Dogecoin sharks and whales need to read this before cutting any losses

- Investors’ sentiment towards Dogecoin was at an extremely low level.

- DOGE circulation was also down but there are chances for a bullish turnover.

A large part of crypto projects gained investors’ attention as the market turned green in the last 30 days but Dogecoin [DOGE] seemed to be struggling.

Surely this is not only related to the coin price which has gained 25.79% within the period. Still, it may have little to do with it, especially as the meme’s performance was one of the lowest out of the top 10 cryptocurrencies by market value.

How much are 1,10,100 DOGEs worth today?

Power may be about to change hands

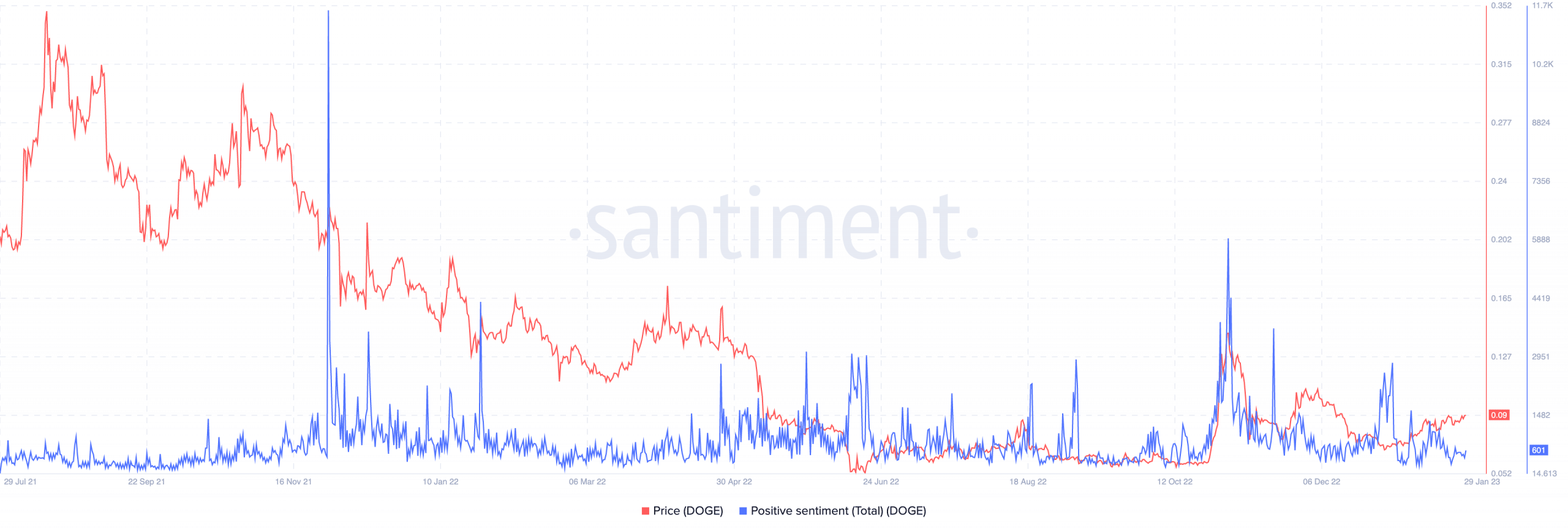

As of this writing, Santiment showed that the positive sentiment exhibited towards DOGE was far from spectacular. In fact, it was at its lowest point since 12 January. And, surprisingly, the greens produced by the broader crypto market remained overwhelmingly obvious after the said date.

With this sentiment in play, it suggested that the crypto community shared a relatively pessimist view of the coin.

This condition could be interpreted as a contrast to the speculation about the bull market being back. This was because the last bull run in 2021 saw memes including DOGE, and Shiba Inu [SHIB] enjoy an aura of positive investor perception in the lead-up to their All-Time Highs (ATHs).

While one might argue that this could be the initial stages of a bear market exit, past cycles were not as worse as the present circumstances.

