Dogecoin facing dip from $0.09 – Should traders go long or short?

- Dogecoin showed strong bullish intent on the price chart.

- The lack of volume slightly dampened the buyer vigor.

Dogecoin [DOGE] witnessed a significant whale transaction on the 15th of February, but the price rebounded strongly after a minor dip. However, the bulls were unable to reclaim the 78.6% Fibonacci retracement level.

In other news, the meme coin managed to enter the top 10 cryptos by market capitalization for a brief window of time. However, Chainlink [LINK] was quick to flip DOGE at press time and push it downward to the 11th spot.

Examining the Fibonacci levels alongside the structure

Based on the drop from $0.0944 to $0.075 in the first week of 2024, a set of Fibonacci retracement levels (pale yellow) were plotted. A bearish order block on the 12-hour chart at the $0.084 region was also highlighted in cyan.

Together, they underlined the strong resistance that has been present at the $0.083-$0.086 region. In the past few days, DOGE bulls were able to break out past it after more than a month of trying.

However, while the market structure and the momentum from the RSI signaled bullishness, caution was warranted. The OBV was yet to break out past the local highs set earlier this year. This meant that buying volume had been relatively weak despite the price gains.

The 78.6% retracement level at $0.09 also forced a minor dip in the past 12 hours. Dogecoin was trading at $0.086 once more, and a retest of the former resistance zone indicated that this was a buying opportunity for the bulls. Or is it a rejection and the beginning of a downtrend?

Clearing some of the confusion around the price action

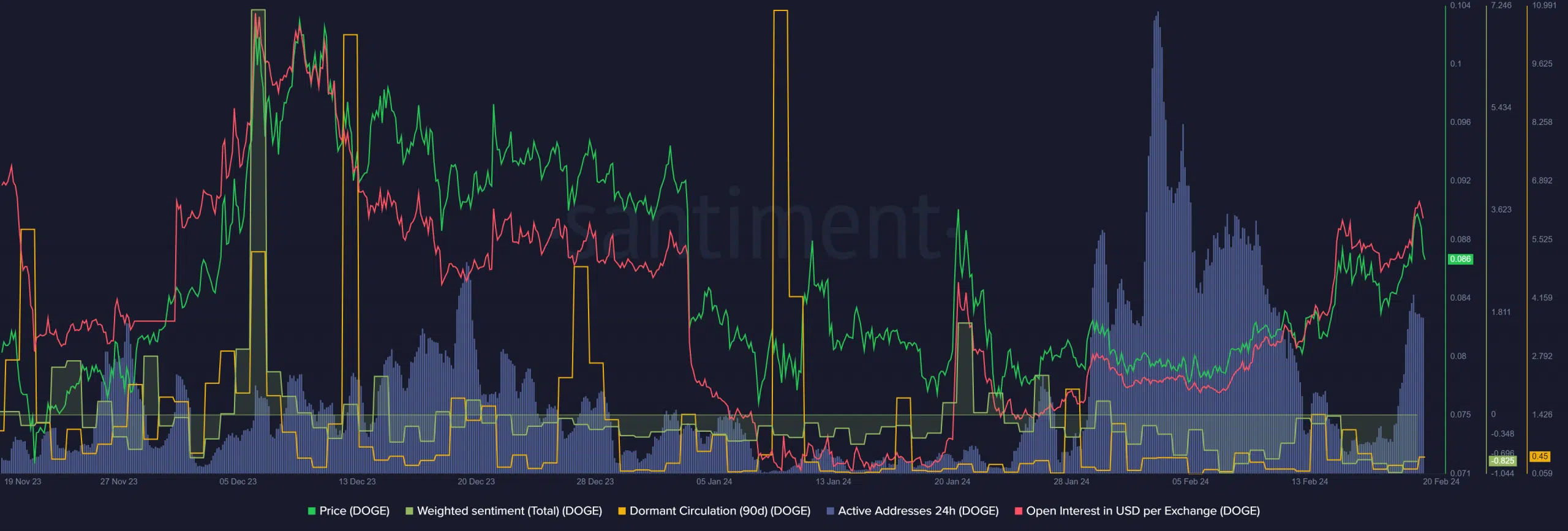

Source: Santiment

Meme coin investments are wrought with risk. The weighted market sentiment has been negative since the final week of January, which meant that the market participants were not too keen on buying DOGE.

However, the Open Interest rose steadily higher, which showed speculators were excited to bet on continued price gains. The active addresses also soared in recent days and could fuel demand for Dogecoin.

Realistic or not, here’s DOGE’s market cap in BTC’s terms

Putting all the information together, it appeared that buying Dogecoin was a safer bet than going short. The $0.0815-$0.083 represented a pocket of liquidity that could be swept before the rally continues.

If the token prices fall below the $0.081 mark, traders could flip their bias bearishly. A drop below $0.0819 would flip the market structure bearishly as well.

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion.