Despite price drop, around 93% of Ethereum investors are still facing this

Ethereum has become the engine for many other crypto-applications, from DeFi to NFTs. ETH’s recent price rally, the one followed by a bloodbath, has increased the % supply of ETH on spot exchanges. That being said, however, it hasn’t recovered completely.

ETH, at press time, was trading at the $2,671-level. While the price was observed to have dropped by nearly 10% in 24 hours, a recovery is underway, with ETH’s trade volume up by 86% in 24 hours. The increase in trade volume could be a sign of the increase in the number of sellers across exchanges, especially when we consider the percent of ETH on exchanges.

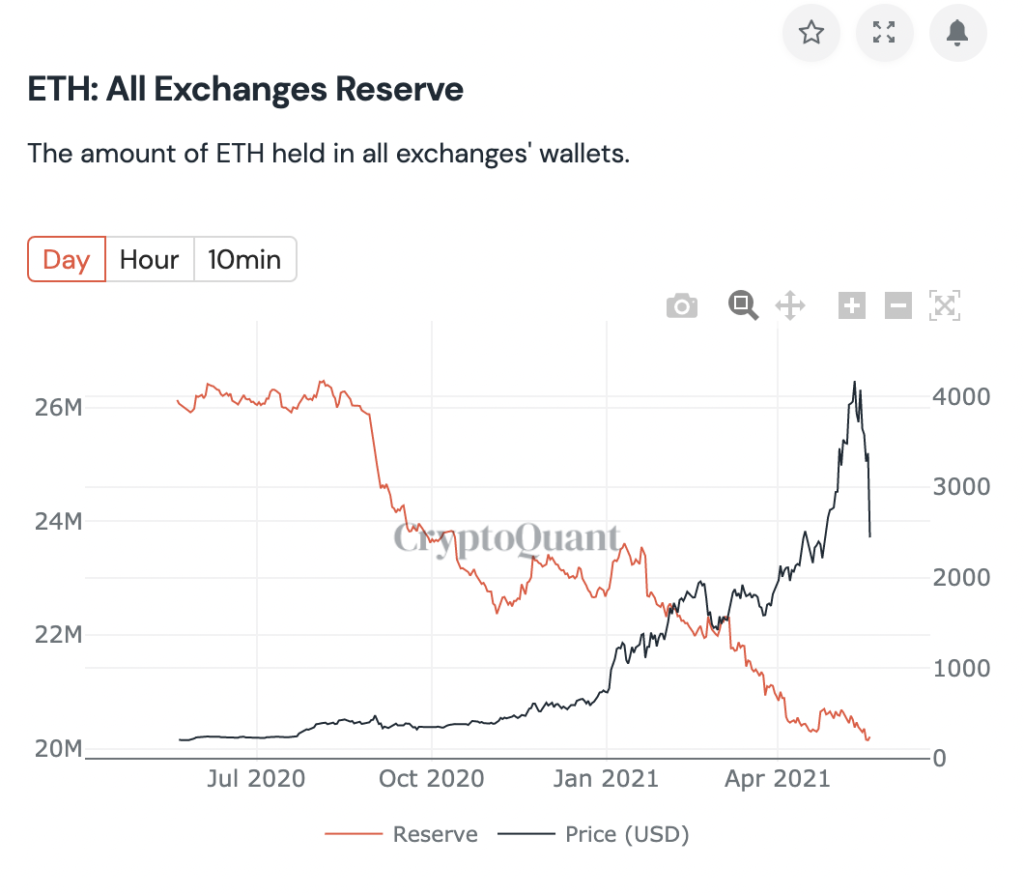

Source: Cryptoquant

Based on the attached chart, there has been a hike, a relatively small one with exchange reserve data. Though ETH may be competing for the store of value narrative, its price is being largely driven by the demand across exchanges, the transaction volume, and the transaction volume of L2 scaling solutions. The market capitalization of ETH, at press time, was at the $310 billion level and the concentration of large HODLers was at 41%.

ETH’s price rally was different pre-2021. Now, it is even more so. In fact, despite the price drop, 93% HODLers were profitable at the said price level of $2,671. $184.38 billion worth of large transactions occurred on the ETH network over the past week, despite a drop in value. Further, the investment inflows dropped by nearly 4% while on-chain sentiment was bearish, based on the data from IntoTheBlock.

Additionally, ETH scaling solutions have negatively impacted the transactions on the ETH network. The narrative has shifted from the competition with scaling solutions to the competition against DeFi summer 2.0. Several DeFi tokens have rallied consistently over the past few weeks; SUSHI, BAKE, and AAVE are in the top 5 DeFi tokens besides LINK.

While the recovery hasn’t started for most tokens, they are likely to start following the lead of a few other altcoins.

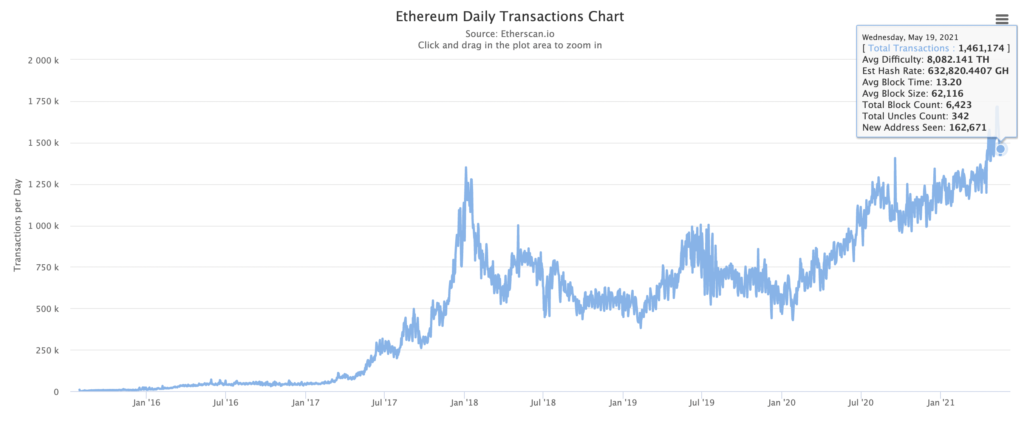

Source: Ethscan

Finally, daily transactions have now hit early-May 2021 levels. It hit a peak last week, based on the above chart from Etherscan. It is expected to recover, and based on the demand for Ethereum, the narrative might just shift to that of “ultrasound money.” Among others, ETH is a part of the competition. The next price rally of “ultrasound money” might be led by ETH based on the above metrics.