Does this metric’s 3-month high raise questions about how safe Bitcoin is

Bitcoin, on the back of a strong rally, has been making some interesting changes price-wise this week. However, its effects can be observed on other metrics as well. For investors, the foremost important factor is profitability. Looking at the data, it appears that things might be changing for the market’s investors.

Could this be a sign of Bitcoin falling?

Is Bitcoin on a downtrend?

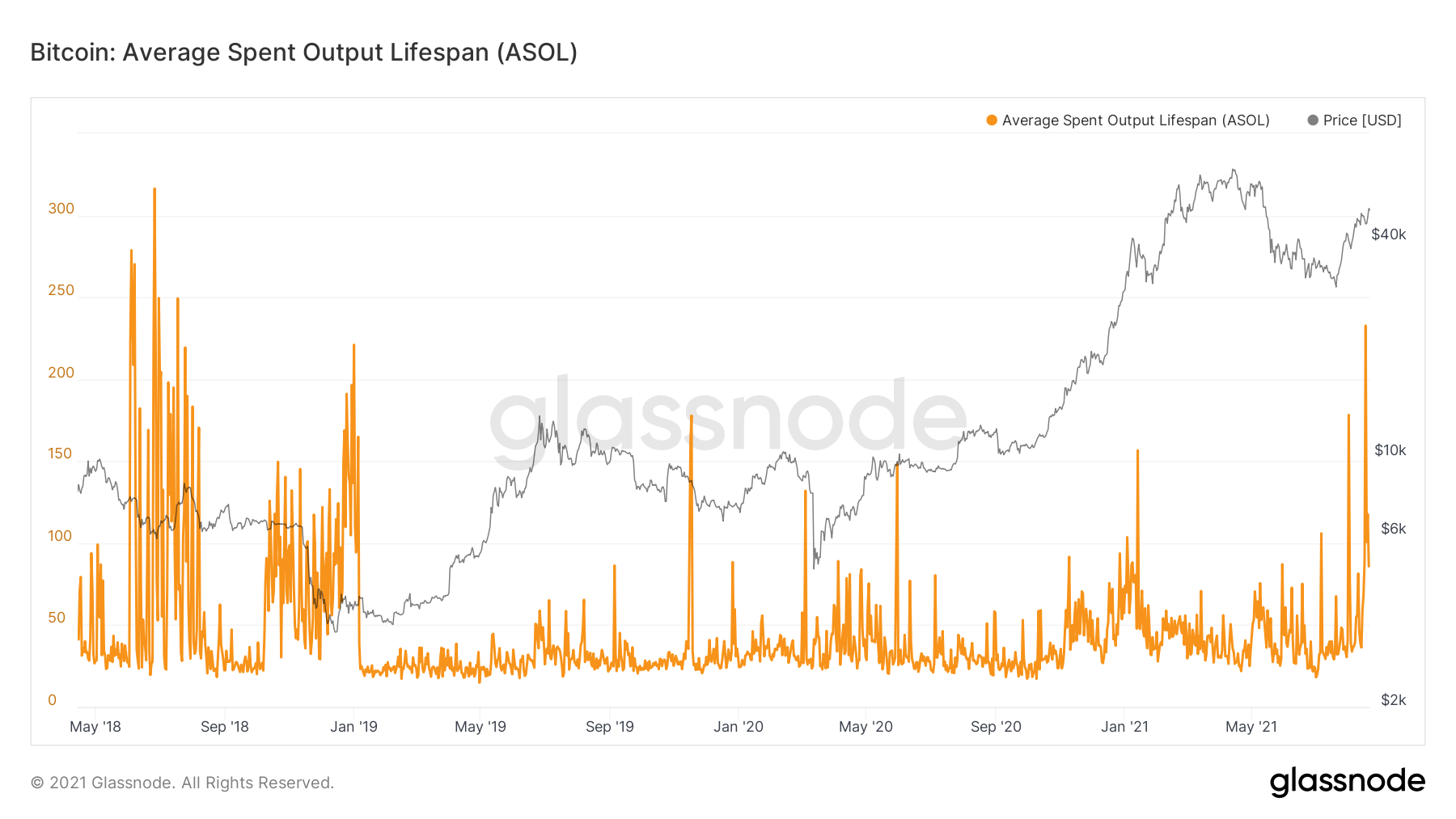

To answer that question, we’ll first have to look at the fact that the market witnessed major HODL selling as the ASOL (Average Spent Output Lifespan) touched a 3-year high of 232 on 17 August 17. This is the first sign that older coins have moved to sell since July 2018.

