Dogecoin shrinks to a lower range- Short-selling opportunities limited?

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion

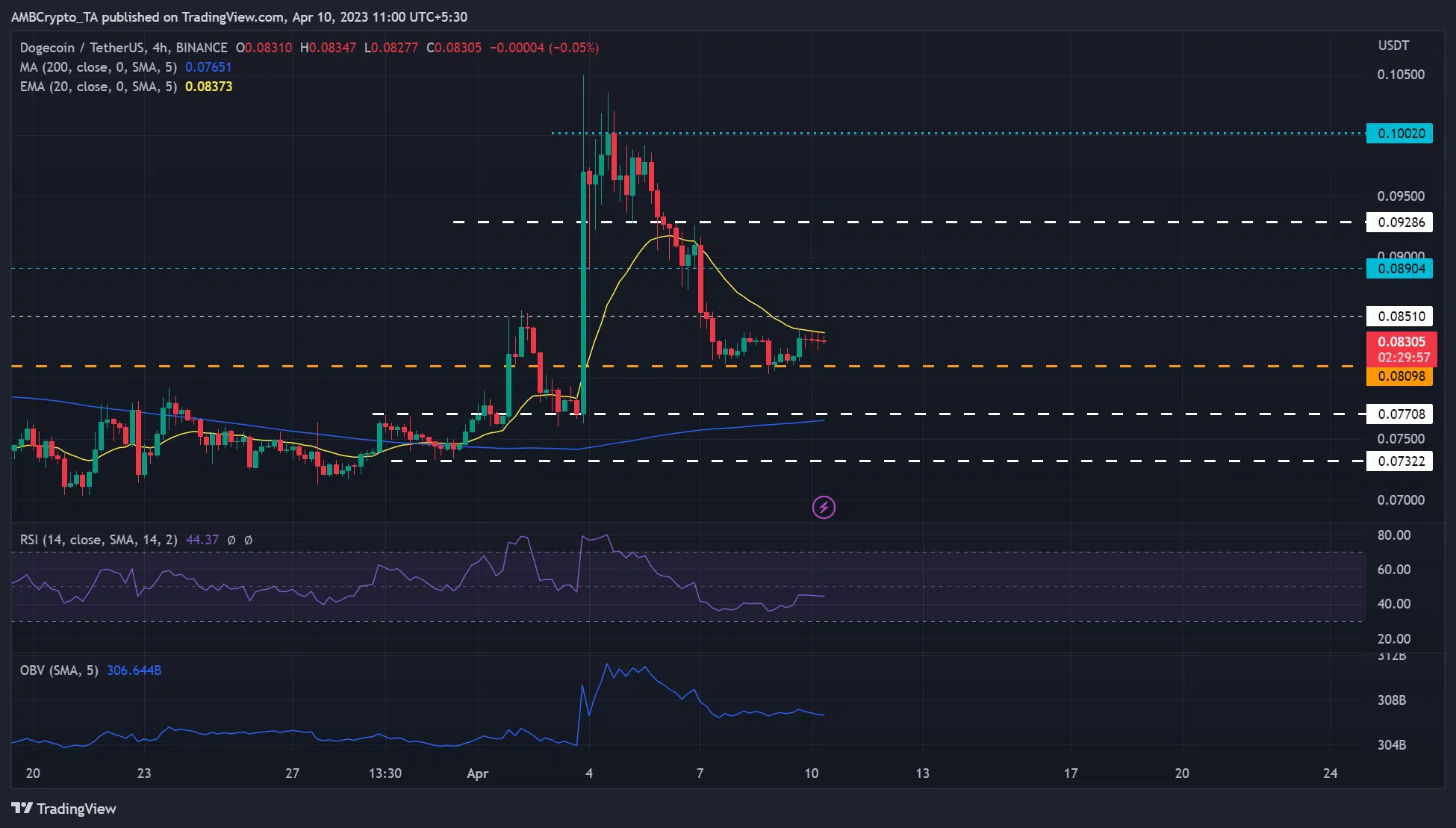

- The 4-hour chart was bearish at press time.