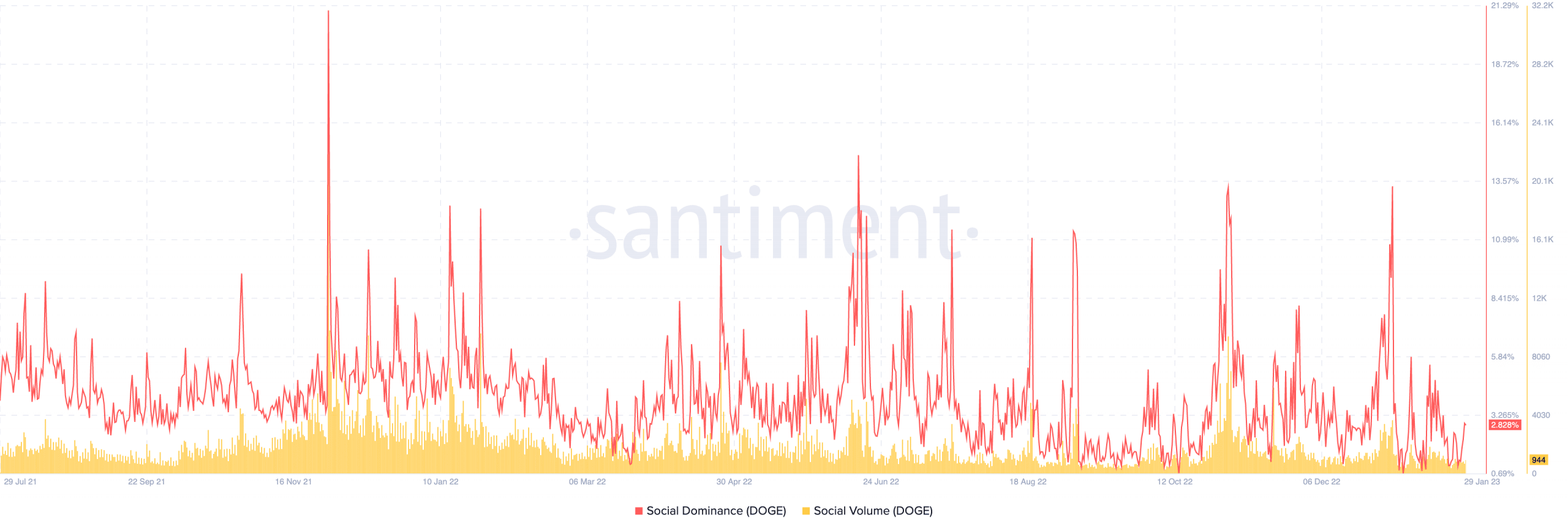

On the social front, information from the on-chain platform showed that DOGE was amid recovery and decline.

At press time, the social dominance was 2.828%— an increase from the dump on 27 January. Social dominance weighs the position of an asset regarding conversations around it and hype.

The change in trend points to an attempt to turn around the DOGE’s involvement in discussions around the crypto community.

The social volume also accompanied the dominance trend with a rise to 944. This meant that prospective investors could have increased their search for the coin. With this state, DOGE may have a chance at matching up to its peers to bulls’ delight.

Is your portfolio green? Check out the Dogecoin Profit Calculator

Caution bulls, Caution!

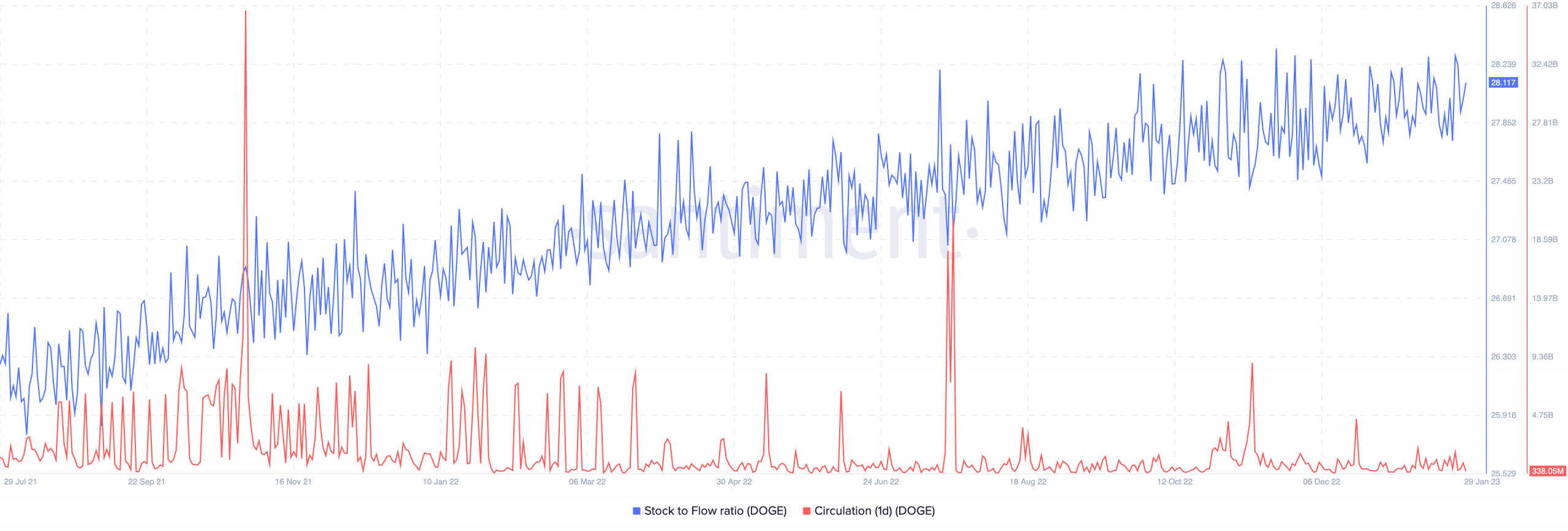

Regardless of the current circumstances and possible bull excitement, the stock-to-flow ratio increased to 28.117.

The metric measures the abundance of an asset in relation to the new and existing supply. An interpretation of the escalation meant that DOGE remains bountiful in the holders’ possession.

Meanwhile, the meme circulation was not as rife as may have been expected. At the time of writing, the one-day circulation was down to 338.05 million.