Dogecoin repeats 2020’s trick – Should you bet on a similar breakout in 2024?

- Dogecoin’s bi-monthly RSI surge mirrored the bullish setup seen before 2020’s rally

- Positive on-chain metrics and cautious optimism underlined potential

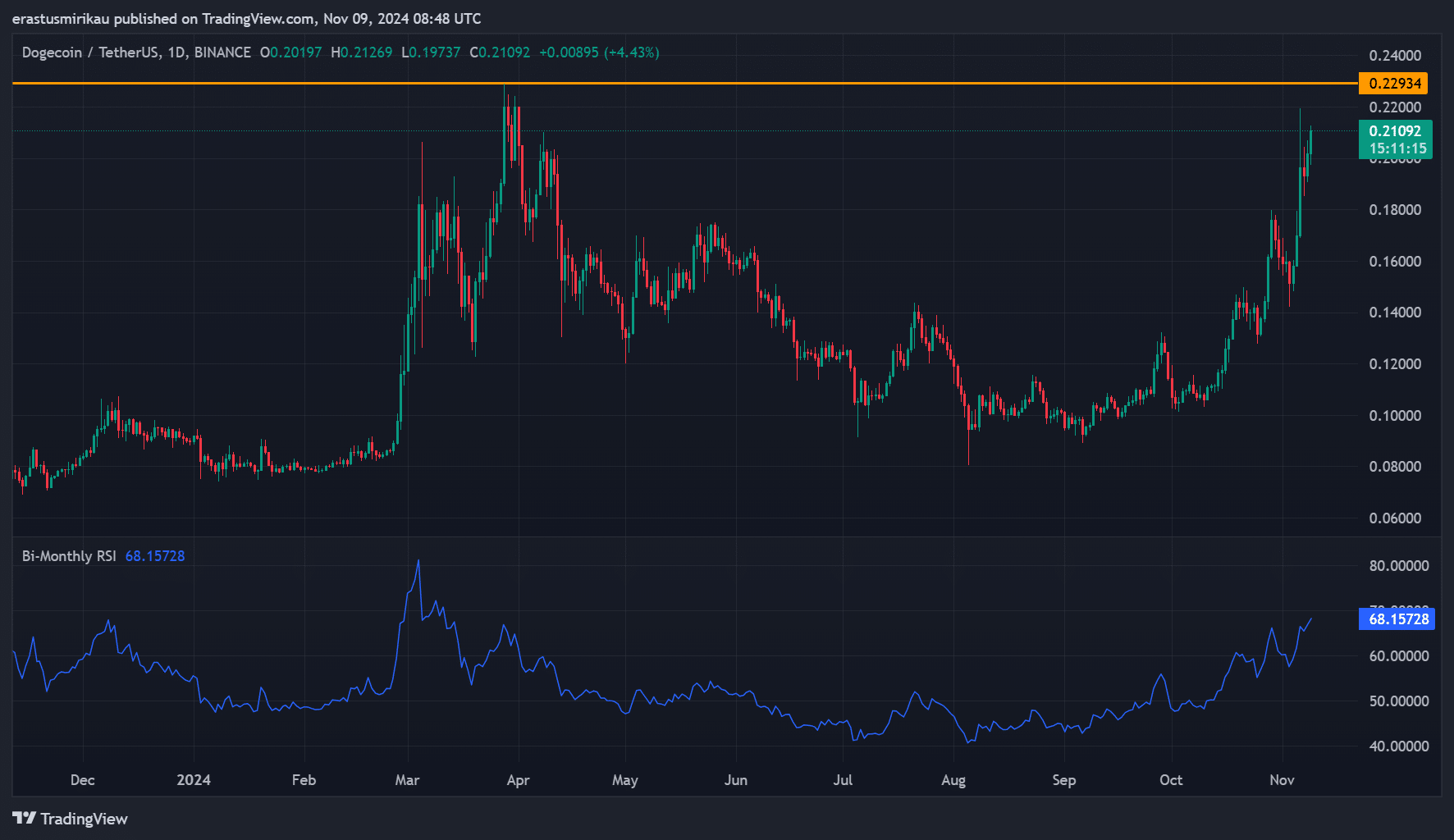

Dogecoin [DOGE]’s bi-monthly RSI has surged to levels not seen since 2020, mirroring a pattern that ignited a major rally years ago. At press time, DOGE was priced at $0.2112 following a 7.17% hike in the last 24 hours. Owing to the same, the memecoin now appears set for a potential breakout on the charts.

Worth noting, however, that with key resistance levels approaching, the next three candles will be pivotal in determining if this momentum can drive Dogecoin to a new bullish phase.

Is the technical setup favoring a breakout?

