Despite TRON dominating Ethereum, new challenges emerge for TRX

- TRON outperformed Ethereum in stablecoin dominance.

- The network’s growth is shown in TVL, whale interest, and price increase.

The cryptocurrency world has seen tremendous growth in recent times, with several networks vying for dominance in different sectors. One area where TRON [TRX] has been making significant headway is in the stablecoin sector.

Interesting. More than 50% of USDT is on Tron and this % has been growing recently.

For comparison, 39.87% is on Ethereum. pic.twitter.com/V30EbK1EJA

— Patrick | Dynamo DeFi (@Dynamo_Patrick) February 6, 2023

TRON saw growth in these aspects

As per the tweet above, 50% of USDT was present on the network, as opposed to Ethereum [ETH]. This dominance in the stablecoin sector was a significant achievement and could suggest TRON’s strength in the DeFi space.

The stability that USDT provided made it a crucial component of DeFi, and TRON’s ability to hold a significant portion of USDT was testament to its growing influence in the sector.

Read TRON’s [TRX] Price Prediction 2023-2024

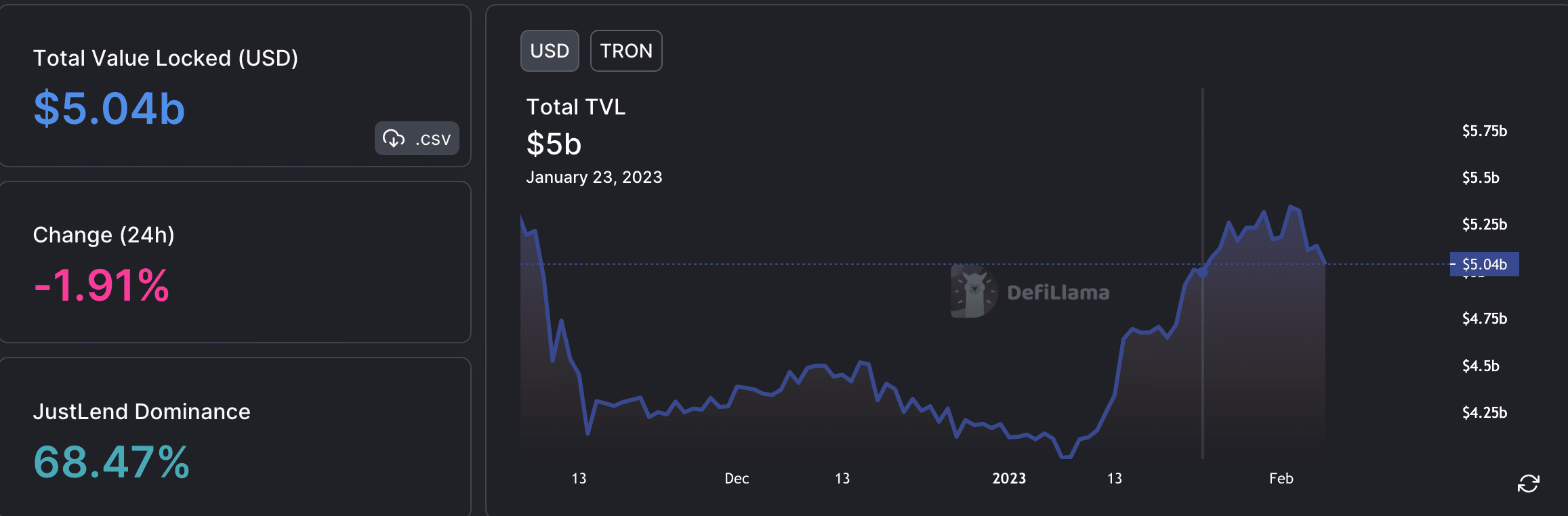

Along with its stablecoin dominance, TRON also saw an increase in its TVL. According to DefiLlama, TRON’s TVL increased from 4.11 billion to $5.04 billion, indicating a growing interest in the network. The rise in TVL also suggested that more people are placing their trust in the TRON network and its capabilities.

