DOGE plunges, hits $0.0700 support: Will sell pressure take over

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion.

- DOGE remained bearish on the 12-hour timeframe.

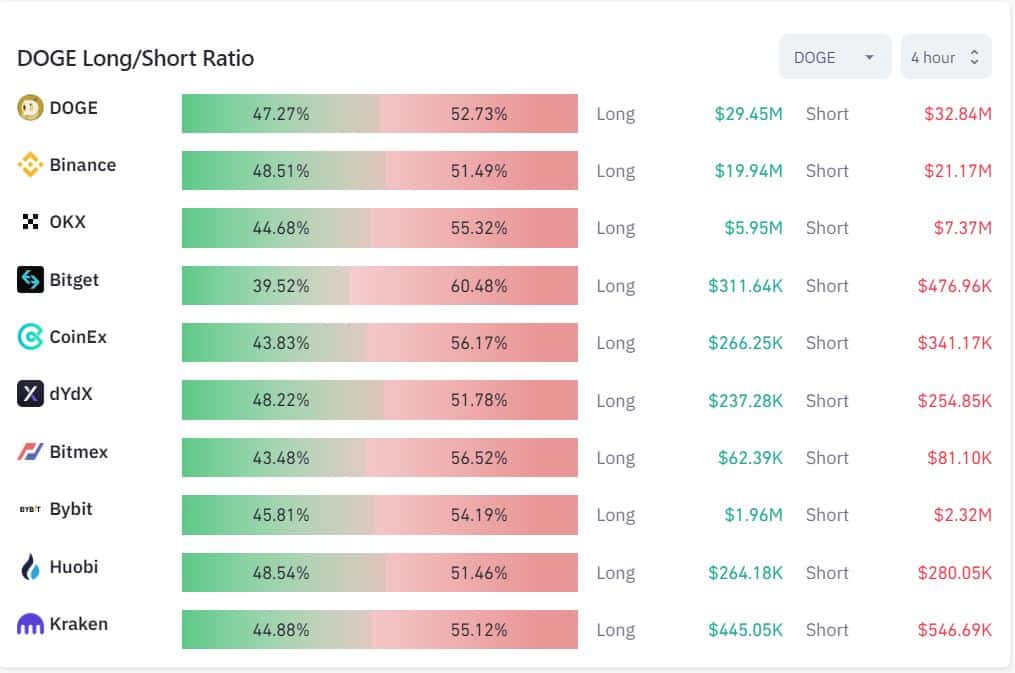

- Sellers dominated the long/short ratio by 52.73%.

Dogecoin [DOGE] experienced a significant bullish rally at the beginning of April that saw its price surge to $0.1016. However, it has been on a bearish decline afterward, shedding over 30% of its value. This saw DOGE trade at $0.0736, as of press time.

Read Dogecoin’s [DOGE] Price Prediction 2023-24

With Bitcoin [BTC] continuing to trade sideways between $26k and $27k, selling pressure could see DOGE sink lower.

Will $0.0700 support hold?