Dogecoin’s bi-monthly RSI reached 68.15, signaling growing buying pressure. Back in 2020, a similar RSI level marked the start of a massive price surge. As expected, this has fueled speculation that Dogecoin could be on the verge of another major move, according to an X post (formerly Twitter).

However, while a high RSI indicates strength, it also hints at a possible overbought condition. Hence, the aforementioned finding raises questions about whether this momentum will hold or if a short-term consolidation is more likely.

Recent candlestick patterns underlined steady gains, with Dogecoin forming higher highs – A sign of growing bullish sentiment. And yet, at press time, the price faced a key resistance level at $0.229. Breaking through this level is essential for Dogecoin to confirm a bullish breakout, whereas failure could lead to a temporary pullback. This can potentially delay the memecoin’s next rally.

DOGE on-chain signals – Fundamentals aligning with price movement?

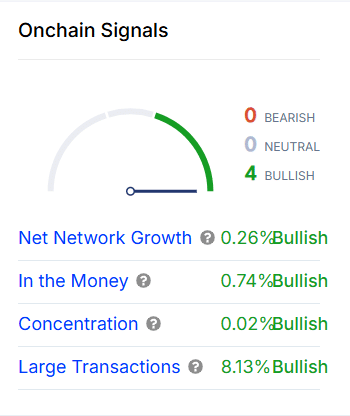

On-chain metrics also flashed some bullish signs. Net network growth increased by 0.26%, indicating rising engagement and interest on the Dogecoin network. Such growth often aligns with sustained positive sentiment, suggesting that more users are entering the Dogecoin space as its price climbs.

Additionally, 0.74% of addresses were “In the Money” at press time, signaling profitability for holders and supporting stable holding patterns.

Also, large transactions jumped by 8.13%, indicating heightened activity from bigger market players. This large-scale interest can be interpreted as a positive sign, one that is well in line with the memecoin’s recent price hike.

Dogecoin’s daily active addresses also surged, recently surpassing 32,000, according to Santiment analytics. This uptick in user engagement coincided with the broader bullish sentiment, showing that more participants are actively transacting.

DOGE market sentiment – Are traders betting on a breakout?

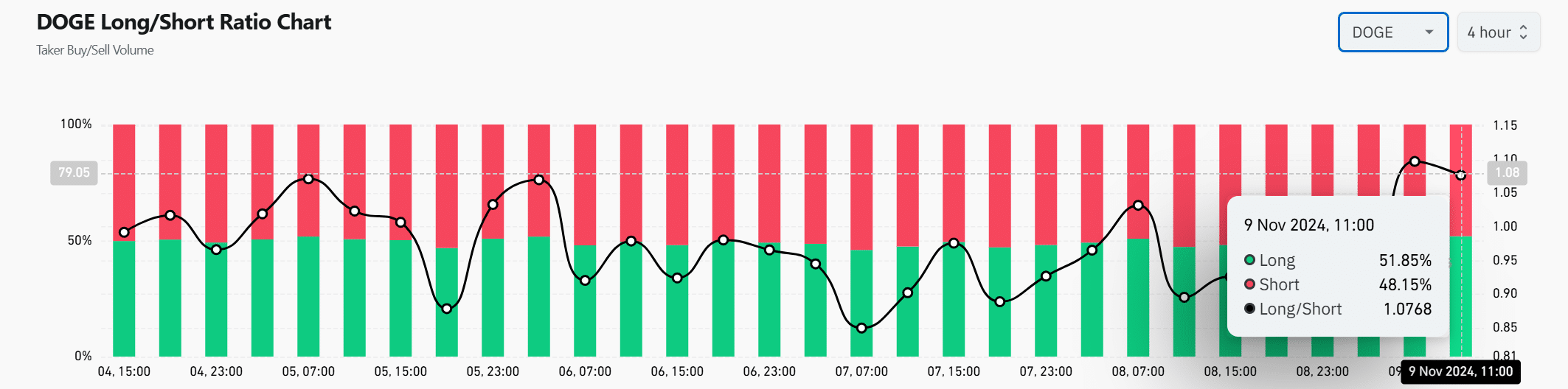

Finally, the long/short ratio revealed that 51.85% of traders were in long positions, just edging out the 48.15% in shorts.

Such cautious optimism means that while traders have been preparing for a breakout, they remain alert to possible resistance. A strong move above $0.229 could sway sentiment more firmly towards a bullish outlook, attracting additional buyers.

Is your portfolio green? Check out the Dogecoin Profit Calculator

Owing to a rising RSI, bullish on-chain signals, and a balanced market sentiment, Dogecoin flashed promising signs of a breakout.

If it clears the $0.229 resistance level, it could ignite the next phase of a strong rally. However, failure to break this level may lead to a temporary pause.