Dogecoin secures $0.060, but sell pressure prevails

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion.

- DOGE secured the $0.060 level but fronted a sluggish recovery.

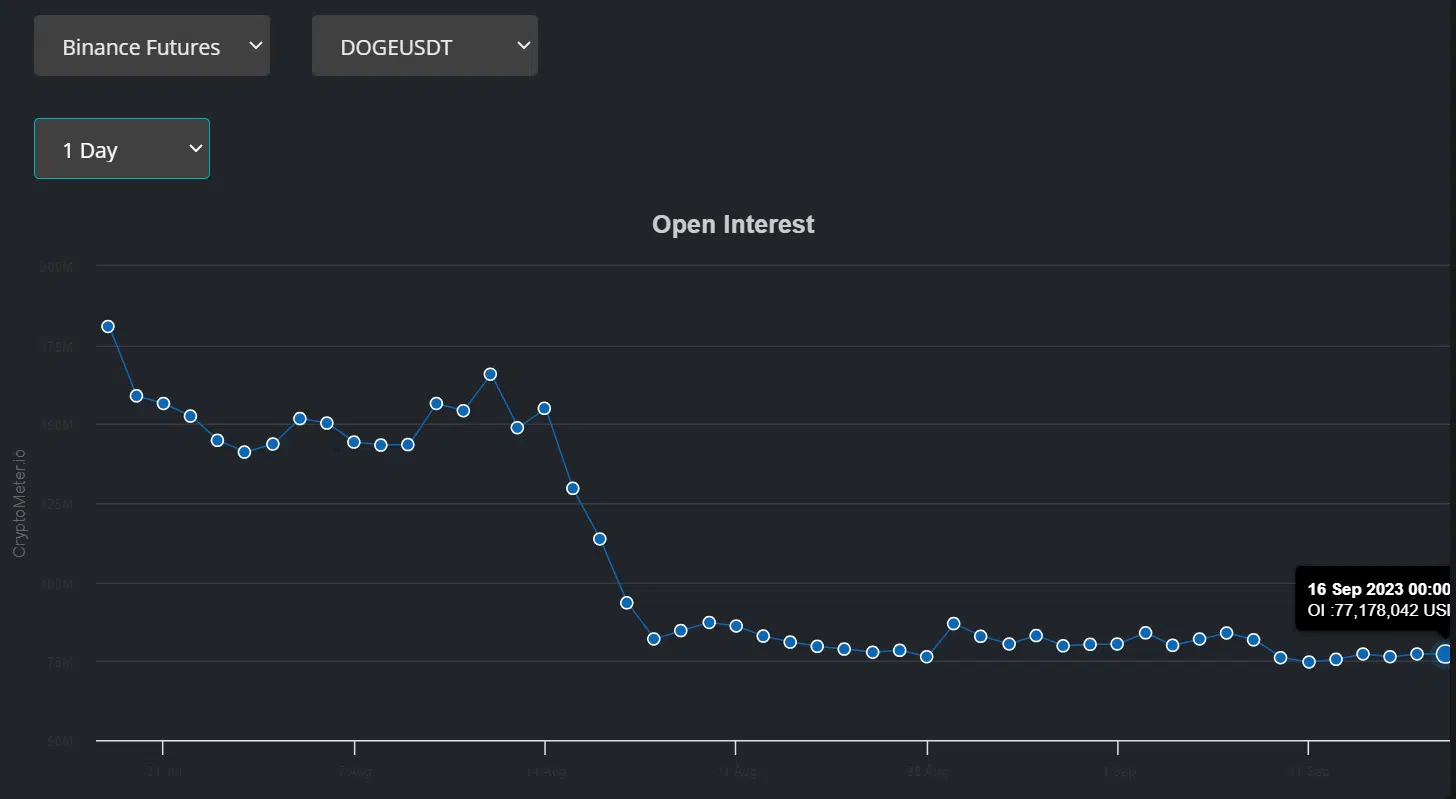

- DOGE’s Open Interest rates wavered in the past four weeks.

Despite the recent recovery, Dogecoin [DOGE] was still under intense sell pressure as of press time. The meme coin traded at $0.0622 at the time of writing, up about 4% from its recent low of $0.059.

Is your portfolio green? Check out the DOGE Profit Calculator

However, wavering demand and increasing short positions could undermine the recovery unless next week’s FOMC Meeting injects positive impetus.

Here are the key target levels for Dogecoin

A Fibonacci retracement tool, yellow, was plotted between the July high of $0.0838 and June lows of $0.0530. Based on the tool, the bulls have consistently defended the 23.6% Fib level of $0.0603 in June, August, and September.

Between mid-August and mid-September, DOGE consolidated losses above the same 23.6% Fib level ($0.060). A false breakout to 50% Fib level ($0.068) retreated at $0.060 at the end of August.

Ergo, if the Fed’s decision on 20 September is dovish, DOGE could target the 38.2% Fib level ($0.0648) or 50% Fib level ($0.0684). Such an upswing could even push DOGE to the roadblock near $0.075 (white), especially if Bitcoin [BTC] rallies beyond $28k.

