Dogecoin

Dogecoin mirrors a key 2020 pattern, and that means DOGE will now…

Dogecoin experienced a strong upswing over the past months. Analysts eye a repeat of 2020 pattern that saw a 1366.67% surge.

- DOGE surged by 30. 45% over the past month.

- Market fundamentals suggested investors’ favorability as analysts eye a major pump.

Over the past three weeks, Dogecoin [DOGE] has traded above 200 EMA, signaling a strong bullish trend.

This continued rise has brought about widespread discussion within the Dogecoin community, with analysts predicting an upcoming uptrend.

Prevailing market sentiment

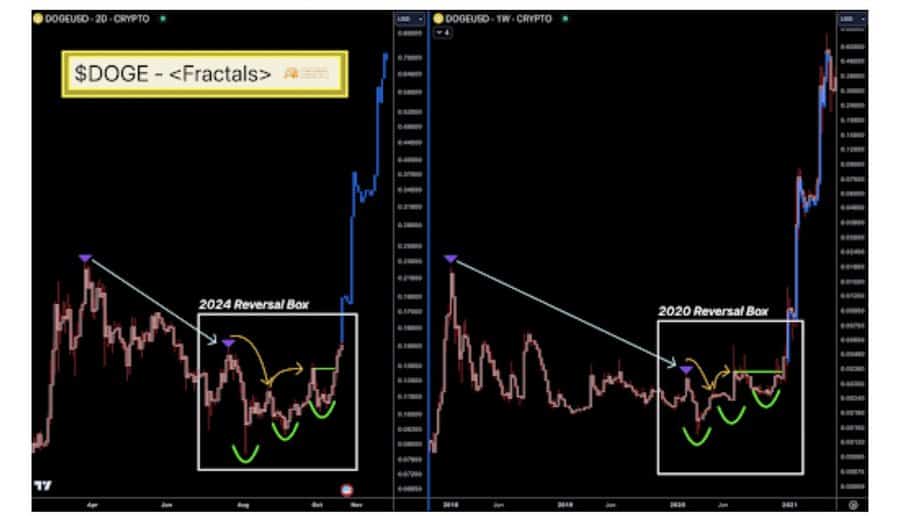

In an analysis, the CEO posited that DOGE’s price action was mirroring the 2020 ‘Reversal Box’ pattern.

Consequently, the memecoin has formed three higher lows and broke out of major resistance.

For context, when DOGE forms a Reversal Box pattern, it signals the end of stagnation and the beginning of a potential upward rally.

Therefore, when higher lows form, it suggests that the selling pressure is weakening and buyers are starting to dominate the market.

When this pattern formed in 2020, Dogecoin saw a strong upswing. For example, during the latter part of 2020, DOGE surged from $0.0023 to $0.00048. Also, the memecoin hiked from $0.006 to $0.088, gaining 1366.67% in the same year.

This surge prepared for the 2021 major Dogecoin bull run to ATH.

Therefore, if history repeats itself, the memecoin will experience a major pump as it did in 2020.

DOGE’s price chart indicates…

While the analysis provided by the CEO provided a promising outlook for Dogecoin, it is essential to counter-check other market fundamentals.

The question is does the current market conditions support a potential rally?

For starters, Dogecoin’s active addresses have experienced sustained growth over the past month.

At press time, DOGE’s active addresses were at a monthly high of 764.84k. This suggests there was high participation and demand for the memecoin.

Source: Santiment

Additionally, Dogecoin’s MVRV Long/Short difference ratio has been rising over the past month from a low of -17.13 to -7.76, at press time.

This suggests that long-term holders are confident with the memecoin’s future value. As such, when the market absorbs selling pressure from short-term holders, it would lead to a price rally.

Finally, large holder inflow has experienced a sustained uptrend over the past week. This has surged by 358.64% from a low of 252.92 million to 1.16 billion.

Such an increase in inflow suggests that investors are increasing their funds into DOGE, anticipating more price increases.

What next for Dogecoin?

At the time of writing, DOGE was trading at $0.1396. This marked a 3.5% decline over the past day.

However, the memecoin has been on an upward trajectory, hiking by 30.45% over the past month.

Realistic or not, here’s DOGE market cap in BTC’s terms

Thus, as observed through the above market indicators, Dogecoin is experiencing favorable market conditions that could set the memecoin for more gains.

Therefore, if these current market conditions are maintained, DOGE is well positioned to reach $0.1658 in the short term.