Dogecoin’s price rally – Here’s when profits will roll in

- DOGE’s MDIA plummeted, indicating rising interest from previously dormant addresses.

- The price might drop to $0.18 before it begins another rally.

After ending the previous week on an impressive note, Dogecoin [DOGE] seems committed to hitting another yearly high this week.

At one point, the price of DOGE dipped to $0.19. But press time data showed that a 7.23% increase has driven the price back above $0.20.

Dogecoin’s rally has been in the faces of market participants for a while. However, not many could confirm what was the catalyst. Interestingly, AMBCrypto did.

The slumbering ones are now full of life

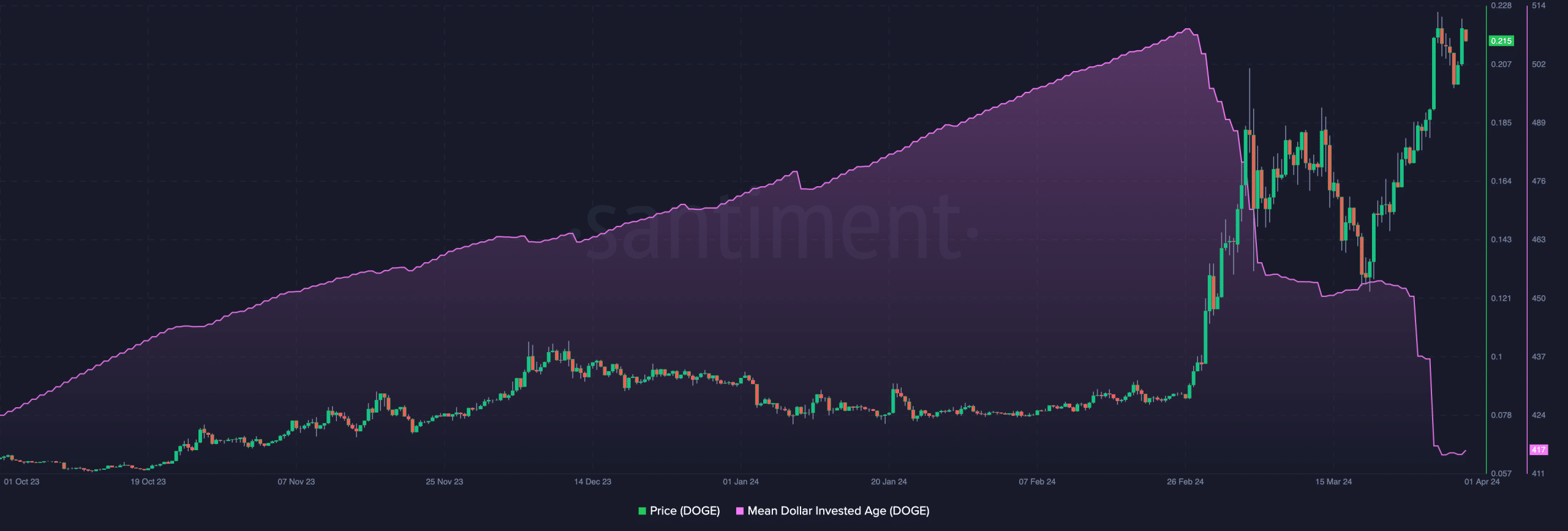

According to our on-chain analysis, there has been a change in the Mean Dollar Invested Age (MDIA), and this has been influential to the price increase.

If a cryptocurrency’s MDIA climbs, it implies that many coins are becoming dormant. This could cause doldrums on the network, thereby, making it challenging for the price to rise.

DOGE’s MDIA has been falling since the 27th of February. But on the 21st of March, it tumbled harder.

Typically, this is an indication that dormant addresses are moving a ton of coins that have been dormant for a while.

Whenever this happens, the price of the cryptocurrency rises, and if it continues, a more significant jump could be close. Meanwhile, AMBCrypto checked the volume around Dogecoin.

