Dogecoin market cap crosses $62B – Will DOGE see more gains?

- DOGE has seen more active addresses in the last 30 days.

- It remains the biggest memecoin by market capitalization.

Dogecoin [DOGE] has crossed an impressive milestone, surpassing a $62 billion market cap.

This surge reflects a strong recovery from the lows seen earlier in 2024, driven by increased on-chain activity, surging transaction volumes, and growing investor interest.

As DOGE climbs higher, the question arises: Can it sustain its momentum through December, or is a correction on the horizon?

Dogecoin’s market performance

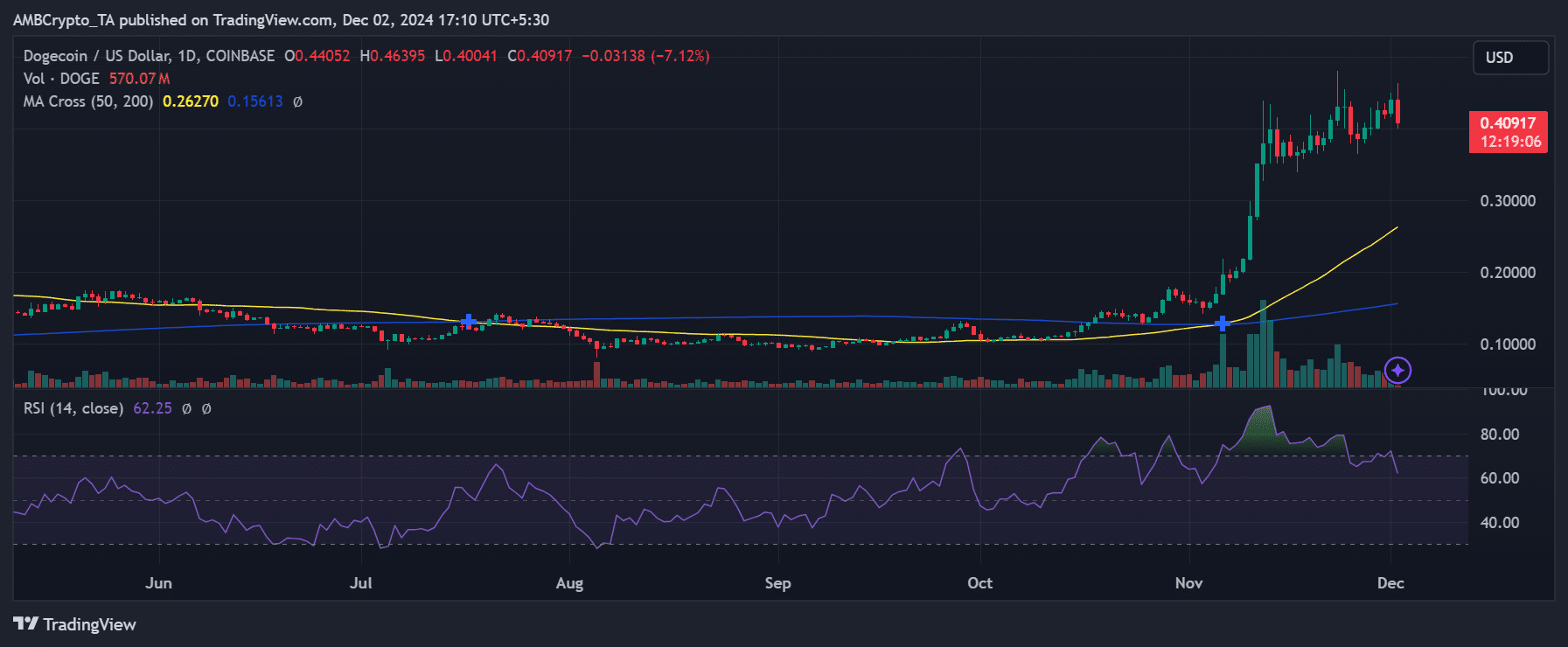

Dogecoin has experienced a parabolic rise, with its price currently trading around $0.44 after rallying from under $0.10 in October.

This remarkable growth has been supported by strong technical indicators that underline the strong market sentiment.

The 50-day moving average at $0.26 has served as a springboard for the rally, while the 200-day moving average at $0.15 remains a critical long-term support level.

The widening gap between these averages signals sustained bullish momentum.

The Relative Strength Index (RSI) was 62 at press time, suggesting that Dogecoin had cooled off slightly from the overbought conditions observed earlier in November.

