Does Ethereum’s bull run still have to wait for Bitcoin?

With Bitcoin’s price dropping at the start of the week, it wasn’t hard to imagine how Ethereum’s price would react. Given the fact that the altcoin market is generally tied to Bitcoin thanks to the high correlation, ETH’s price fell by close to 30 percent since. However, for a coin to perform well on the price charts, it also requires the backing of a strong network and the confidence of its miner community.

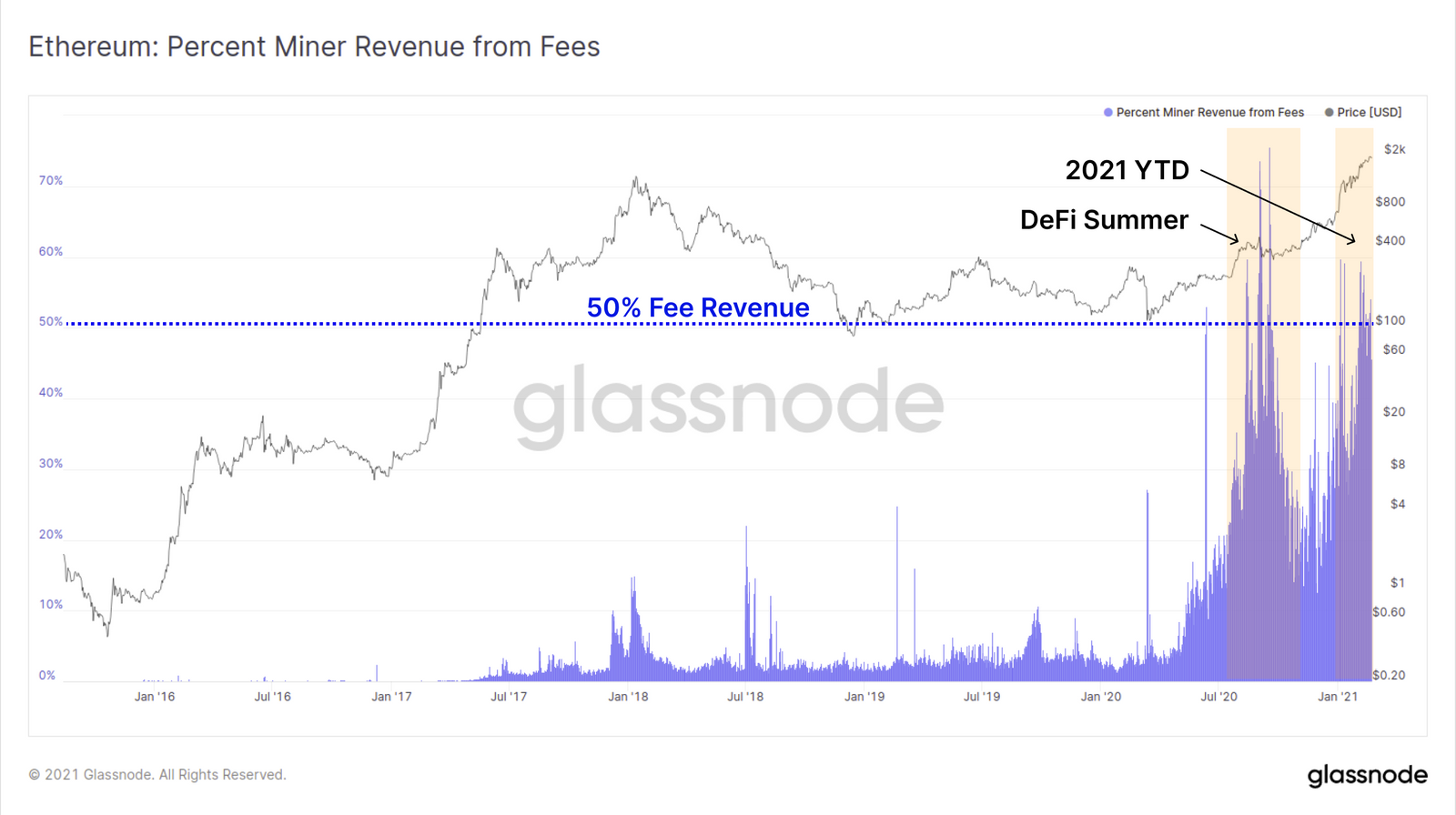

Source: Glassnode

These two factors for ETH at the moment are quite promising and allow investors to have confidence in ETH’s long-term prospects. Ethereum miners at the moment are fairly profitable. In the past week, Glassnode’s data highlighted that Ethereum transaction fees have been able to sustain over 50% share of the total block reward. This has happened only on two major occasions, the first being the ‘DeFi summer’ between August and October 2020, and throughout most of 2021.