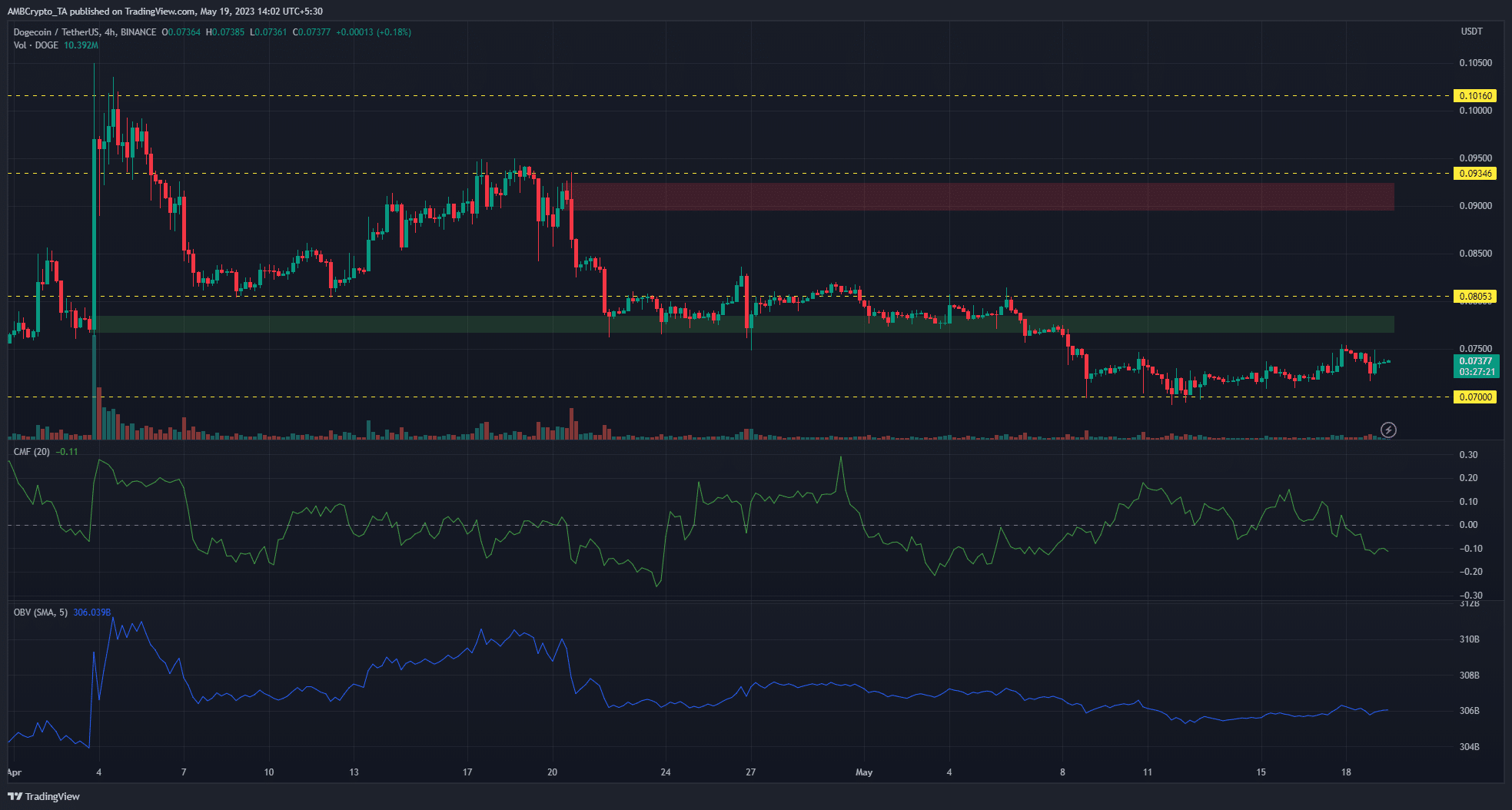

DOGE’s sharp rise in early April was swiftly curtailed by sellers at the $0.1016 resistance level. This pushed DOGE to the $0.0805 support level with bulls rallying to touch $0.0934 briefly. The bearish order block and resistance at $0.0934 ushered a new wave of selling pressure that pushed DOGE to its lowest price level since March.

With price trading at the $0.0700 support level over a 10-day period, bulls have temporarily halted the bearish momentum. However, they have been unable to push on from the support level for more gains. This suggested that bears could force another downward move again, especially if Bitcoin drops toward the $25k level.

Technical indicators on the four-hour chart leaned toward sellers. The Chaikin Money Flow (CMF) dipped under the zero mark and stood at -0.10, as of the time of writing. This hinted at continued outflows for DOGE. The On Balance Volume (OBV) also remained flat, hinting at limited demand for DOGE.

An uptick in volume could spur a bullish rally from the $0.0700 support level. Conversely, another re-test of the support level could see DOGE experience more aggressive selling. This could see bears target the next support level at $0.0632.

