How the hike in outflows is placing Bitcoin ETFs back in the spotlight

- Since approval, new spot ETFs in the U.S. have attracted net inflows worth $807 million.

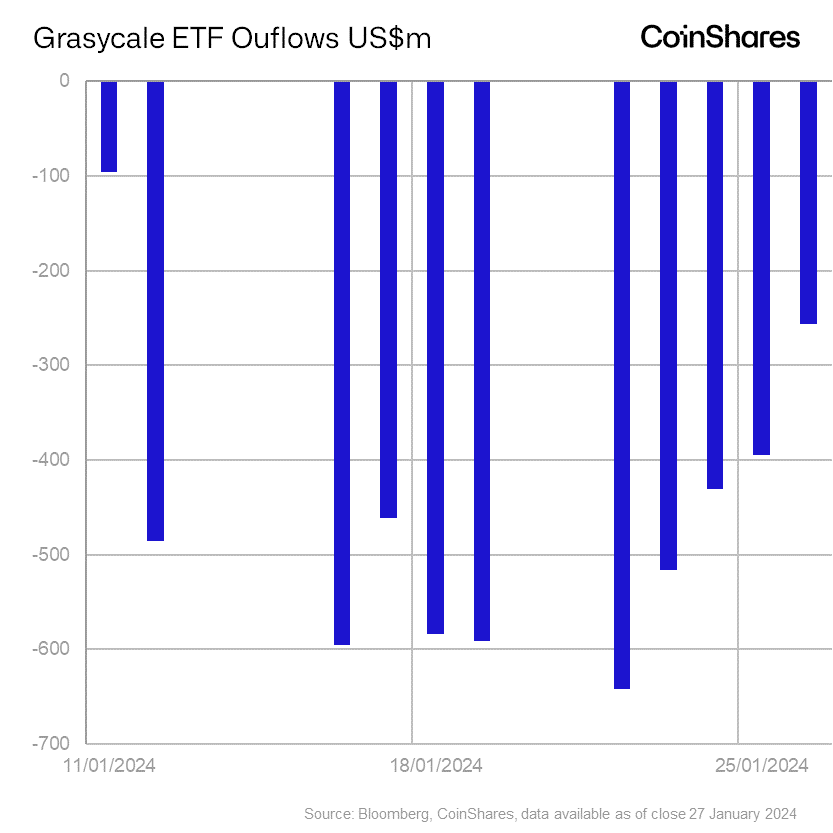

- Daily outflows from GBTC dropped progressively over the week.

Digital asset investment funds recorded significantly higher outflows last week, according to the latest report by crypto asset management firm CoinShares.

Institutional investors pulled out $500 million from the cryptocurrency market, marking the second consecutive week of capital exit. Things clearly turned worse as the outflows recorded in the week before were just $21 million.

The total assets under management (AuM) slipped further to $51 billion, a drop of 2.27% from the previous week.

Recall that the AUM is a measure of flow of investor money in and out of a fund and the price performance of the underlying asset. Investors place high weightage on the AUM before proceeding with their investments into any fund.

Outflows from Bitcoin [BTC], the largest institutional crypto product, increased to $478 million last week. On a year-to-date (YTD) basis though, Bitcoin-linked funds have recorded net inflows to the tune of $791 million.

Much of the action revolved around the dozen odd Bitcoin spot ETFs that were granted regulatory approval earlier this month.

The primary bearish catalyst on Bitcoin’s price – Grayscale Bitcoin Trust (GBTC) – recorded another week of outflows, totaling $2.2 billion. Having said that, daily outflows progressively dropped over the week, which was a healthy sign.

At the same time, the other newly launched ETFs in the U.S. gained $1.8 billion last week. This meant that on a net basis, capital moved out of the U.S. spot ETF market.

Moreover, since the approval on the 11th of January, new spot ETFs attracted net inflows worth $807 million.

“We believe that much of the price falls, despite these positive flows, was due to Bitcoin seed capital being acquired prior to 11th January,” CoinShares noted in the report.

Ethereum [ETH] also recorded huge outflows of investors’ money, nearly $39 million, while Ripple [XRP] and Cardano [ADA] both witnessed exit of $400,000 each.

The silver lining was Solana [SOL], which saw investors pouring $3 million into its investment products. The increase was most likely due to a 19% weekly jump in the price of its native asset SOL, data from CoinMarketCap showed.