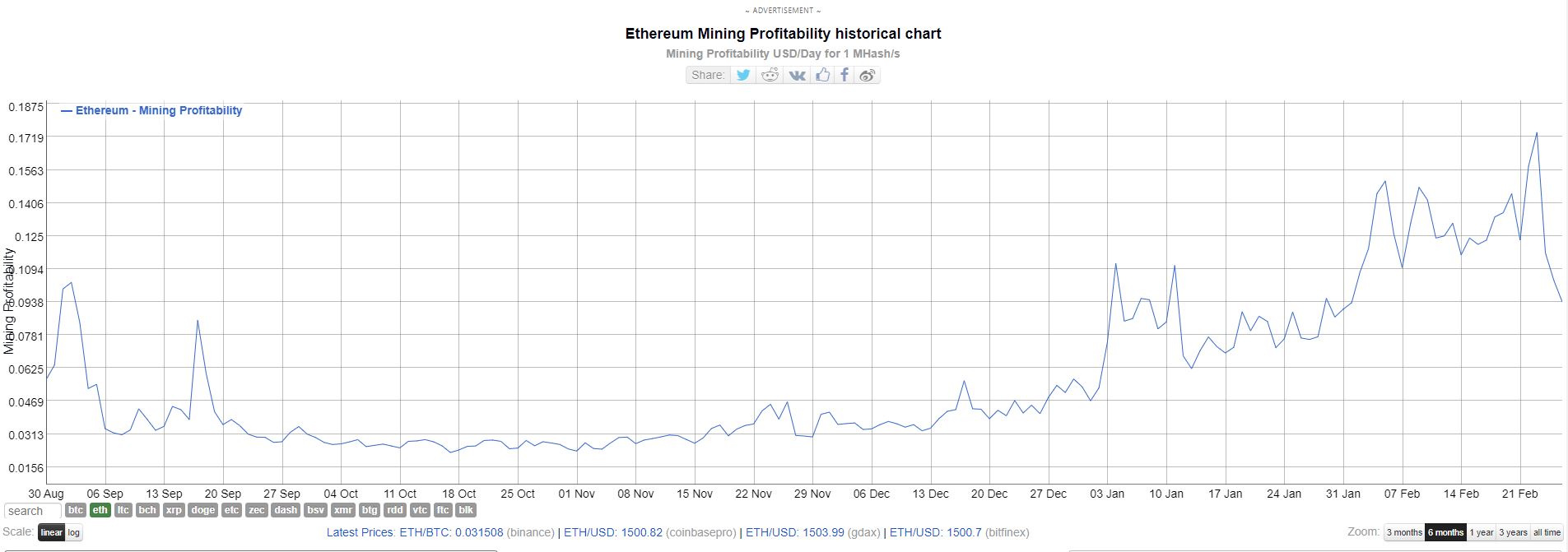

Source: BitInfoCharts

While the price has endured a few price corrections in the past few days, data from BitInfoCharts highlights that the miner fees continue to sustain a fairly high position in comparison to the past 6-months.

In addition to this, Ethereum’s network continues to enjoy a significantly high hash rate. The average daily hash rate hit yet another ATH at 416,083.7354 GH/s and shows that strong network fundamentals continue to back Ethereum overlooking its recent price dip.

Source: Glassnode

As these changes in the ETH market take place, new hodling patterns are also emerging. According to data provided by Glassnode, exchange outflow volume just reached an ATH of $46,637,330.84 and could see more ETH entering cold storage that will in turn be able to provide the coin with the much-needed bullish momentum as the selling pressure subside and accounts go back into hodl mode. However, it was also interesting to note that addresses holding 100+ coins hit an 8-month low while small addresses holding over 0.1 coins reached an ATH of 4,147,382 – signaling slight changes in the user and investor demographic of Ethereum.

Source: CoinMetrics

While these aspects of Ethereum hint at the possibility of a recovery run materializing soon and highlight the fact that its recent price woes are symptomatic of the entire altcoin market and not just specific to ETH, the coin continues to be overshadowed by BTC’s price movements. The altcoin market for the majority of its existence has danced to Bitcoin’s tune and this doesn’t look like changing any time soon, even for assets like ETH that are likely to continue moving in BTC’s sway.

Market data from CoinMetrics highlighted the increasing correlation ETH has registered with BTC. The correlation had fallen on multiple occasions in the past months starting in October 2020. However, the narrative is soon changing with the BTC-ETH correlation going up at the time of writing and is currently at 0.664. This makes an independent bull run hard to achieve for ETH and in the coming weeks, and as the trend remains unchanged it is no surprise that ETH has hit price levels in the $1.3k vicinity. However thanks to the above-mentioned fundamentals backing ETH at the moment, the $1.3k – $1.5k range is likely to be temporary and traders can expect the coin to head towards the current ATH in the coming months.