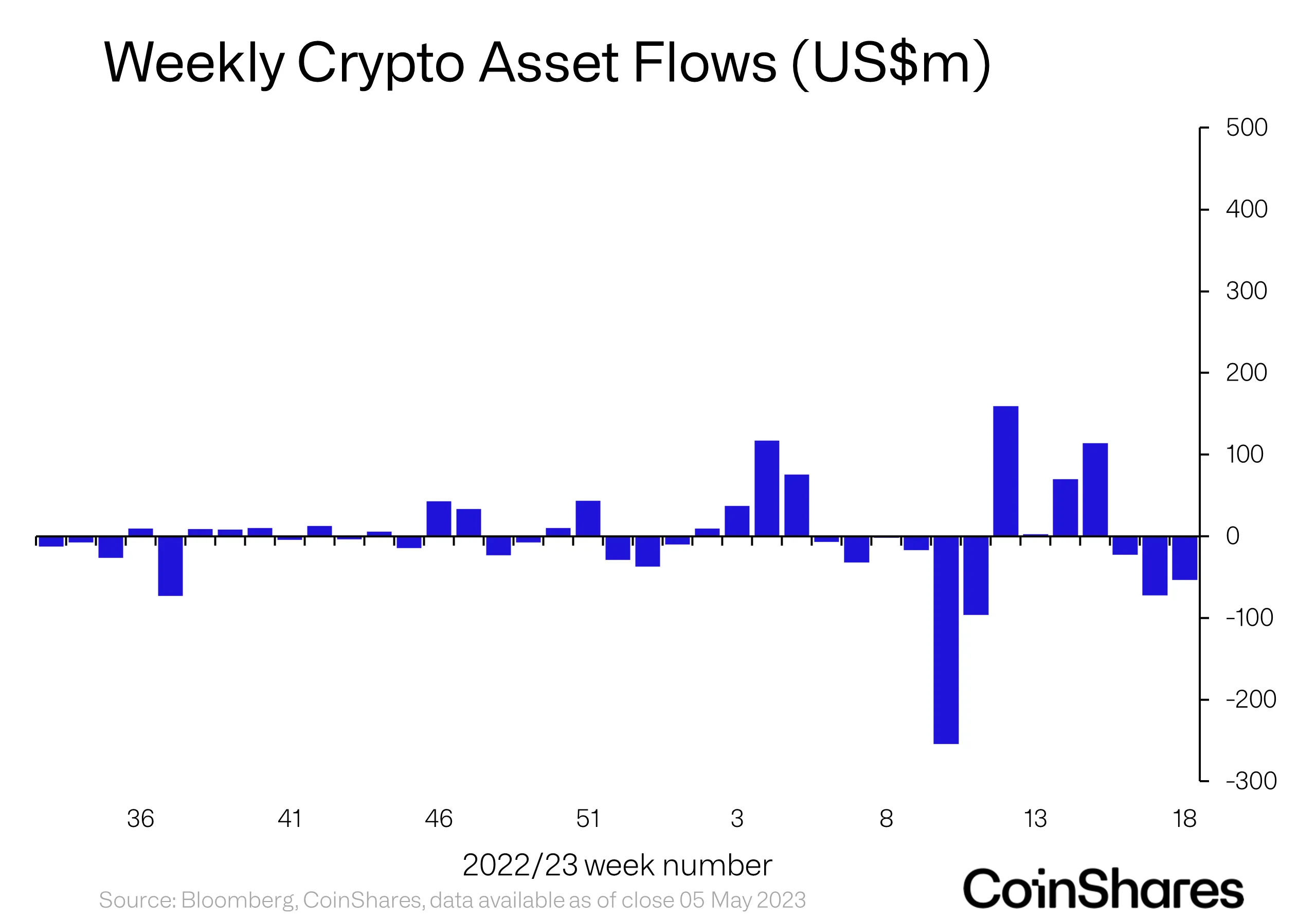

Digital assets lose their shine as $156 million flows out in third consecutive week

