Bitcoin holders, do you wonder what’s up with BTC network? Read this

- Bitcoin holders stay put despite high market volatility.

- Bitcoin inscriptions contribute massively to the fees generated by miners, offsetting some selling pressure.

The surge in the value of Bitcoin has led to a significant increase in the profits of numerous Bitcoin holders. However, despite the profit-taking opportunity, a considerable number of these holders have chosen to maintain their positions.

Read Bitcoin’s Price Prediction 2023-2024

According to data provided by Anthony Pompliano, the founder of Morgan Creek Digital, more than 50% of all BTC supply hasn’t moved in the last two years. This indicated that many addresses have resisted the urge to sell their Bitcoin as prices have surged.

More than 1 out of every 2 bitcoin in circulation has not moved in the last 2 years.

We hit a new all-time high of 53% today. pic.twitter.com/W6GzopMAtu

— Pomp ? (@APompliano) April 10, 2023

Under pressure?

However, the tides could turn against Bitcoin soon with the arrival of selling pressure.

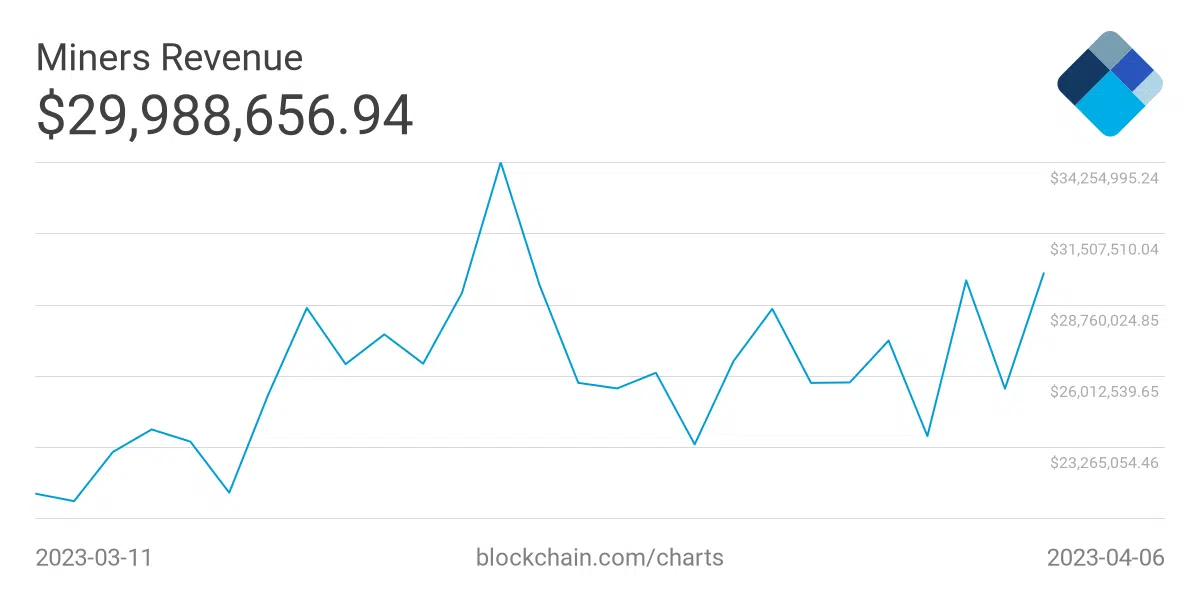

One factor that could increase selling pressure on Bitcoin is the miner revenue which has been falling over the last few weeks.

As mining difficulty rises, and energy costs increase, a decline in mining revenue would force miners to sell their BTC to stay afloat.

Some relief

However, the popularity of Bitcoin Inscriptions and Ordinals may provide some relief to these miners in the future.

According to Messari’s data, Bitcoin’s Inscriptions have started to contribute almost 30% to fees being generated on the Bitcoin network.

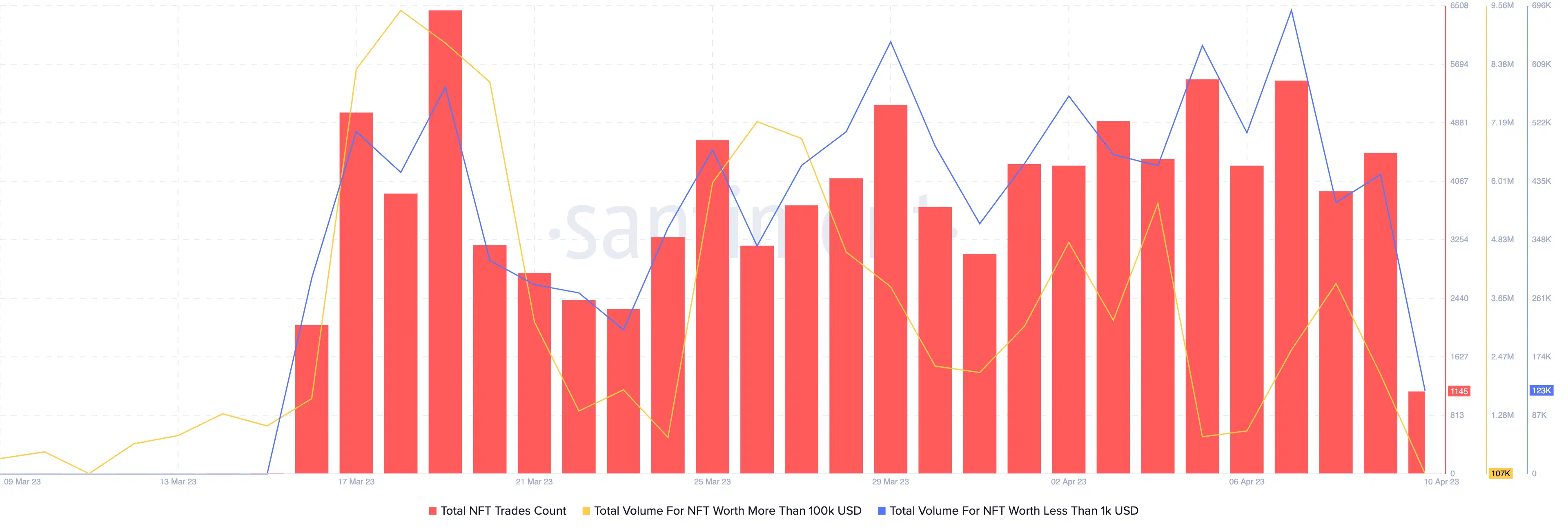

Interest in Bitcoin NFTs has also remained stable as showcased by the high NFT trade count on the Bitcoin network.

But the frequency with which large transactions were being made in the Bitcoin NFT space had declined. Relatively smaller transactions which were less than $1,000 were more prominent on the network.

This indicated that there was a high retail interest in Bitcoin’s NFT market, at the time of writing, and the NFT volume wasn’t being driven by a select few large addresses and transactions.

In fact, Bitcoin received another boost as its exchange reserves decreased, indicating that Bitcoin holders were feeling more positive about the cryptocurrency’s future.

Additionally, CryptoQuant reported that the funding rate for Bitcoin was favorable. Thus, indicating that traders have predominantly taken long positions and are optimistic about the cryptocurrency’s prospects.

Is your portfolio green? Check out the Bitcoin Profit Calculator