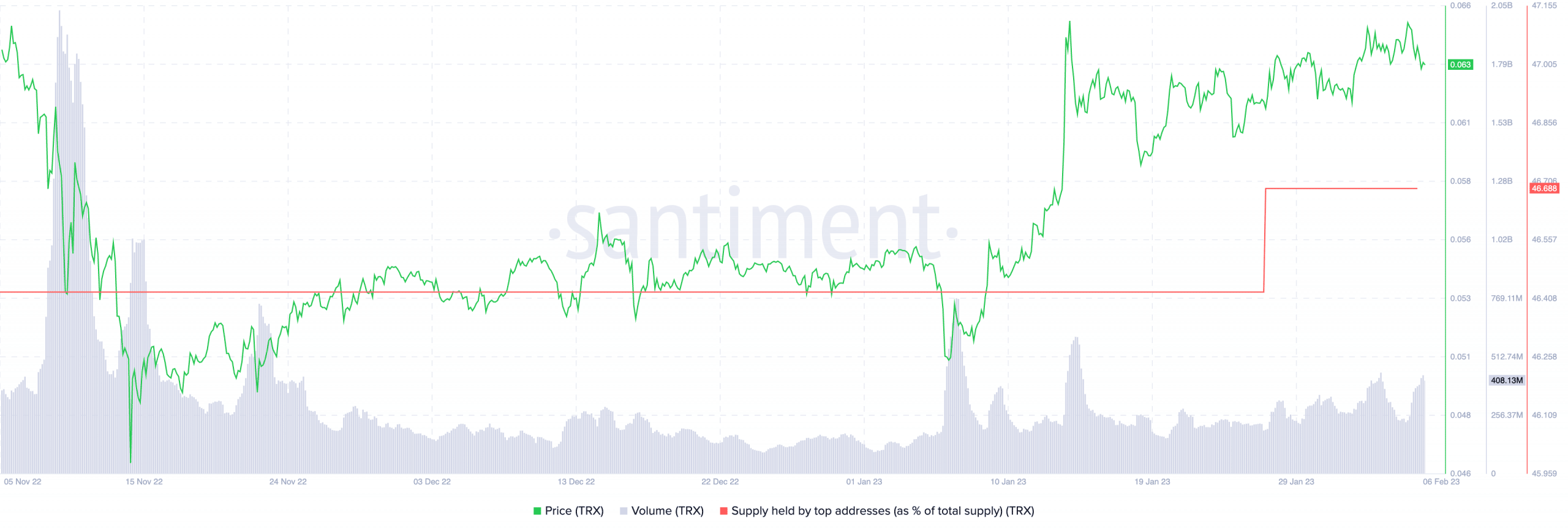

Another positive indicator for TRON was the increasing interest of whales in the network. As more and more whales invested in TRX, the price of the token also increased, providing a significant boost to the network.

Not all roses and sunshine

In spite of its growing performance, TRON was not bereft of challenges. According to Santiment, TRX’s volume fell from 902 million to 423.75 million, which could impact the protocol’s future. The declining volume suggested that fewer people were actively trading TRX at press time, which could negatively impact the network’s liquidity.

Along with the declining volume, the number of stakers on TRON decreased by 21.49% over the last 30 days. This could suggest a lack of confidence in the network, causing a drop in TVL and future stability.

Another issue that TRON was facing was the decrease in the number of active and new accounts on its network. The decrease in active accounts is also a negative indicator, as it could lead to a drop in liquidity and make it more challenging for people to trade on the network.

In conclusion, the network’s dominance in the stablecoin sector is a significant achievement, but the network also faced several challenges that could impact its future. It remains to be seen how things pan out for the altcoin.

![Solana [SOL] gains on Ethereum [ETH] but faces sell-off risks](https://ambcrypto.com/wp-content/uploads/2025/04/5B92B32E-5F8B-49F6-94A3-D0086EF6CCA2-400x240.webp)