Despite AAVE’s moves to clear bad debt, these areas remain at a loss

- The Aave community passed the AIP 14 to authorize clearing CRV’s bad debt.

- Aave’s on-chain transaction volume was largely at a loss at press time.

On 26 January, the developers of the Aave [AAVE] protocol had announced that they had acquired 2.7 million Curve [CRV] tokens from the latter’s platform.

Read Aave’s [AAVE] Price Prediction 2023-24

This change was the result of the community’s endorsement of Aave Improvement Protocol (AIP) 144, which saw the deployment of a swap contract that acquired 2.7 million CRV at a maximum unit value of $1.15 per CRV and a USD Coin [USDC] spend limit of a little over $3 million.

Despite the announcement, AAVE failed to register substantial gains on its daily chart. In which areas did it falter?

Examining Aave’s transaction volume position

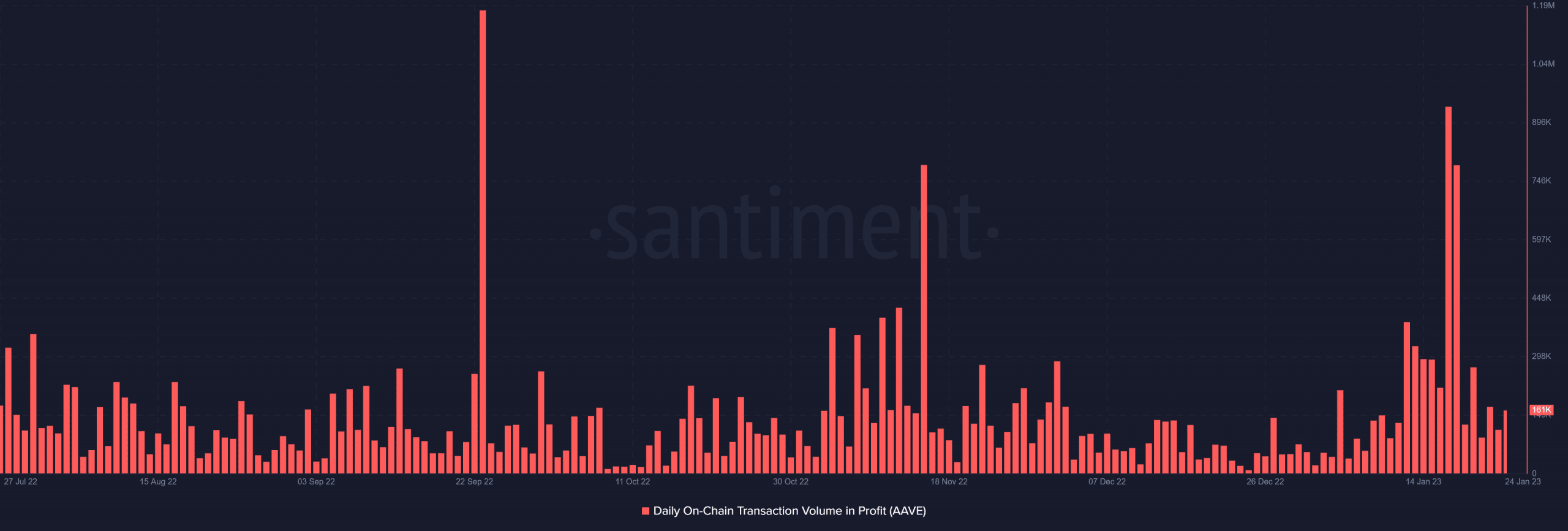

An examination of Aave’s transaction volume data revealed some information about the viability and health of the protocol. It had $161,000 in profit as of the time of writing, according to the Daily On-Chain Transaction Volume in profit.

The statistics also revealed that the protocol did not suffer from a lack of transaction volume. However, examining this statistic by itself might not be adequate to reveal the protocol’s genuine condition.

