Dogecoin: With buyers exhausted, DOGE may head in this direction…

Dogecoin [DOGE] was exchanging hands at $0.1418 per token at the time of writing. The price of leading meme coin rallied by over 130% in the last week, data from CoinMarketCap revealed.

Courtesy of Elon Musk’s final acquisition of social media giant Twitter, data from IntoTheBlock revealed that up to 62% of DOGE investors had turned a profit in the recent price boom. Faring better than holders of leading coins Bitcoin [BTC] and Ethereum [ETH], respective holdings in profit for these assets were 54% and 57%.

DOGE bulls calling it quits?

Following several days of token accumulation and a corresponding surge in price, DOGE buyers no longer appear to be able to support any significant price rally. According to data from CoinMarketCap, DOGE’s price was up by 16% in the past 24 hours. Its trading volume, however, declined by 10% within the same period. This was a classic indication that a price reversal was imminent as buyers in the DOGE market witnessed exhaustion.

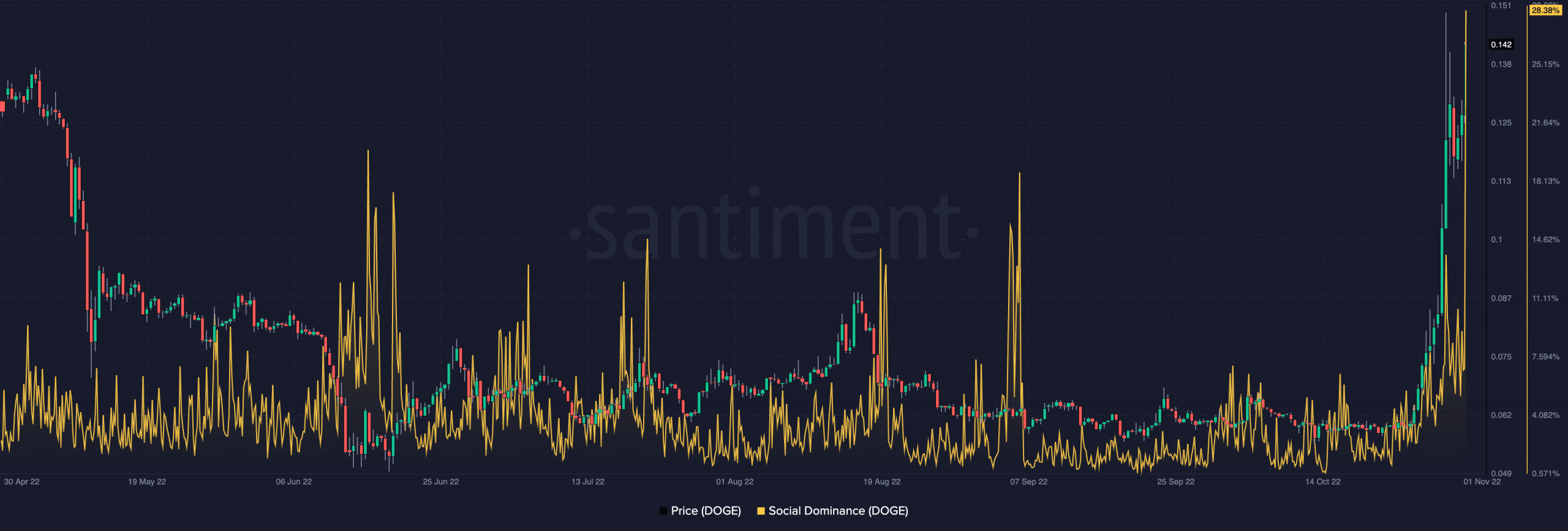

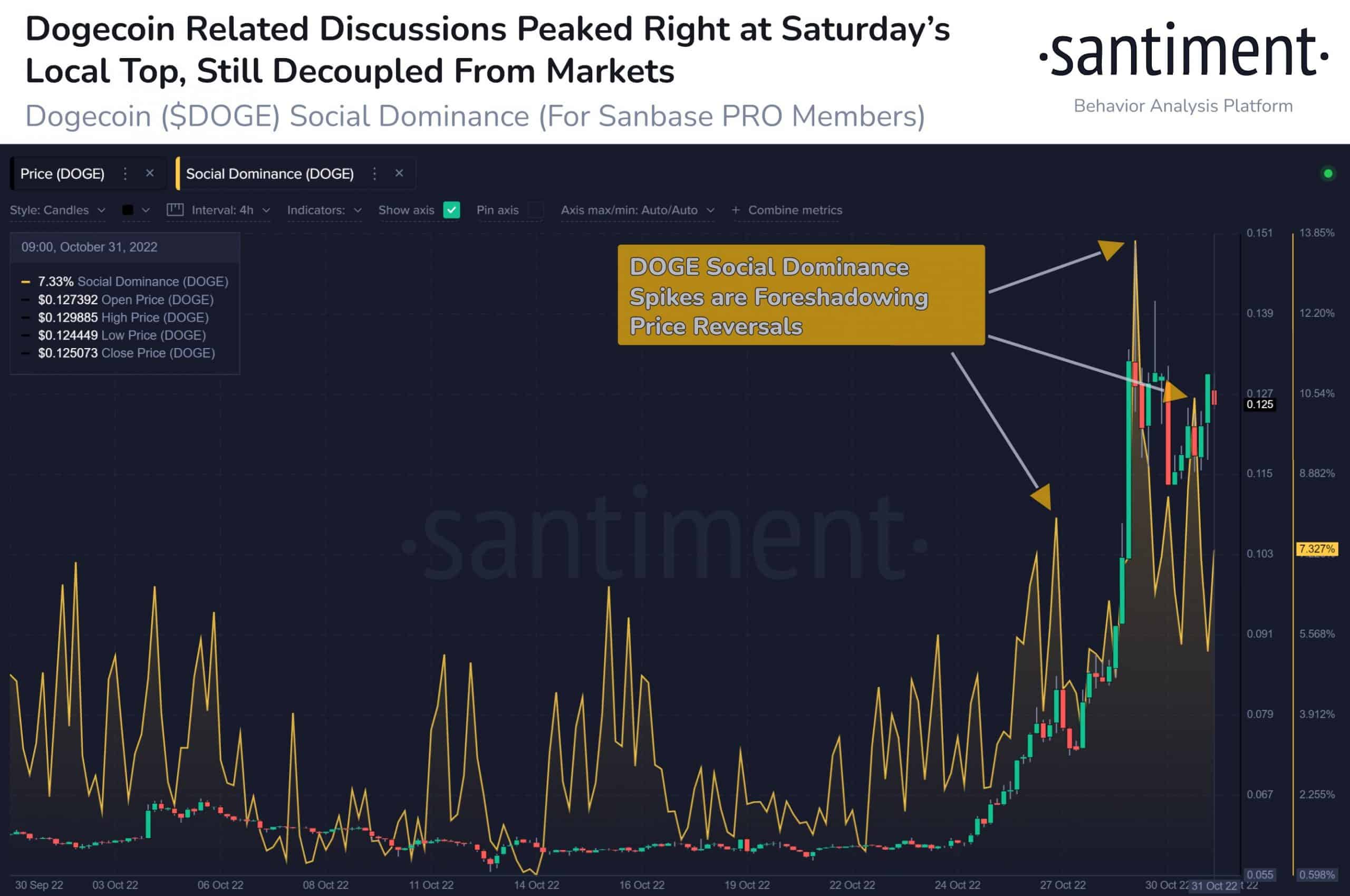

Furthermore, data from on-chain analytics platform Santiment revealed a surge in the asset’s social dominance. As of this writing, DOGE’s social dominance was 28.38%, the highest in the past six months.

While a rally in an asset’s social activity acts as a precursor to a price rally, a continued spike in social dominance during the price rally usually hints at a price reversal. According to Santiment, “DOGE social dominance spikes are foreshadowing price reversals” as DOGE-related discussions peaked right after the local top on 29 October.

With the market marked by buyers’ exhaustion, a sustained rally in the asset’s social dominance would be mere “noise.”

