Dogecoin [DOGE]: Assessing the odds of a 15% drop on the charts

Disclaimer: The findings of the following analysis are the sole opinions of the writer and should not be considered investment advice.

- DOGE continues to trade under its month-long resistance at $0.065

- More downside remains the likelier path for DOGE

Dogecoin [DOGE] recorded a surge in mid-August and threatened to break past the $0.078-resistance level. For the space of a couple of days, the level held as support, but the bulls were overwhelmed quickly thereafter. Since then, the price has made a series of lower highs. Dogecoin did not show a high probability of a strong move north as the price toiled beneath a month-long resistance level.

To the south, the $0.055-level could halt the bears.

Bearish order block near month-long resistance

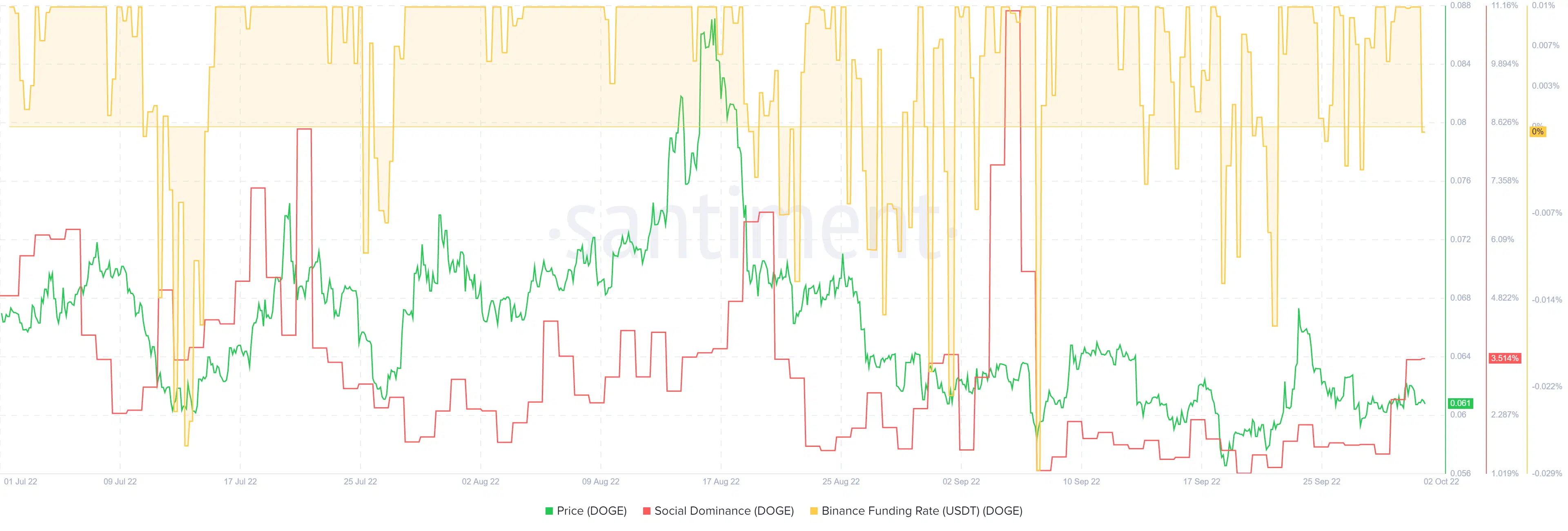

The Visible Range Volume Profile showed the Point of Control to lie at $0.069. This revealed that from mid-May, the level that DOGE has traded the most volume at was $0.069. Just beneath this level was a bearish order block.

The daily timeframe underlined the market structure to be bearish as the previous lower high at $0.065 in September was unbeaten. The confluence of a key resistance level and the 12-hour bearish block (highlighted by the red box) set up a clear selling opportunity.

Sellers would look to drive the price as far south as the $0.05-$.055 region. To increase the risk-reward ratio, a move towards the $0.065 highs of the past two days can be used to enter a short position.

The technical indicators revealed a slight bearish bias. The RSI was near the 50-mark and showed no real trend in progress. The CMF dipped below -0.05 recently to show significant capital flows out of the market.

Social dominance doesn’t help DOGE on the price charts

The Social Dominance metric has risen for Dogecoin over the past week. Yet, this might not see DOGE grab investors’ attention. In fact, a spike could also follow a sharp drop in price. After all, the meme coin was ranked 10th on CoinMarketCap with a market capitalization of $8 billion, at press time.

The funding rate stood in positive territory for much of the past month, apart from the quick negative projections during instances when DOGE saw quick declines. The positive funding suggested bullishly positioned speculators, but this changed overnight as the rate slid back to near 0% for DOGE.

From a technical standpoint, DOGE stood under its month-long resistance zone. Even though buying volume was present over the past two months, it was not enough to overturn the downtrend.

Bitcoin also had bearish momentum as it was unable to flip $20.5k to support from mid-September. Dogecoin could follow BTC on a northbound rally. Even so, a move south over the next week appeared more likely at press time.