024

Along with the growing volume, the amount of gas used by Avalanche also witnessed an increase over the last week. This could suggest that there may be a resurgence of interest in Avalanche that could happen soon.