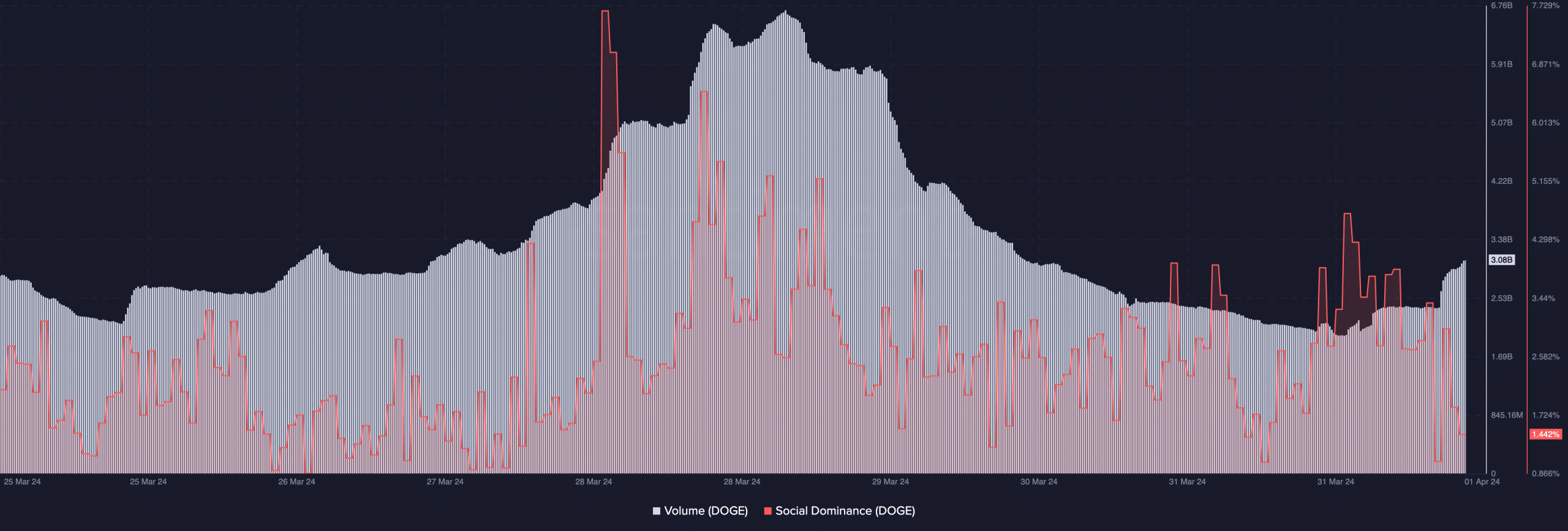

Volume is an indicator of interest. If the metric increases, there is a lot of buying and selling. However, a decline in volume suggests decreasing interest in a coin.

On the 31st of March, Dogecoin’s volume was 2.03 billion. However, data as of this writing showed that the metric had climbed to 3.07 billion.

A fall comes before the jump

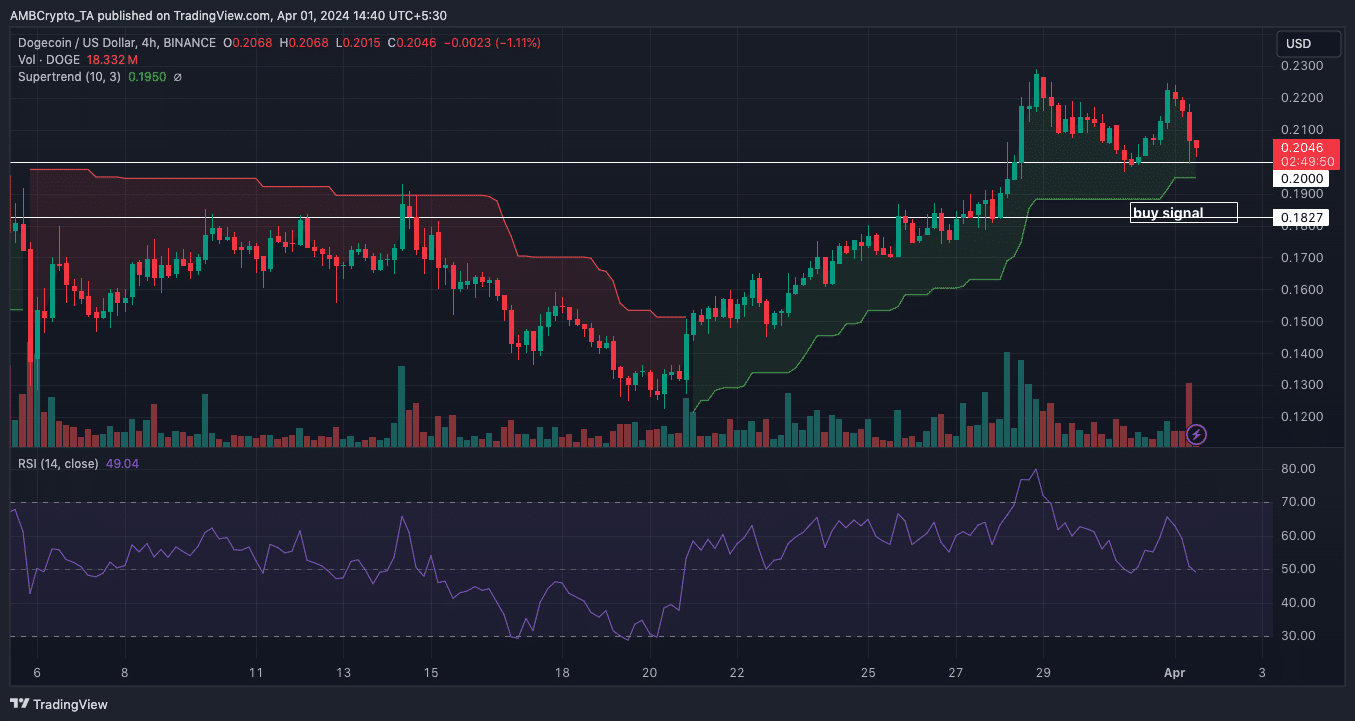

However, DOGE’s price might likely fall in the short term. This was because the volume increased as the price retraced, indicating that there was strength to back the drawdown.

When AMBCrypto checked the social dominance, we observed that the metric fell, suggesting that discussion around DOGE had decreased.

However, this decline could be an opportunity for market participants to buy at discount prices. Before concluding, let’s see what the technical perspective predicts.

On the 4-hour timeframe, DOGE was on the verge of tripping below $0.20 support. If this happens, the coin might decline to the next area of interest, around $0.18.

However, the Supertrend showed that a buy signal was around $0.18 and $0.19. Therefore, if DOGE drops that low, it could be time to accumulate before the next leg up.

Read Dogecoin’s [DOGE] Price Prediction 2024-2025

Furthermore, the Relative Strength Index (RSI) had turned downwards, suggesting that sellers have been booking profits. Should the momentum remain bearish for some time, DOGE might decline to $0.16.

But within a short period, provided bulls get back into the market, the value of the coin might target a new yearly high.