This indicates that there is room for further upside if buying pressure resumes.

However, key levels to watch include the immediate resistance at $0.50, a psychological and technical barrier that could define its December trajectory.

On the downside, immediate support lies at $0.40, with stronger support around $0.35 if a correction occurs.

Depending on market sentiment and trading volume, the technical setup suggests that Dogecoin could consolidate within this range before attempting another breakout.

The market capitalization has followed a similar trend, climbing as the price trended upward. As of this writing, the market capitalization has seen a slight retraction to around $61.3 billion.

A look at Dogecoin’s network growth

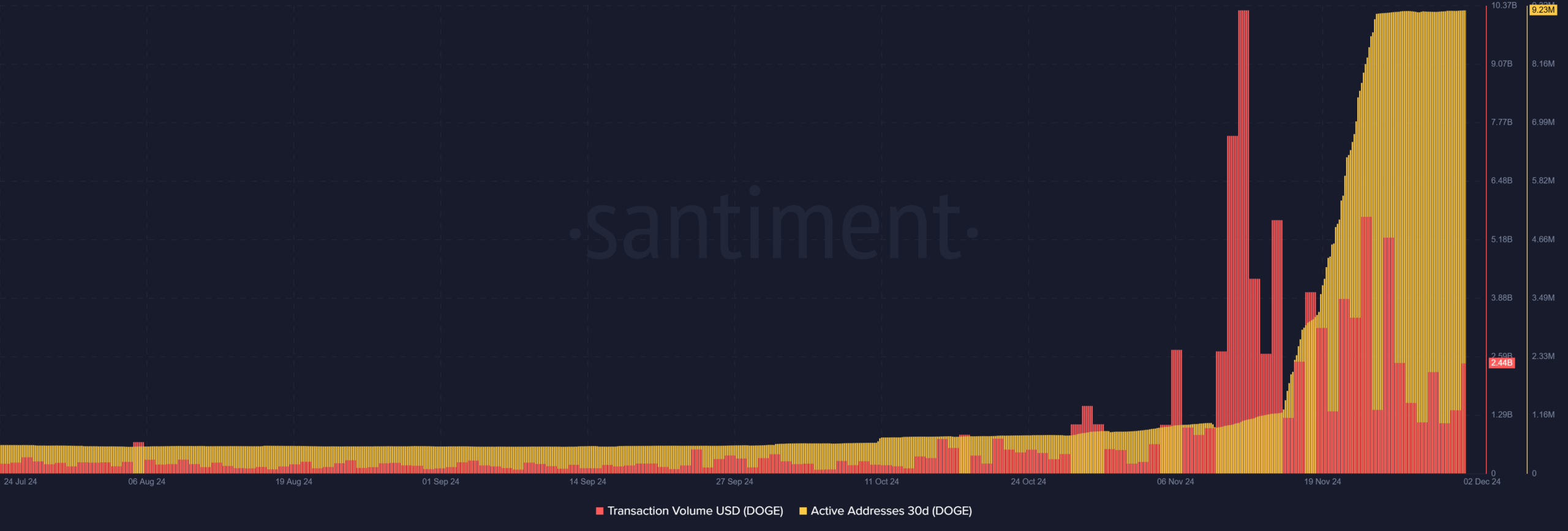

Dogecoin’s on-chain metrics present an equally bullish picture. Transaction volume spiked significantly in November, with daily volumes peaking at over $10 billion mid-month before stabilizing around $2.44 billion in early December.

Although this decline signals a cooling off in speculative trading, the network remains active and engaged, reflecting sustained adoption.

Active addresses on the Dogecoin network surged dramatically in November, reaching a record 9.23 million. This increase indicates rising participation, with both new and existing users engaging in the ecosystem.

The data confirms that Dogecoin’s rise is not purely speculative but is backed by tangible network growth, strengthening its market position.

Market sentiment and December projections

If Dogecoin breaks above the $0.50 resistance, it could target $0.60 or higher by mid-December, driven by its increasing market cap and strong network activity.

Such a breakout would likely attract more retail investors, further fueling upward momentum.

Is your portfolio green? Check out the DOGE Profit Calculator

Conversely, a failure to maintain support at $0.40 could lead to a retracement toward $0.35, particularly if transaction volumes and active addresses decline.

Profit-taking by whales could exacerbate short-term volatility, adding to the risk of a correction. The broader cryptocurrency market, especially Bitcoin’s performance, will also be crucial in determining Dogecoin’s trajectory.