Decoding the reasons behind Chainlink’s [LINK] recovery from crash

A token that has recently been making up for lost ground in the crypto market is Chainlink [LINK]. New developments on the network are already showing positive reinforcements on the native LINK’s prices. However, the question is- What are these changes that have taken place on the network and where does the performance of the token go from here?

Back with a bang!

Chainlink’s native token LINK went on a 40% surge since 24 June after bearing the weight of the crypto crash recently. At press time, iT was trading at $7.26 after the drawdown. The hike is subjected to several announcements released by the network via their social media platforms.

Like other blockchains, Chainlink too, seems to have postponed their developments because of the ongoing bear market. This has made developers much more active on the chain as compared to their activity levels in the last few weeks.

In the last 24 hours, Outer Ring, a sci-fi MMO, released its collaboration with Chainlink. Outer Ring has integrated with the Chainlink VRF to distribute more than 350,000 NFTs from the Lootboxes sale. The due date for the sale is set for 29 June. Outer Ring will also deploy Chainlink Price Feed for securing the platform from potential hacks.

.@OuterRingMMO has integrated #Chainlink VRF to help randomly distribute #NFT weapons, armor, ships, and other in-game items from its loot boxes.

Outer Ring is also integrating Chainlink Price Feeds to help set conversion rates in its NFT marketplace.https://t.co/rLTvUK61BM

— Chainlink (@chainlink) June 24, 2022

In an announcement, DefiEdge, a decentralized asset management protocol for Uniswap v3 liquidity provisioners, announced its own integration with Chainlink Price Feeds. This integration will help provide an additional layer of security for Uniswap liquidity providers. The DefiEdge team added,

“We aim to take a security-first approach to the entire protocol design, and Chainlink oracle infrastructure is secure, simple to integrate, and expansive in scope- making it an all-inclusive solution for our team.”

But where does LINK stand in the big picture?

LINK has witnessed a revival in prices after the latest announcements especially in the last 24 hours. At the time of writing, it was up by 2.5%.