Bitcoin ASOL | Source: Glassnode – AMBCrypto

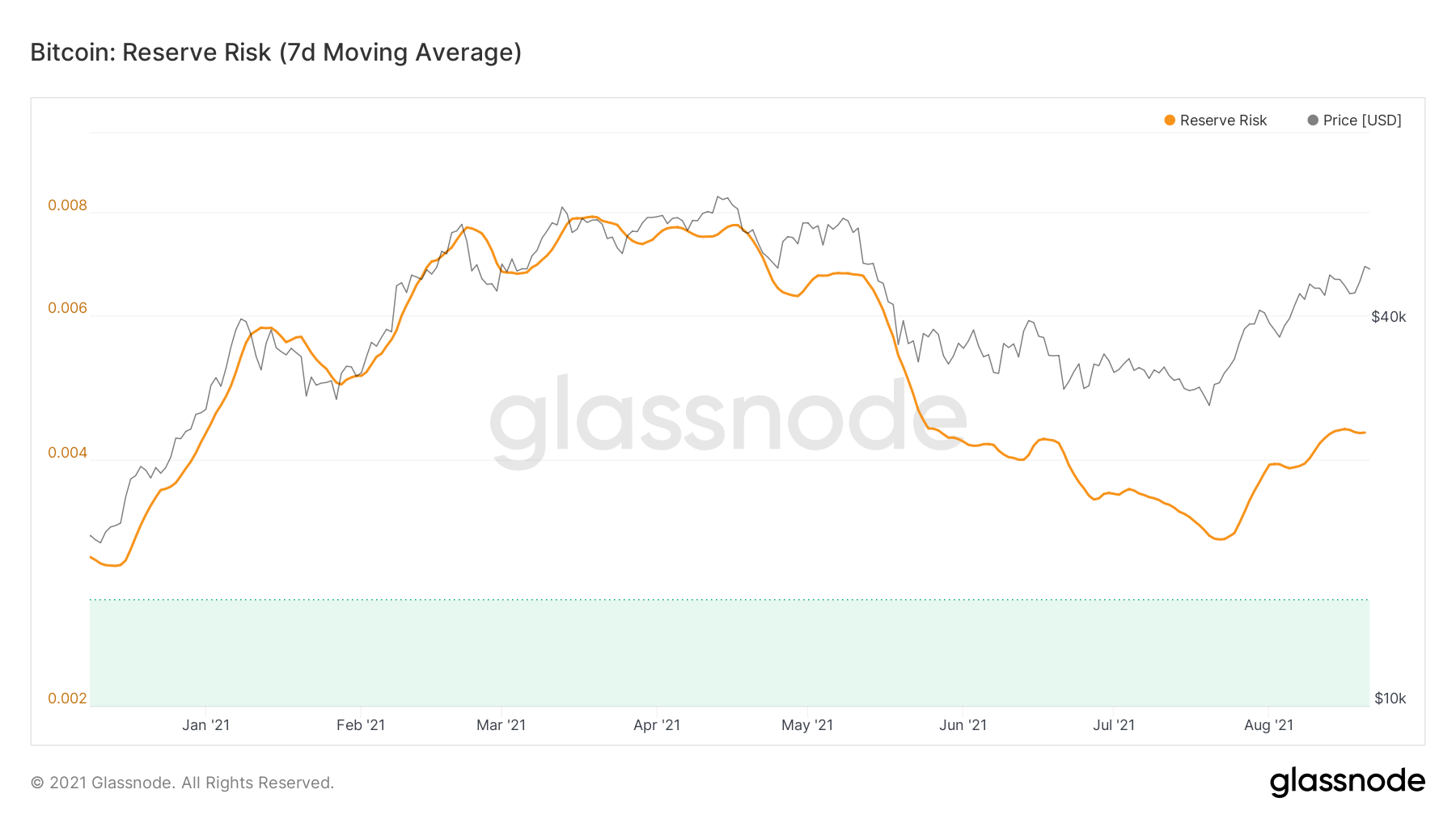

A possible reason why such selling ensued could be the rising Reserve Risk. The indicator is used to show how the market is doing from the investors’ point of view. When the indicator is high – the asset is unattractive and confidence is low. When the indicator is low – the asset is attractive with higher confidence.

