Do Chainlink’s Q4 2021 prospects depend on this ‘2020-factor’

Back in September 2020, Chainlink was regularly one of the top 5 crypto-assets in the space. Alongside DeFi, LINK exploded on the charts, but it didn’t take off as much as the other altcoins.

Fast forward to 2021 and the asset is now ranked 15th on the charts. What’s more, in terms of ‘importance’ and pecking orders, the asset has been well away from investors’ spotlight too.

While the ecosystem continues to churn out important announcements with other blockchain projects, bullish momentum has been absent from the charts. However, a recent development suggests there might be a turn of events going forward.

Are whales coming back to accumulate Chainlink?

According to data from Santiment, addresses holding between 1M to 10M LINK accumulated an additional 62 million coins worth close to $1.5 billion. During the recent dip after the China FUD, the whales responded quickly and the holder’s supply between 1M-10M rose to 20% from 16.5%.

Now, on further analysis, it can be observed that minor whales or addresses holding between 100k to 1M LINK tokens have consistently increased since November 2020. On the contrary, smaller addresses holding between 100-1000 LINK dropped significantly after recent corrections.

This might have been weak hands getting shuffled out as stronger hodlers played their hands.

But, did whales ever leave at all?

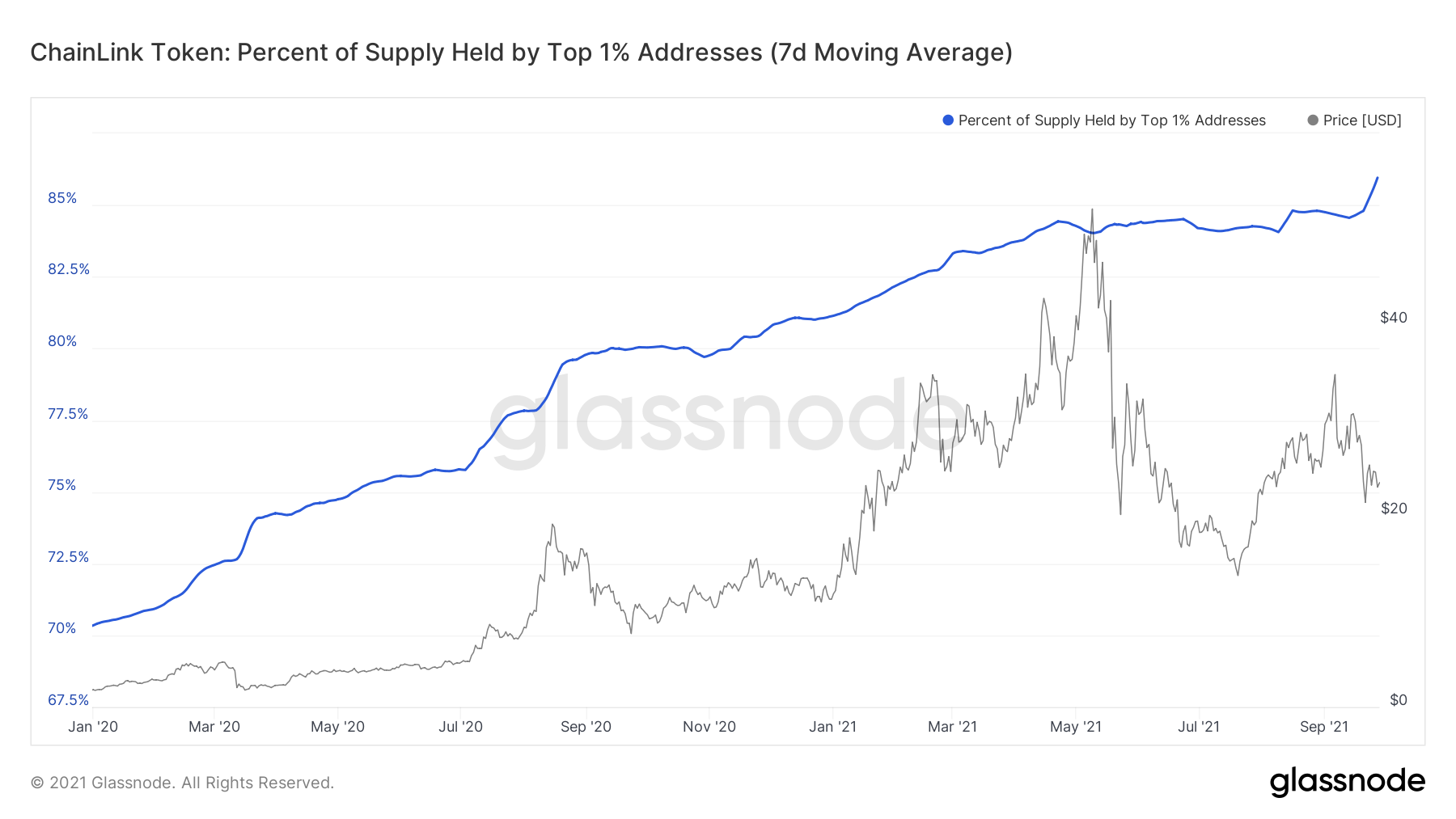

A major narrative during LINK’s rally back in 2020 was the heavy concentration of whale addresses. Many considered this issue to be resolved in 2021 as distribution increased.

