Decoding why Yearn.Finance continues its losing streak despite healthy ROIs

One of the top 15 projects in the DeFi space, Yearn.Finance is considered to be amongst the few reputable projects in the crypto space. But this reputation is taking a hit day on the day as the value of the project as well as its token YFI is declining.

Yearn.Finance, 12 months later…

Although five months late, the DeFi protocol released their quarter 4, 2021 report highlighting the ups and downs in their earnings, generating $44 million in EBITDA.

Although the figure is a significant growth in comparison to 2021, it does not represent the value of its native token, YFI, which witnessed a spectacular downtrend continuing into 2022.

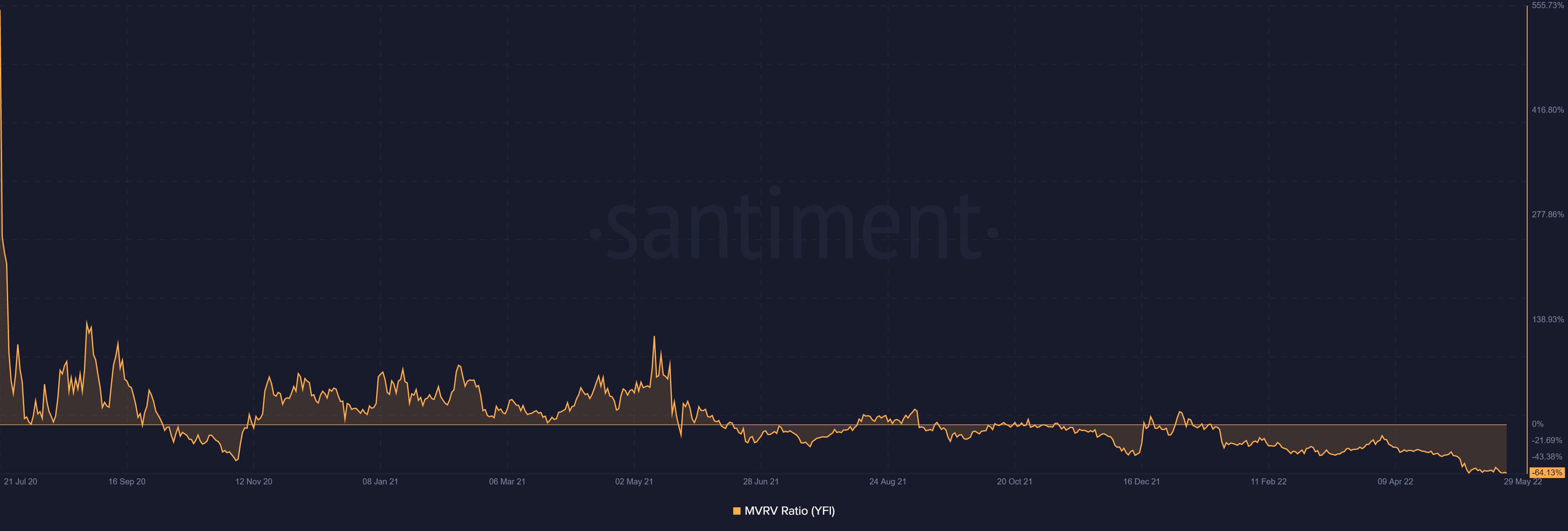

Holding the tag of being the most expensive coin back in May 2021, YFI peaked at $96,655. However, the downfall that followed resulted in the altcoin plummeting by 91% to date to trade at $7,427.

Multiple attempts at recovery back in December 2021, and March 2022, failed to provide any support to the coin, which is how over 92% of all of its investors are suffering losses today.