However, a drop and daily session close below the 23.6% Fib level ($0.0603) will weaken the market structure. In such a scenario, a depreciation towards $0.0556 could be feasible.

Meanwhile, capital inflows to DOGE markets declined, as shown by the southward movement of the Chaikin Money Flow (CMF). Besides, the Relative Strength Index (RSI) has overstayed in the low ranges since mid-August, reinforcing the elevated sell pressure in the past four weeks.

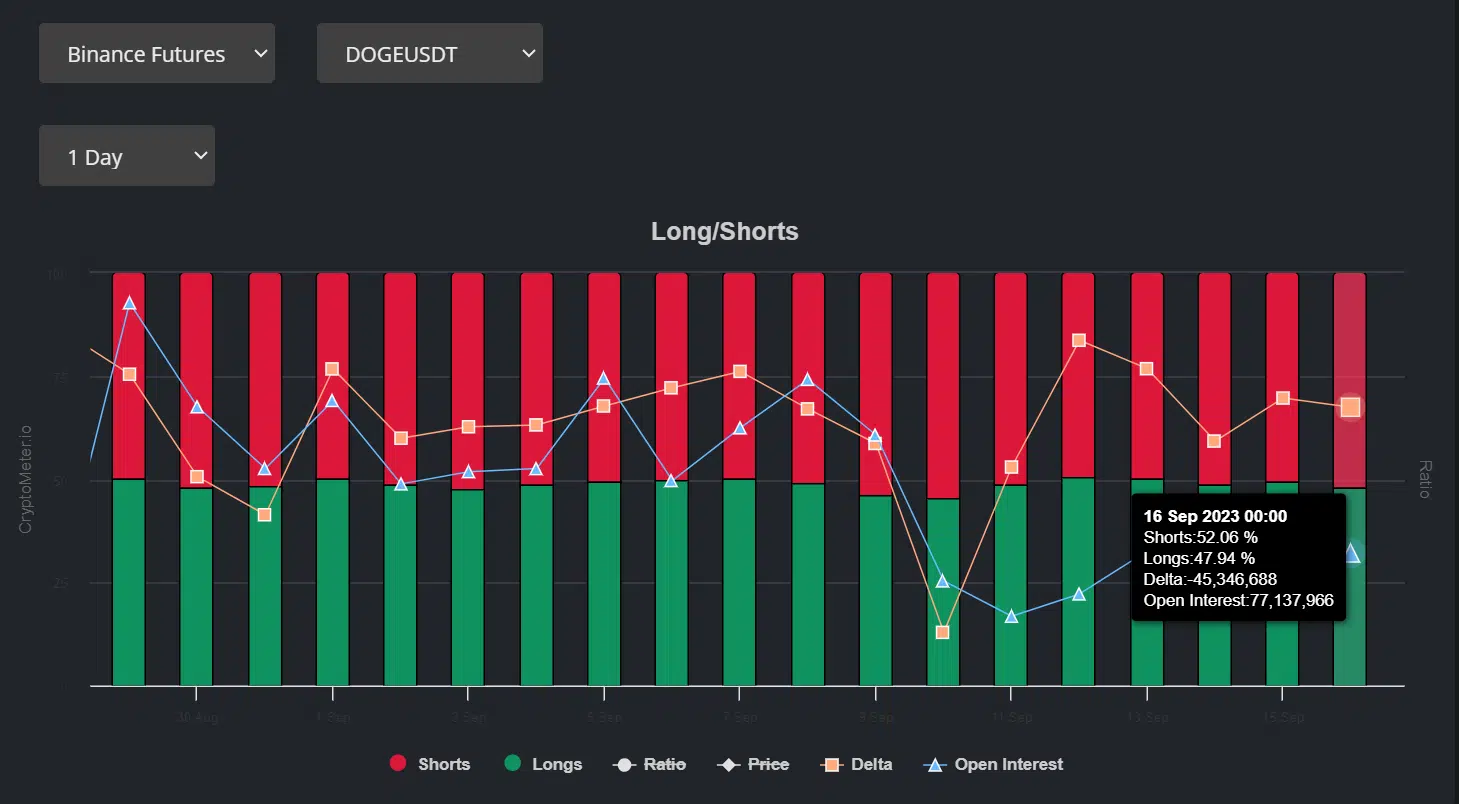

Short positions increased as demand wavered

Futures market data confirmed the spot’s market bearish pressure. In the past three days, more players took short positions against DOGE. It meant that they expected a further drop in the future.

How much are 1,10,100 DOGEs worth today?

In addition, Binance Futures data showed that DOGE’s Open Interest rate wavered above $74 million in the past four weeks (since mid-August). It demonstrated stagnant demand for DOGE, which could extend the price consolidation above $0.060.

However, the FOMC Meeting will induce volatility, and 38.2% and 50% Fib levels were key targets to consider.