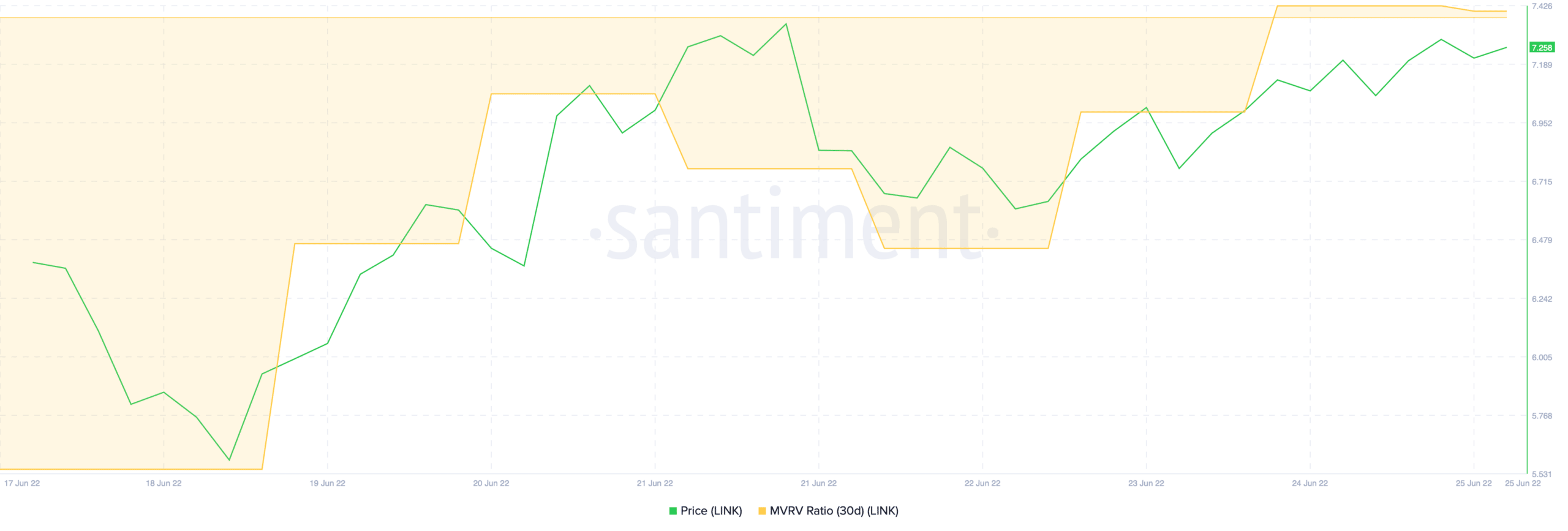

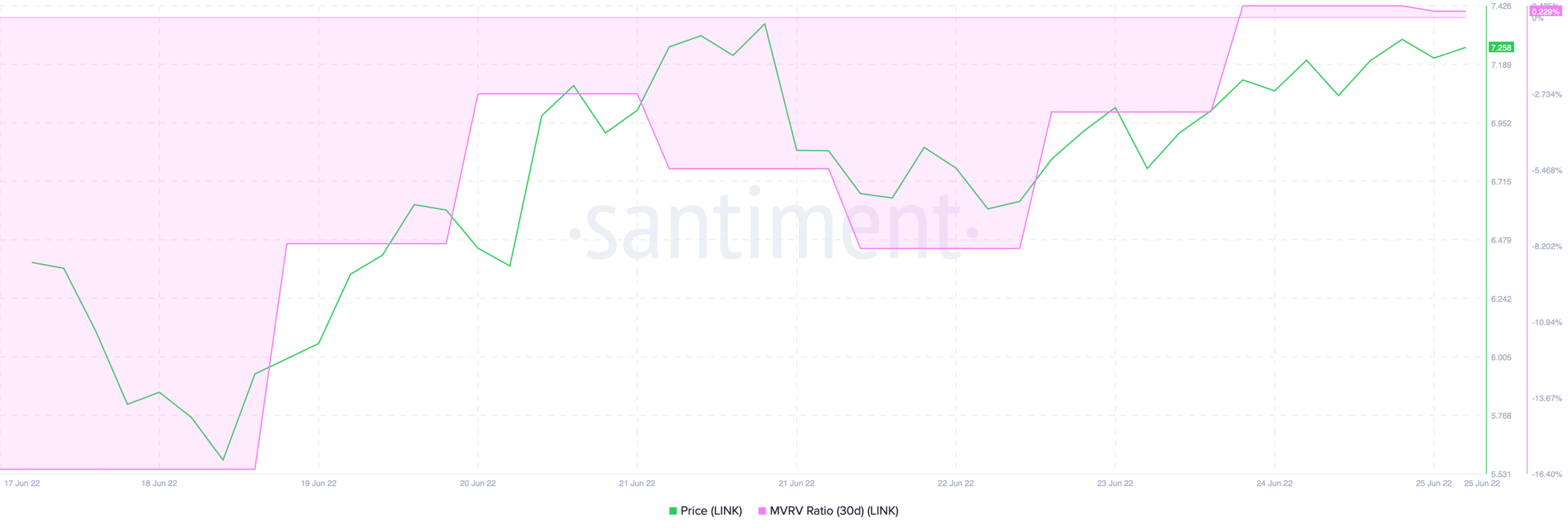

Furthermore, metrics are also suggesting a push in the upward direction. The MVRV ratio is hovering at its highest point during the week. It is currently stranded at 0.2% after escaping the weekly bottom of -16.2% at the height of the crash.

The social dominance of LINK has also increased multi-fold in the last few days. This metric is also at its weekly high at an index value of 7.4. The developments on the network are being credited to be the driving factors behind the rise of the social dominance of Chainlink.