All that is good must end

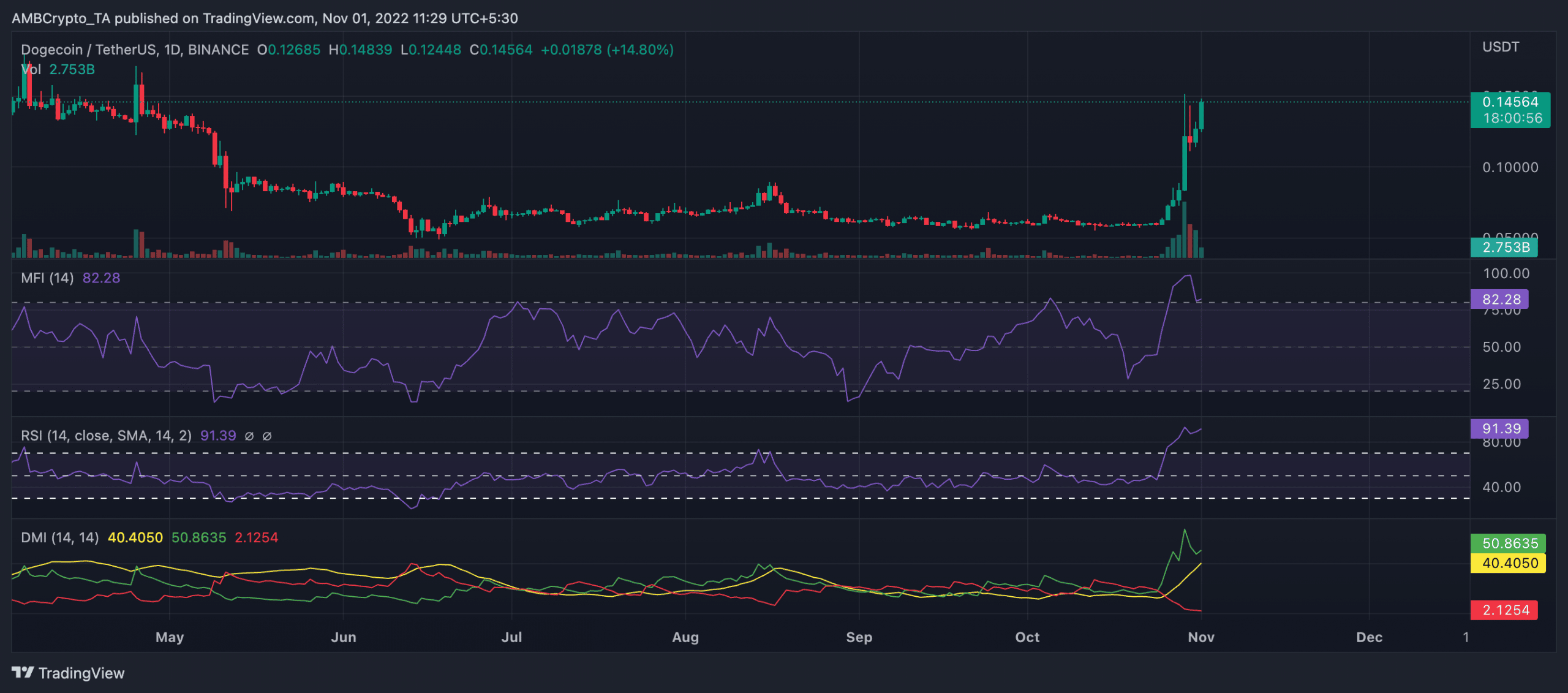

An assessment of DOGE’s performance on the daily chart showed key indicators pointed towards a coming price reversal. As of this writing, the asset’s Relative Strength Index (RSI) was significantly overbought at 91.39. Also, in an uptrend, DOGE’s Money Flow Index (MFI) was spotted at a high of 82.28.

The positions occupied by these key metrics showed that DOGE was significantly overbought at press time. Typically, such highs are usually followed by a price reversal as buyers, more often than not, cannot sustain an asset’s price at that level.

Per DOGE’s Directional Movement Index (DMI), the buyers had control of the market at press time. Their strength (green) at 50.86 rested solidly above the sellers’ (red) at 2.12. Furthermore, the meme coin registered a price rally with no corresponding uptick in trading volume in the last 24 hours. Thus, control was bound to change hands in the coming days.