Decoding whether Uniswap whales can trigger a 44% surge for UNI

- A whale bought 243,198 UNI tokens, signaling potential bullish momentum as Uniswap’s price rebounded from a key support.

- UNI targeted a 44% surge, aligning with resistance levels, driven by substantial whale accumulation and market trends.

Uniswap [UNI] has rebounded from a crucial support level amid significant whale accumulation. In a noteworthy transaction observed by Lookonchain, a whale or institutional investor spent 2 million USDC to acquire 243,198 UNI tokens.

The investor deposited 2 million USDC into a Kraken account and withdrew the UNI tokens, valued at approximately 1.96 million USD at press time, just 50 minutes before Lookonchain’s report.

In addition, the same whale deposited 4 million USDC to Kraken and withdrew 35,983 Aave [AAVE] tokens (valued at 3 million USD) and 123,183 UNI tokens (valued at 1 million USD).

These substantial transactions suggested a higher possibility of a bullish reversal as UNI traded above crucial support levels.

Uniswap: Price and trading volume

As of press time, UNI was priced at $8.00, with a 24-hour trading volume of $146,641,362, per Coingecko. This represented a 1.50% price decline in the last 24 hours and a 1.18% price decline over the past seven days.

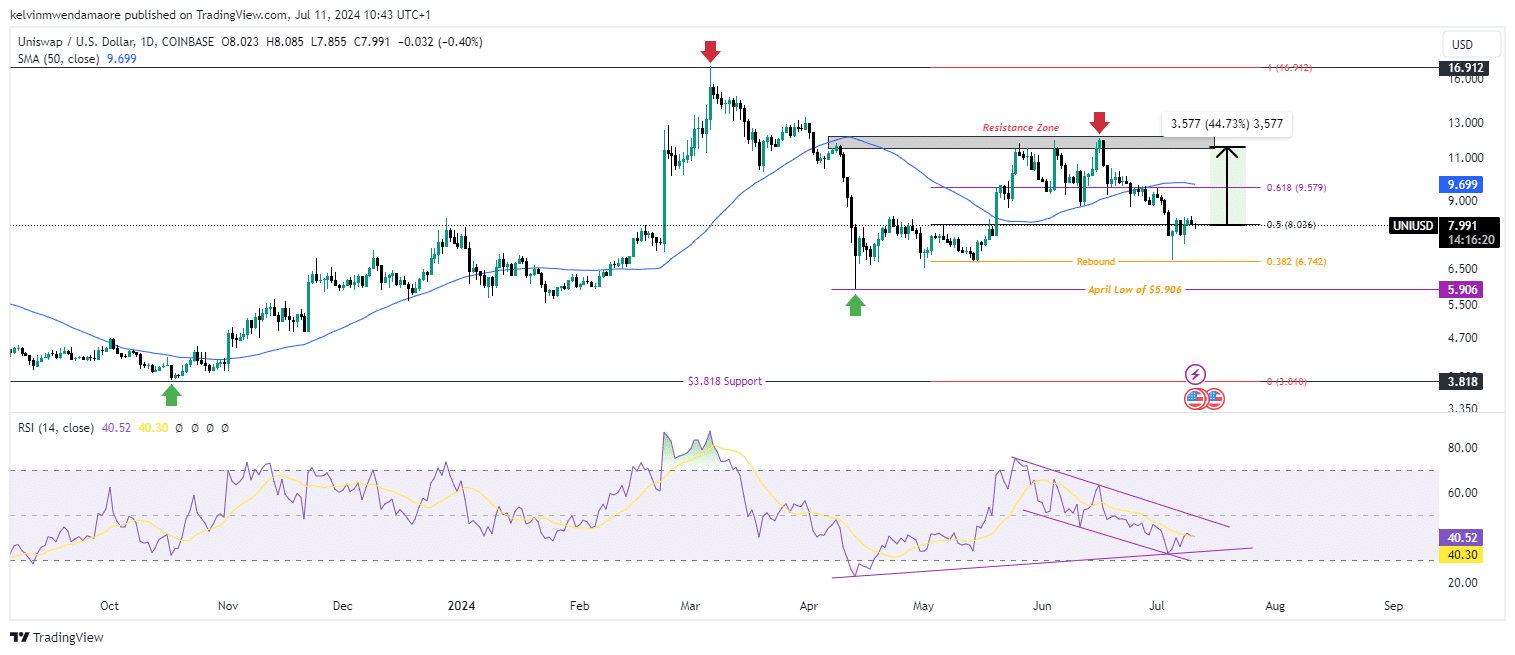

Despite this recent decline, the price has been fluctuating within a resistance zone between approximately $9.5 and $12, after peaking near $16.912 in the past.