Yearn.Finance price action | Source: TradingView – AMBCrypto

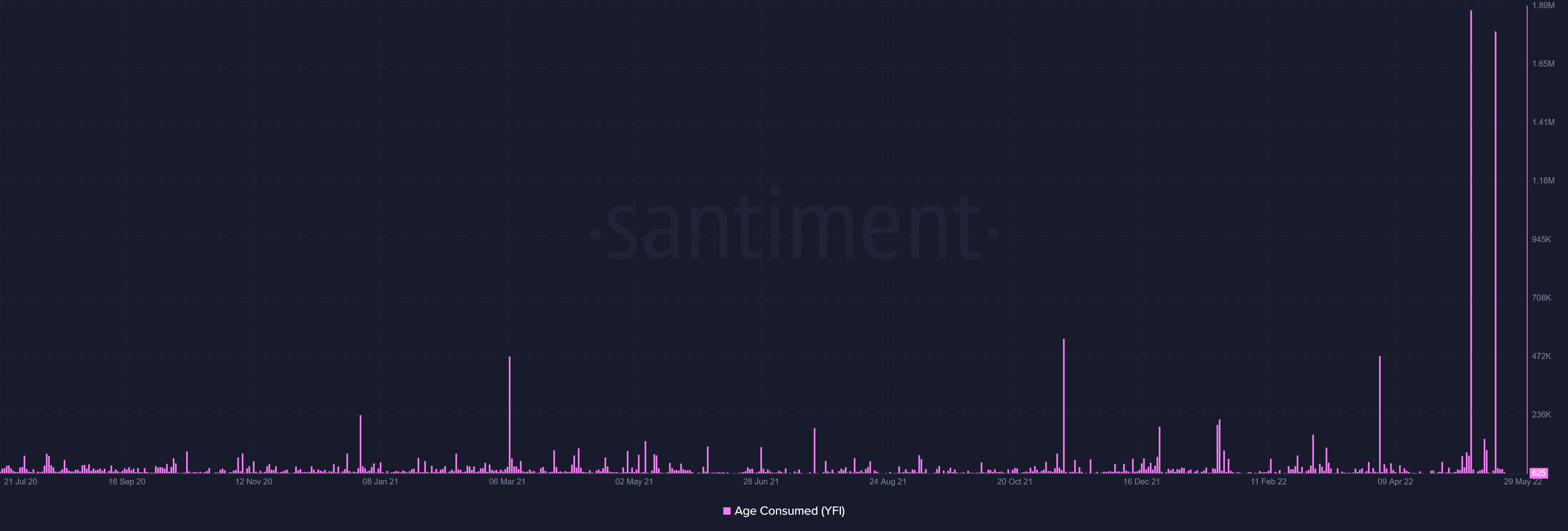

The two instances where YFI holders experienced the highest losses were in this month itself, on 13 May and 24 May, when over $100 million worth of YFI fell to the mercy of the bears.

These two days were also the recipient of the most panic felt by investors in over two years as long-term holders moved around and probably even sold their holdings, destroying over 3.5 million days.

YFI LTH selling | Source: Santiment – AMBCrypto

This is verified by the selling visible on-chain as investors sent 1,628 YFI worth over $12.1 million back into exchanges.

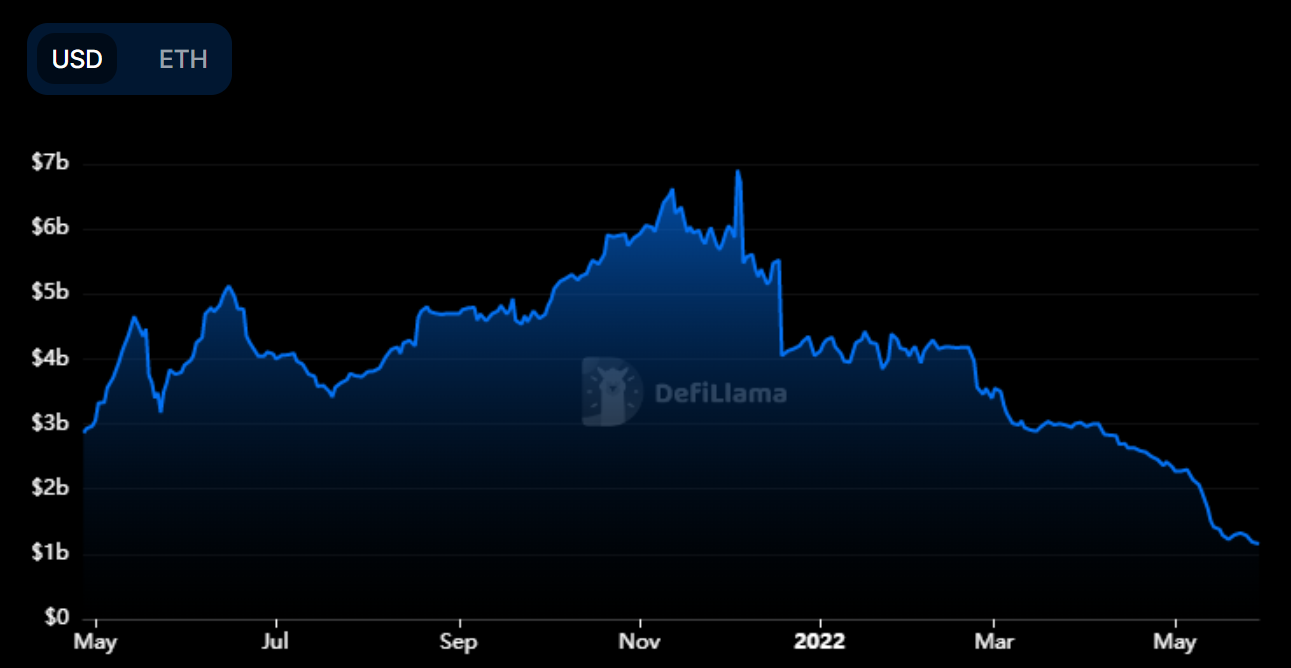

To add to that, the total investments locked in the protocol also depleted significantly, from $7 billion in December 2021 to just $1.16 billion today.

Yearn.Finance TVL | Source: DeFi Llama – AMBCrypto

Put simply, the prevailing market conditions across all the fronts have resulted in the protocol and YFI losing all of its value, falling to the lowest point it has since its inception.

YFI Market value | Source: Santiment – AMBCrypto

This can be undone only when the broader market exhibits recovery signals which is definitely not going to be the case for the next few weeks.