At the moment, the Reserve Risk is at a 3-month high. This would imply a huge signal of loss of confidence in Bitcoin. On the contrary, however, the cryptocurrency has hiked significantly over the last 2 days.

Bitcoin Reserve Risk | Source: Glassnode – AMBCrypto

In fact, many also expect that Bitcoin will be breaching the $50k-mark soon.

Is Bitcoin going up then?

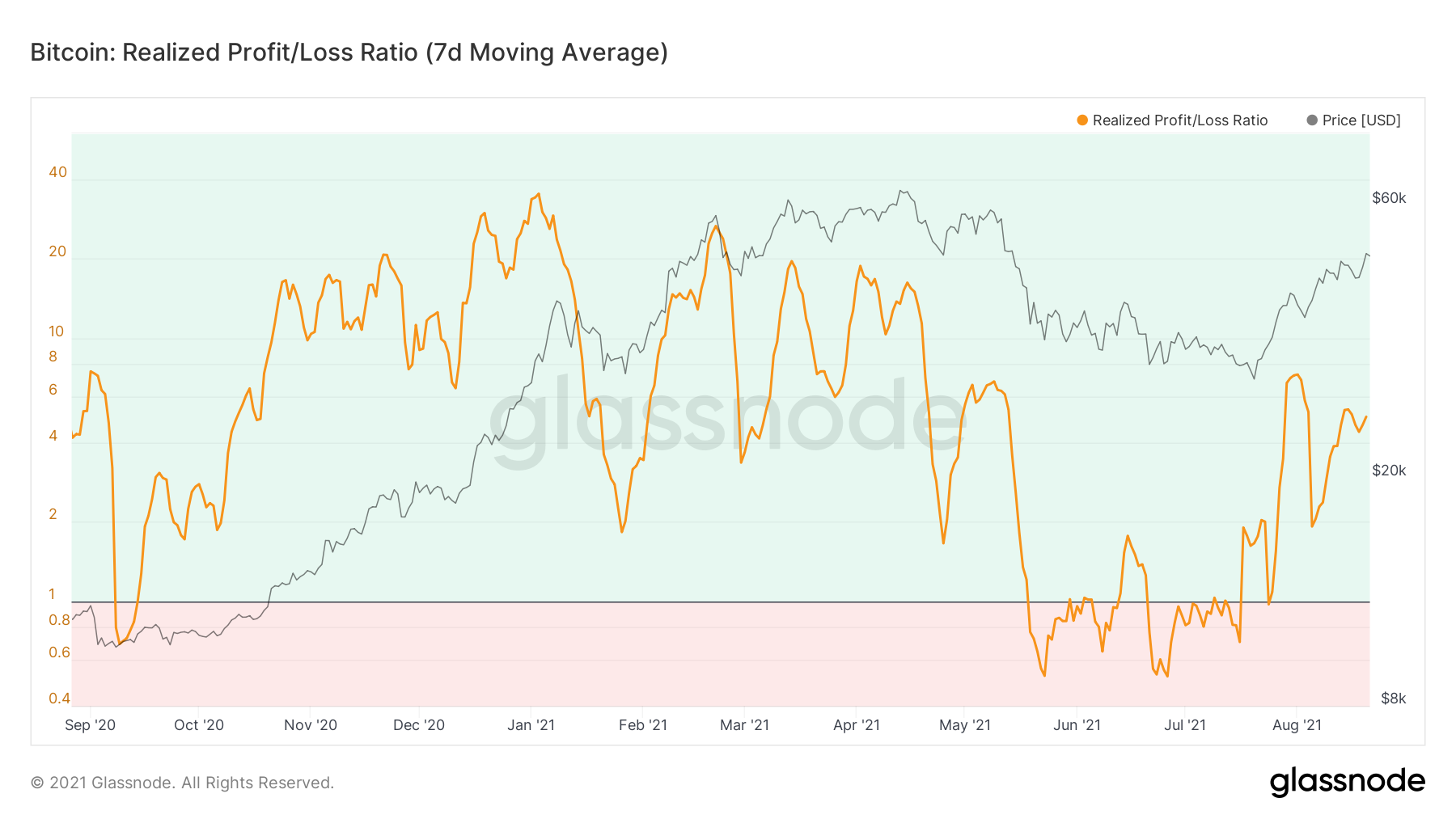

While up is a debatable answer at the moment, what can be said surely is that the investors and the network are both doing well right now. For the past 2 months, realized profits have been increasing as the profit/loss ratio continued to hike gradually.