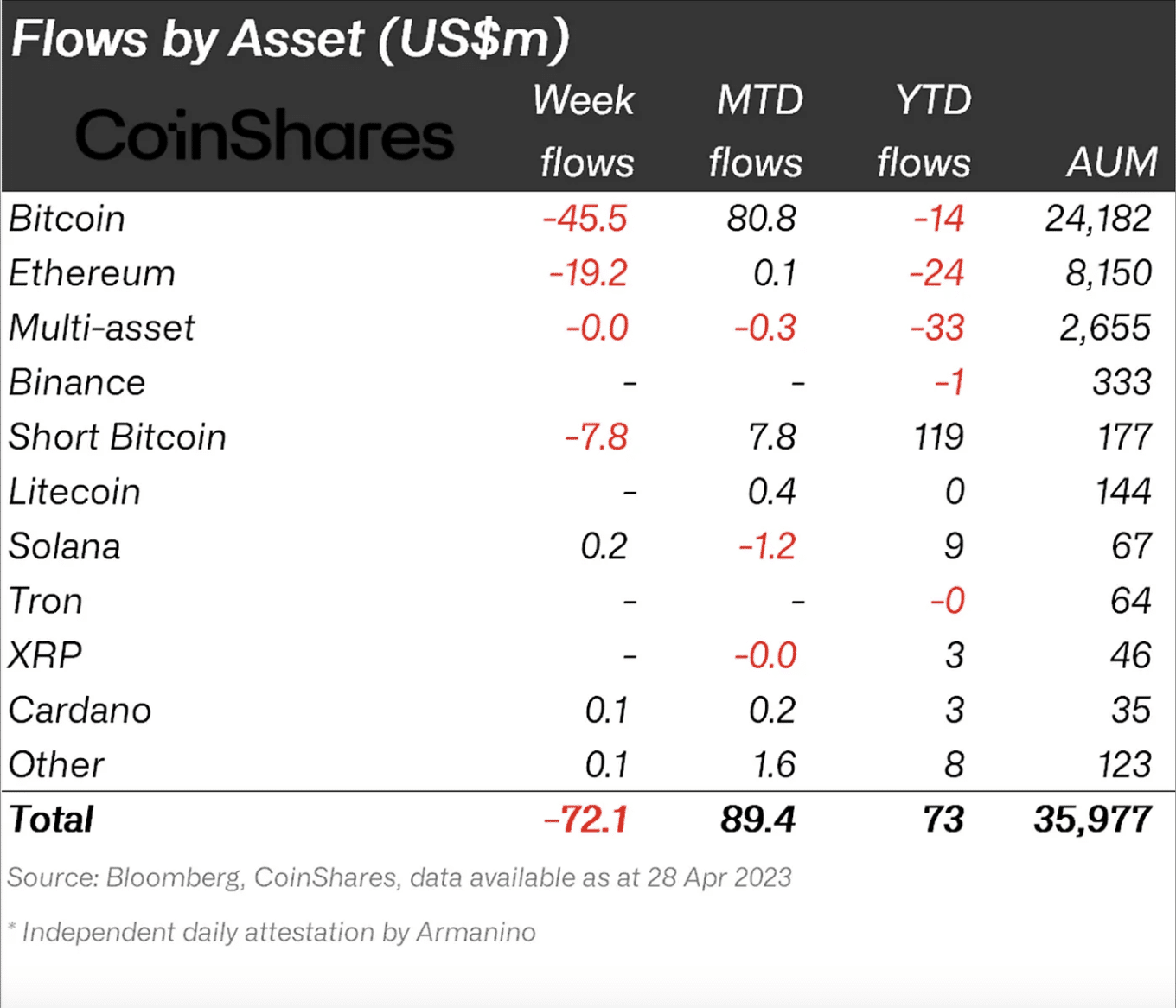

- Digital investment products saw outflows of $54 million last week.

- While investors focused their attention on BTC, altcoins saw no major traction.

Outflows from digital asset investment products totaled $54 million last week, bringing the third consecutive week of outflows to $156 million, CoinShares found in a report published on 9 May.

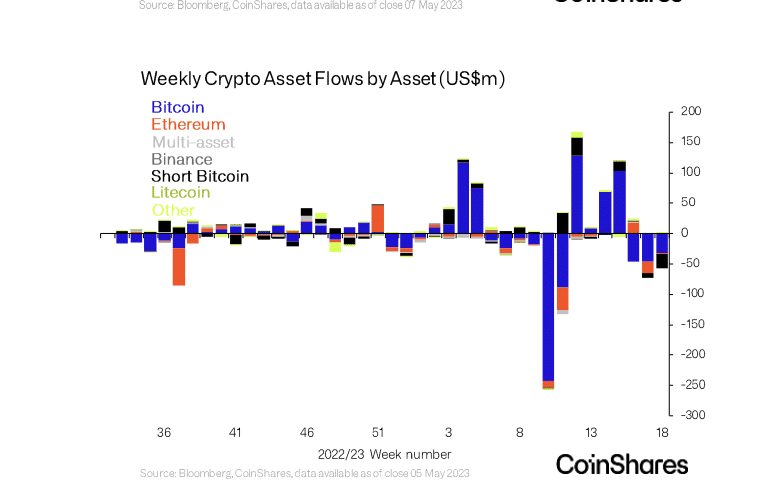

In the last three weeks, as negative sentiments ravaged the general cryptocurrency market, there were significant outflows from investment products. A notable portion of those outflows were related to Bitcoin [BTC].

Interestingly, while the past few weeks were marked by outflows, Coinshares noted:

“Volumes for the broader digital asset industry remain half of what they were at the beginning of the year, while volumes in investment products are 16% above their year-to-date average.”

This meant that investment products related to digital assets remained relatively active compared to the rest of the industry despite several weeks of outflows from this asset class.

As sentiment remains sour, BTC sees increased liquidity exit

According to CoinShares, “Bitcoin was again the primary focus from investors,” as the king coin logged outflows that totaled $32 million last week.

This accounted for 59% of the total outflows recorded during the same period. The additional $32 million in outflows brought the leading coin’s year-to-date outflows to $46 million.

As investment in the U.S. market “turned markedly positive” with inflows of $18 million from that region, short-bitcoin investment products recorded their largest weekly outflows of $23 million last week.

The large volume of outflows recorded by this asset class during last week resulted in a 19% decline in its year-to-date inflow from the previous week. According to the report, this stood at $96 million last week. In the week before, this was $119 million.

Altcoins saw no major action

Per CoinShares, investors showed little interest in altcoins during the period under review, with only minor outflows of $2.3 million from Ethereum [ETH] investment products.

The only altcoin to see significant activity was Solana [SOL], which had inflows of $3.4 million, the second-largest inflow in the last 12 months. This brought the asset’s year-to-date inflows to $12 million. The total value of Solana’s Asset Under Management (AUM) went up to $67 million.

Regarding blockchain equities, CoinShares found:

“Blockchain equities also endured weaker sentiment last week, seeing outflows totaling US$7.3m, the largest weekly outflows since the beginning of 2023. Given recent positive price performance in the sector, we believe it is due to profit taking.”