At press time, the Relative Strength Index (RSI) for UNI had a value of 40.52, suggesting the market was approaching oversold conditions.

A descending triangle pattern in the RSI indicated potential consolidation or a further downward trend.

However, there was a proposed 44% surge, targeting a move from $7.991 to approximately $11.57, aligning with the upper boundary of the resistance zone.

Moreover, the 50-day Simple Moving Average (SMA) was $9.699 at press time, which the price has recently crossed below, indicating potential short-term bearish momentum.

Key support levels to watch are $5.906 and $3.818, while resistance levels are around $9.5 and $12.

The price action and RSI suggested that traders should watch for a break above the resistance zone for bullish confirmation or a breakdown below the support levels for a bearish outlook.

On-Chain activity and market trends

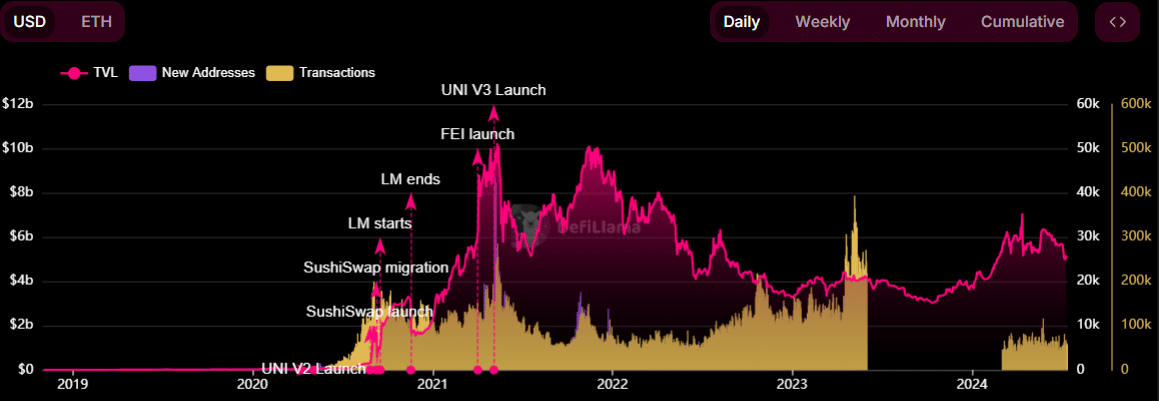

According to DefiLlama, the Total Value Locked (TVL) of UNI was $5.174 billion.

Over the observed period, TVL experienced fluctuations, with notable peaks around key events such as the UNI V3 launch and the FEI launch, reaching highs of nearly $10 billion.

After these peaks, TVL declined and stabilized at the current value as of mid-2023.

New addresses for UNI also showed trends corresponding with major events. A surge in new addresses was observed around the UNI V3 launch, indicating increased user interest and adoption.

This trend, however, saw a decline post these events, aligning with the overall reduction in market activity.

Transaction volumes depicted a pattern similar to TVL, with significant spikes coinciding with major events. High transaction volumes were recorded during the UNI V3 launch and the liquidity mining (LM) initiatives period.

Following these high points, transaction volumes declined, indicating a reduction in trading and liquidity activities over time.

Is your portfolio green? Check out the UNI Profit Calculator

As earlier reported by AMBCypto, Uniswap Labs expressed reservations against the U.S. SEC’s proposed amendments, which could expand the definition of ‘exchange’ and the agency’s mandate over Decentralized Finance (DeFi).

This regulatory concern added another layer of uncertainty to the market.