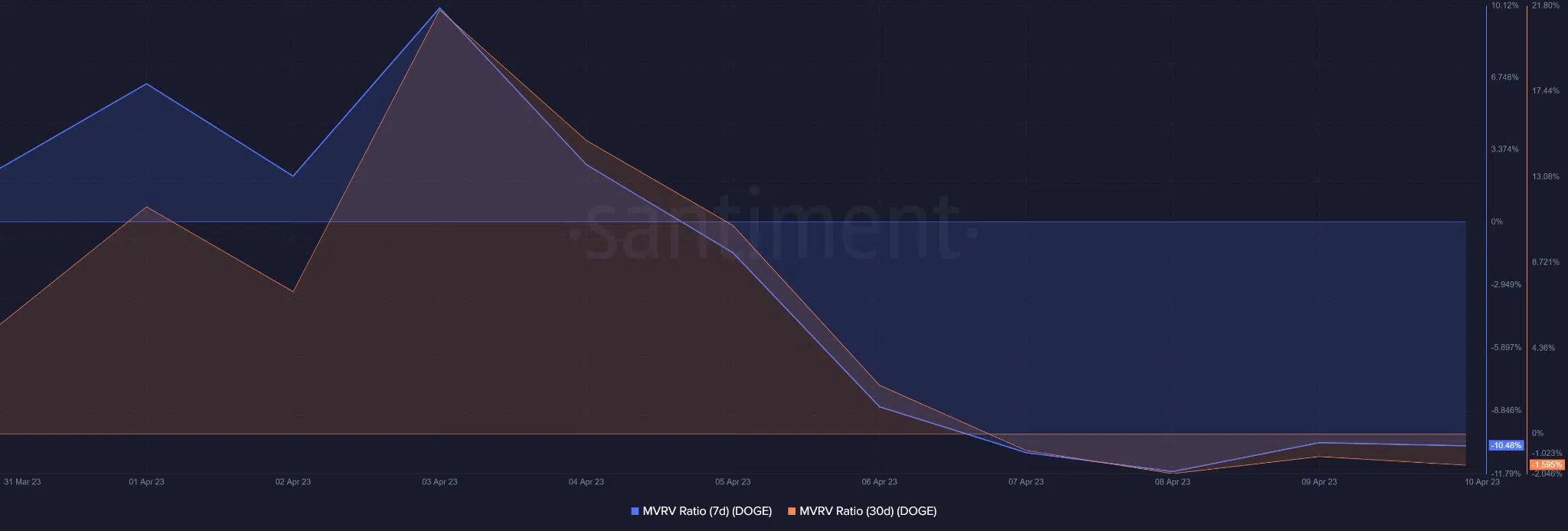

- Weekly holders saw more losses than monthly holders.

Dogecoin [DOGE] sustained short-term sell pressure after Twitter removed its mascot from its logo. But the drop was slowed by the $0.08098 support.

At press time, DOGE traded at $0.08305, up about 1.30% in the past 24 hours, according to CoinMarketCap. But the 20 EMA (exponential moving average) of $0.8373 blocked further recovery.

Read Dogecoin [DOGE] Price Prediction 2023-24

Will bulls defend the $0.08098 support?

The bearish order block at $0.10020 alongside recent Twitter action dented the recent bullish sentiment. Overall, DOGE depreciated about 20%, dropping from its recent high of $0.10500 to near the 20 EMA.

DOGE could continue oscillating in the $0.08098 – $0.08510 range if BTC’s sideways structure of $26.8K – $28.8K persists. In the meantime, DOGE may drop to $0.08098 if the 20 EMA obstacle persists. DOGE may sink even lower to the 200-day MA or $0.07708 support if BTC drops below $26.8K.

But a move beyond the 20 EMA could give near-term bulls the leverage to retest the overhead range boundary of $0.08510. The next key resistance levels are $0.08904 and $0.09286, especially if BTC reclaims its $29K level.

The RSI (Relative Strength Index) was below 50, indicating the looming sell pressure despite the bull’s attempts to defend the $0.08098 support. Moreover, the OBV (On Balance Volume) dipped and fluctuated – indicating a wavering demand for DOGE at press time.

Monthly holders outperformed weekly holders

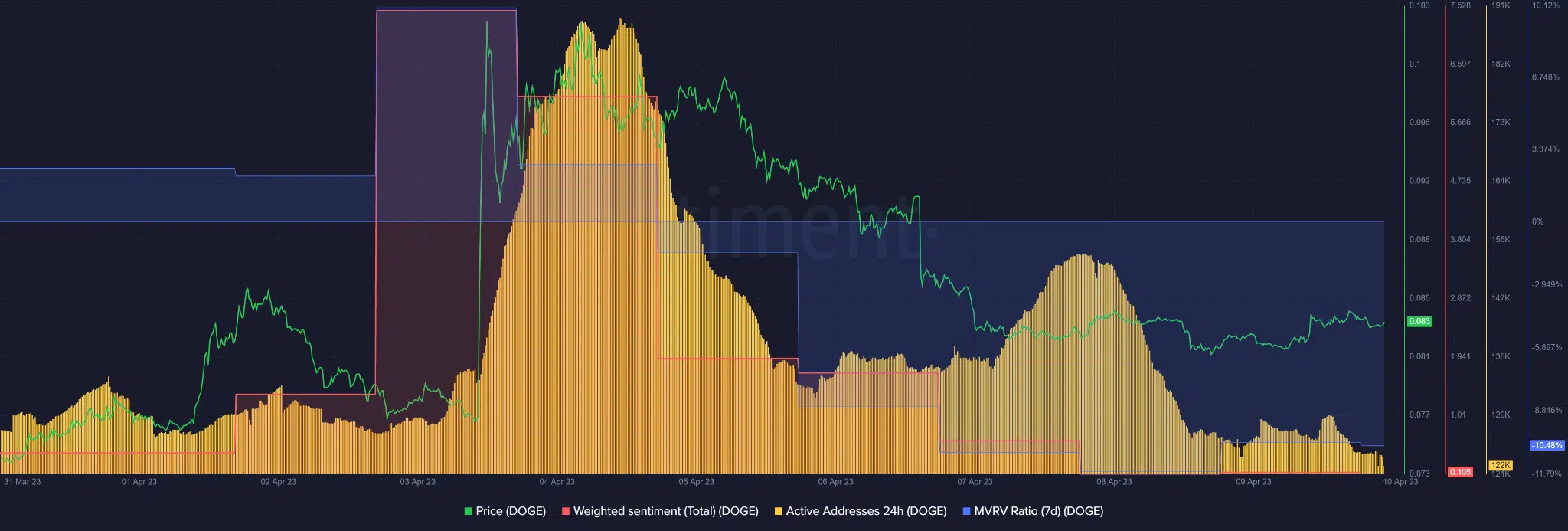

The spike in positive sentiment seen after Twitter changed its logo to the DOGE mascot had declined to a neutral level at press time after Twitter reverted to its original logo.

Similarly, active hourly addresses dipped in the same period, limiting a solid recovery and tipping the scale in favor of bears.

Is your portfolio green? Check DOGE Profit Calculator

In terms of short-term holders’ performance, monthly holders outperformed weekly holders. Monthly holders only incurred 1.5% losses at press time, compared to weekly holders’ 10% losses, as shown by the 30-day and 7-day MVRVs (market value to realized value) ratios, respectively.