Dogecoin bulls must be cautions as the DOGE rally runs into a resistance zone

Disclaimer: The findings of the following analysis are the sole opinions of the writer and should not be considered investment advice

- The market structure remained bearish on the 4-hour chart

- $0.086 could prove to be a crucial level over the next two days of trading

Bitcoin sank as low as $15.5k over the past two days of trading but quickly reversed and fought to climb back above $16.2k. However, it still faced resistance at the $16.5k-$16.7k region. Dogecoin followed Bitcoin on the charts and saw a 15% bounce over the past 36 hours.

Read Dogecoin’s [DOGE] Price Prediction 2023-24

The US Dollar Index stood at 107 but has been in decline throughout November. With the FOMC minutes set to release later on press day, volatility can be expected. Will the bulls be able to press their advantage, or will the bears take control of the crypto market once more?

Dogecoin sees a bounce from a support level but bulls aren’t a dominant force yet

From 8 to 14 November, the region from $0.078-$0.082 was a place where the price regularly wicked down before seeing a bounce. This suggested that strong demand was present, and even a move to $0.073 was quickly reversed. It was this same region within which Dogecoin traded at the time of writing.

$0.0835, $0.089, and $0.0946 are stiff resistance levels to the north. The four-hour chart showed the market structure to be bearish. Meanwhile, even though the RSI climbed back above neutral 50, it exhibited a hidden bearish divergence. This suggested that the previous downtrend could continue soon. The Chaikin Money Flow (CMF) was near 0 and the inference was that strong money flow into or out of the market was not yet indicated.

Cautious traders might want to wait for Bitcoin to make up its mind over the next day or two. The trend has been downward, but the FOMC meeting could throw a wrench into the plans of both bulls and bears.

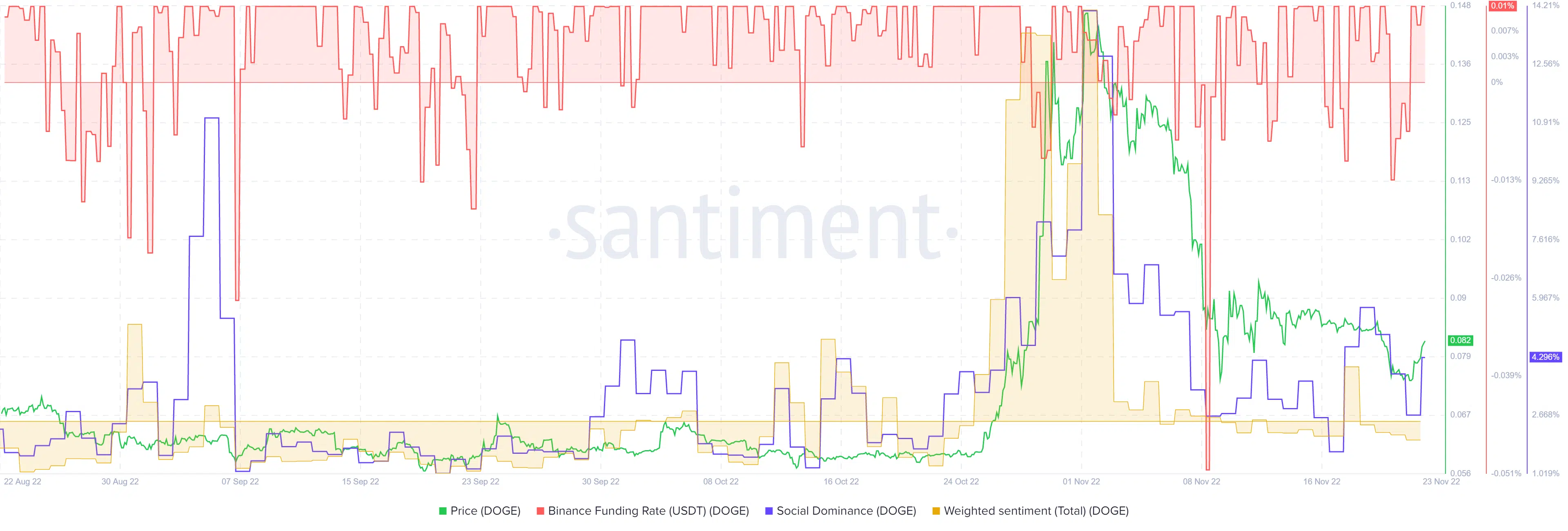

Weighted sentiment and social dominance trend downward

Source: Santiment

The funding rate was positive on Binance. This meant that futures market participants have been bullish in their outlook in recent hours. A fall beneath the zero mark can be indicative of heavy selling pressure on lower timeframes.

The social dominance metric soared earlier in November and still stood strong at 4.3%. However, the weighted sentiment was in negative territory to point out that the social mentions of DOGE were negative overall. A strong rally could change the outlook on social media. To do that, $0.089 and $0.094 would have to be flipped to support levels.