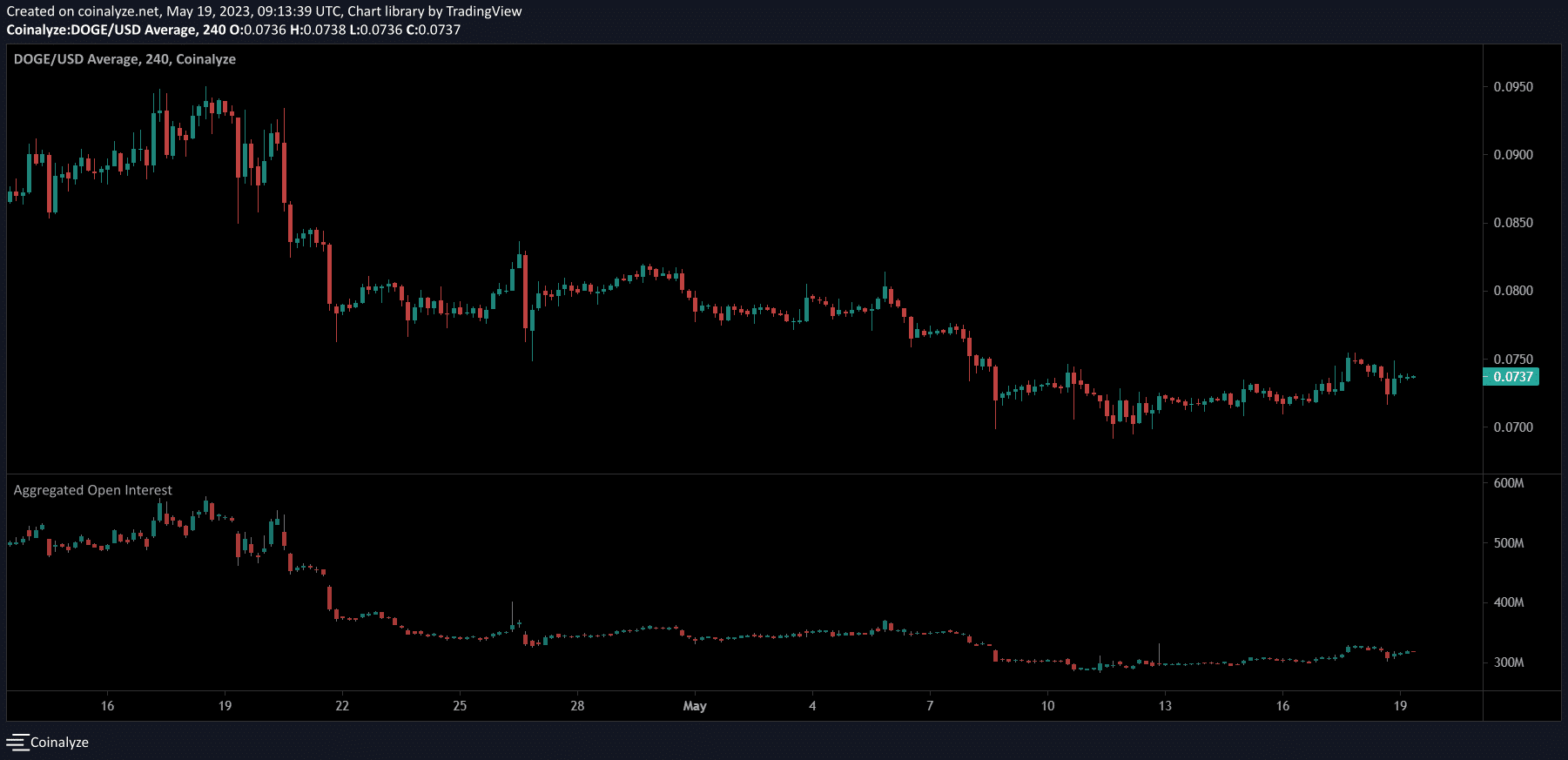

Open interest rates remained in a continual decline

Realistic or not, here’s DOGE market cap in BTC’s term

Data from Coinalyze showed that the Open Interest (OI) rates on 17 May stood at $332.163M but dropped to $317.634M at press time. The outflows indicated a bearish short-term sentiment in the futures market.

In addition, the exchange long/short ratio revealed that shorts held the upper hand, dominating the long/short ratio by 52.73%. With sellers firmly in control, a bullish reversal for DOGE might depend on BTC’s price action in the near term.

Source: Coinglass