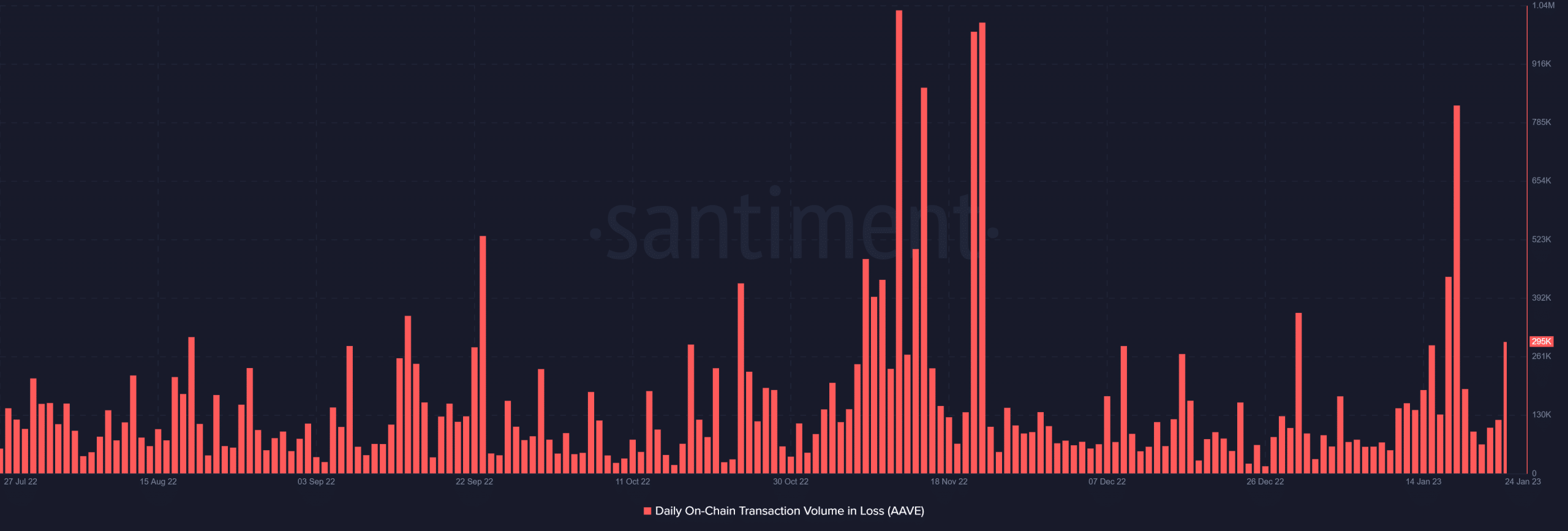

According to the On-chain Transaction Volume in Loss, the protocol had about $295,000 in transaction losses as of this writing. According to past on-chain transaction data, the protocol had been operating at a loss, but the current debt servicing shouldn’t have a detrimental effect on the system.

How much are 1,10,100 AAVEs worth today?

On a daily timeframe

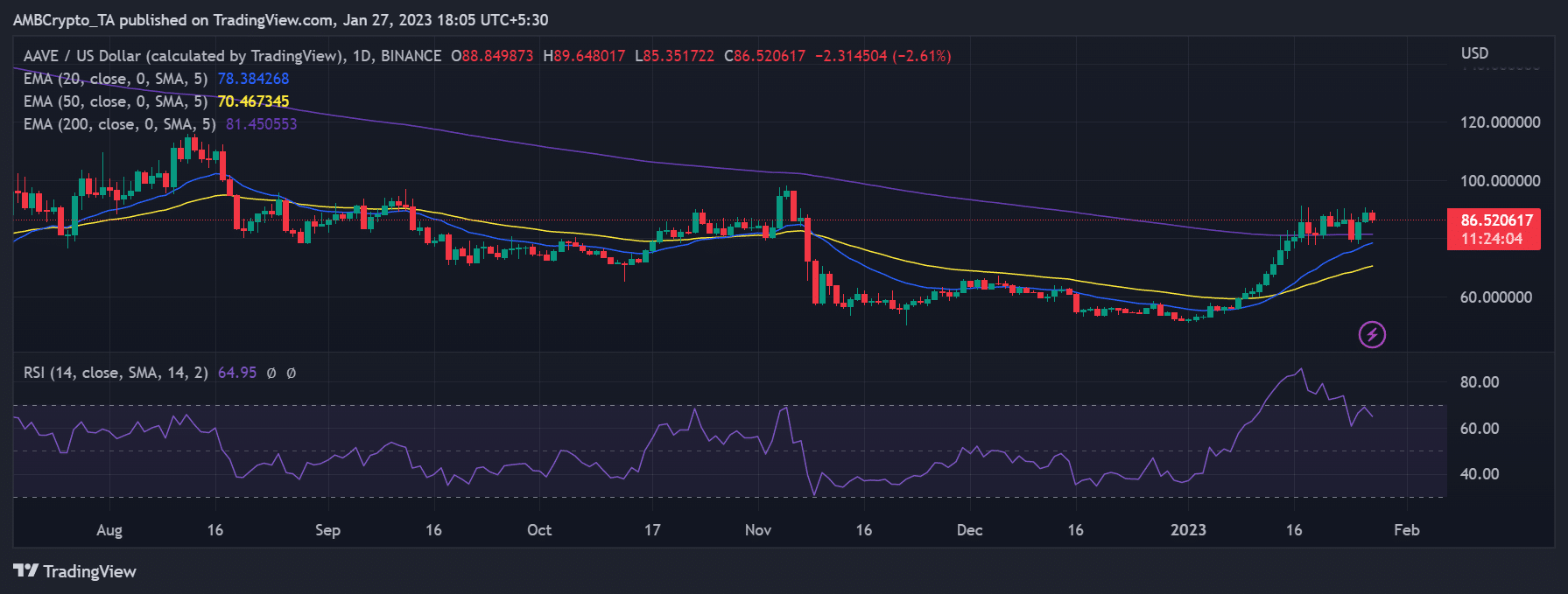

Aave saw an uptrend since the start of 2023, much like the rest of the crypto market. But lately, it struggled to maintain its upward trajectory, and its advance had all but stopped.

However, regardless of the current trend, the token maintained its position above both the long and short Moving Averages (blue and yellow lines), with the blue line serving as its support level.