However, according to Glassnode, the top 1% addresses continue to hold an all-time high of 86% of the LINK supply, increasing from 80% in 2020.

Now, LINK’s ecosystem was critiqued last year for this aspect, but it is undeniable that the asset rallied the most when it reached a certain higher level of concentration among the top 1% addresses. Will history repeat the same in Q4 of 2021? Only time will tell.

Market Structure is a little frail

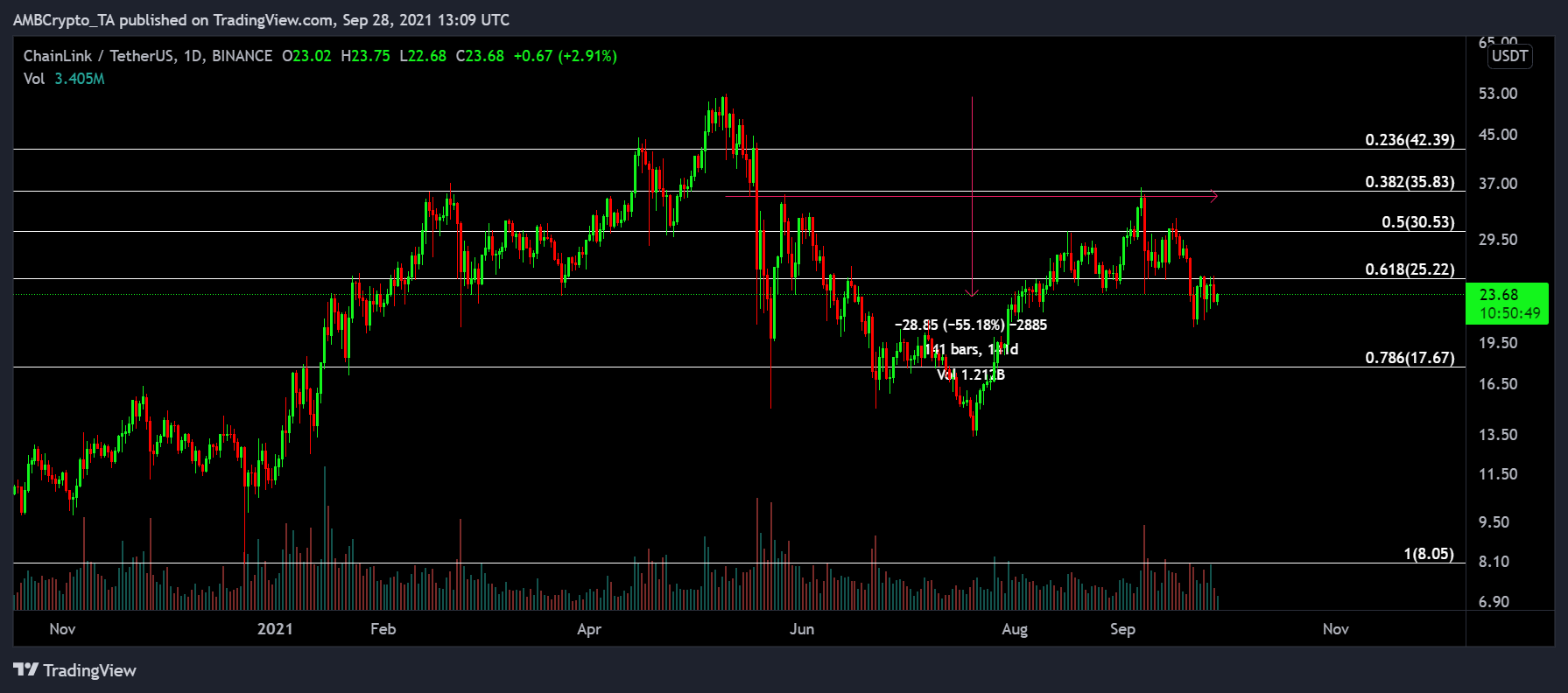

Dropping by 55% from its all-time high at press time, LINK’s major breach after the $25-level could be concerning as it is the 0.618 Fibonacci line.

An immediate daily candle close above the 0.618-mark should protect the asset from further corrections, but rising bearish pressure may drag the asset down to $17.5. This was a range re-tested back in late July.