Despite healthy accumulation, is SAND gearing up for further losses

SAND bags got slightly heavier in the last 7 days especially for those that bought the dip at the very bottom. However, it looks like the cryptocurrency is still trading within its 2-week range and there are signs of potential downside in the next few days.

SAND traded at $1.32 at press time after a 5.80% rally I the last 24 hours, and a more impressive 10.23% in the last 7 days. Zooming out on its price action reveals that it is still trading within a tight range and is due for a breakout. However, the breakout price direction is still a toss-up but perhaps a deeper look at price characteristics may provide some clarity.

SAND is still trading in a descending wedge pattern, but its price is currently stuck between the descending support and resistance. A support retest in the next few days would put the price at sub-$1 prices. On the flip side, a test of the descending resistance means the price will push above $1.5.

Watching out for a potential sell-off

SAND’s gains in the last 7 days were characterized by noteworthy accumulation as demonstrated by the upside in the Money Flow indicator. However, the upside was severely limited by low volumes and the RSI barely experienced any change. The MFI is now about to cross above 80 into the distribution zone and this highlights the potential downside risk.

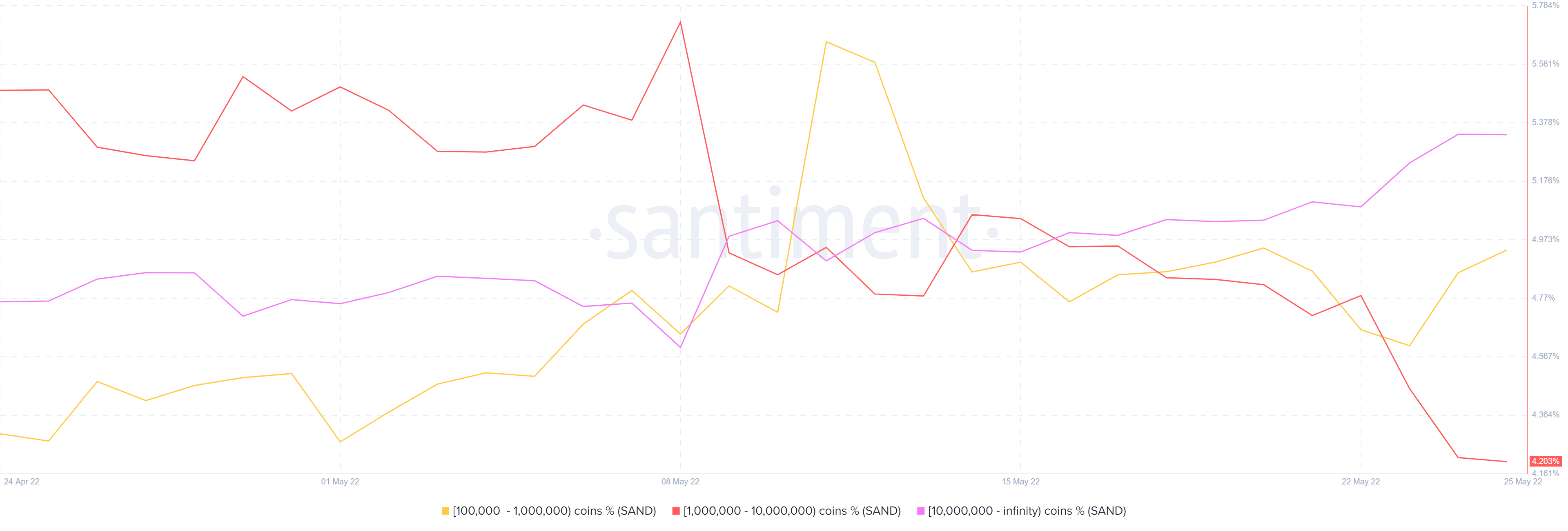

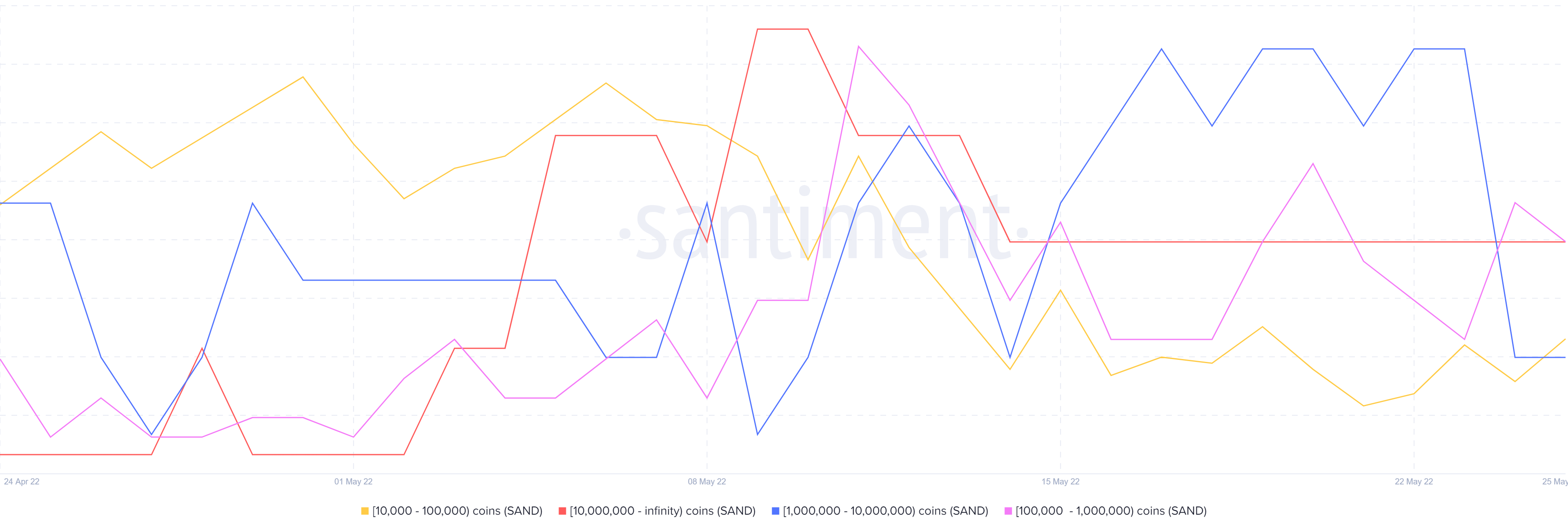

The on-chain analysis side of things reveals mixed outcomes. For example, the supply distribution by balance on addresses shows a drop in address balances between 1 million and 10 million coins. On the other hand, addresses holding over 10 million coins have increased significantly for the last two weeks. This might explain why the MFI registered sharp accumulation but the price action remained relatively muted.

The above observation aligns with the uptick in supply held by whales metric and the whale transaction count metric. However, the balance on addresses provides a clearer picture of what is happening on-chain.

Meanwhile, addresses holding between 1 million and 10 million SAND dropped from 56 t0 52 in the last 24 hours. The number of addresses holding between 100,000 and 1 million SAND dropped from 200 to 198 during the same time.

Conclusion

The above observations indicate that some whales are selling off some of their SAND. Perhaps a sign of profit-taking after the recent gains this week, and points towards a similar conclusion from the MFI.