Additionally, unrealized profits touched a 3-month high on 21 August too.

Bitcoin realized profits rising | Source: Glassnode – AMBCrypto

However, that’s not all. The network has been supported by rising active addresses as more participants entered the market. The latest market rally was a huge contributor to the same.

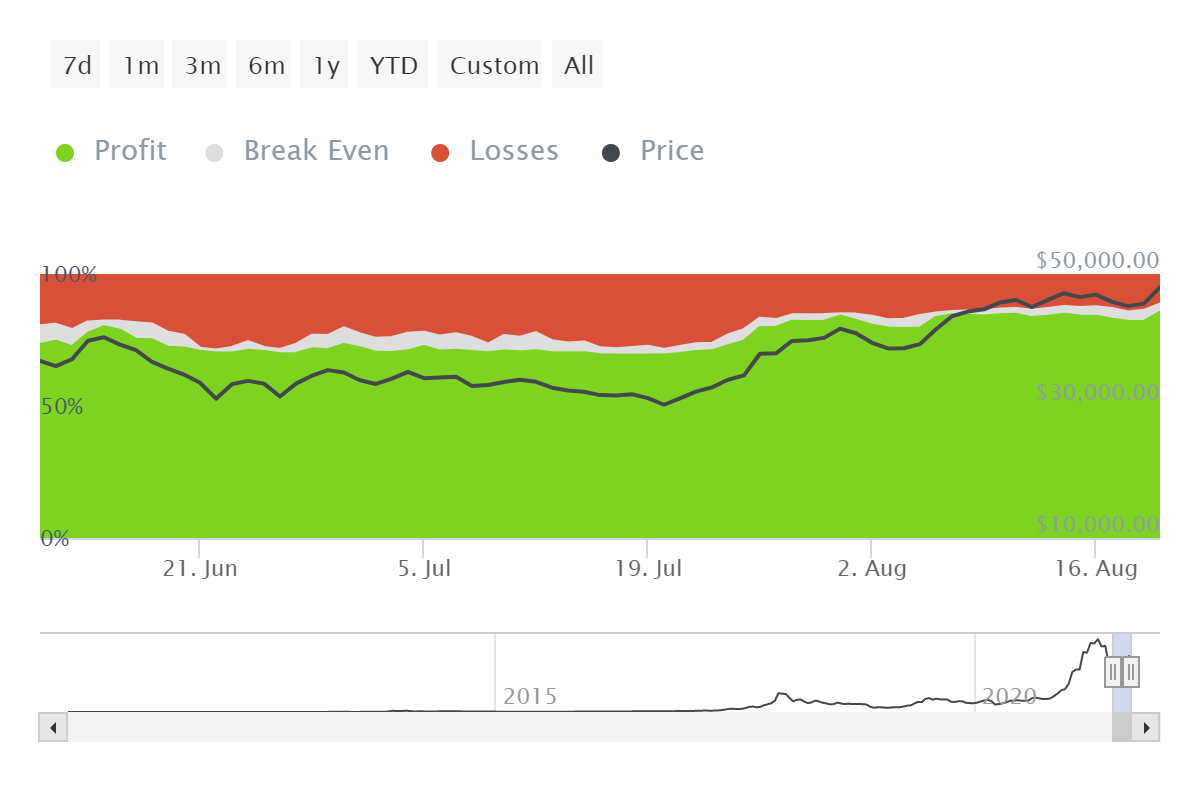

And, in return, those investors have been treated well, especially since with rising prices, more addresses have become profitable.

In fact, Bitcoin has risen by 15% over the last month as volatility in the market came down to a mere 54%.

Profitable addresses are up by 15% | Source: Intotheblock – AMBCrypto

Plus, if you take a look at external factors, you’ll understand further why Bitcoin is safe. The news of Wells Fargo setting up a private fund for Bitcoin in order to offer crypto-investments is one. The news of Coinbase turning its earnings worth $500 million into cryptocurrency is another.

Simply put, Bitcoin is more than safe right now.