dogwifhat market sentiment turns bearish: What’s ahead for WIF?

- WIF has declined by 8.08% in 24 hours.

- Fundamentals suggested a shift in market sentiment, signaling a further dip.

Over the past month, memecoins have made significant gains, with dogwifhat [WIF] leading the pack. As such, WIF has made massive gains over this period.

However, as of this writing, dogwifhat was trading at $2.37, marking an 8.08% decline over the past day.

But prior to this decline, WIF had been on an upward trajectory, hiking by 36.53% on monthly charts with an extension of the uptrend by 13.73% on weekly charts.

Therefore, the question arises — can dogwifhat’s uptrend be maintained, or will a dip on the daily chart signal a potential pullback?

What WIF charts suggest

AMBCrypto’s analysis showed that since reaching $2.8 three days ago, dogwifhat has seen a strong dip, falling by 17.86% over this period.

This drop caused concerns over the memecoin’s future trajectory. As such, it’s essential to determine what other fundamentals suggest.

For starters, WIF’s Relative Strength Index (RSI) has declined from 66 to 54 in three days. This shows that sellers have dominated the market with a higher selling pressure.

The current trend was weakening, suggesting a possible reversal on WIF price charts.

This weakening trend is further supported by the fact that the negative index on DMI sat above the positive index. At press time, the negative index was 27 while the positive index was 25.

A declining +DMI suggested that the current trend was losing momentum.

Looking further, dogwifhat’s Open Interest per exchange has declined from $257.3 million to $207.2 million over the past three days. So, traders were seemingly closing their positions.

Such behavior signals a lack of confidence as investors anticipated a further decline.

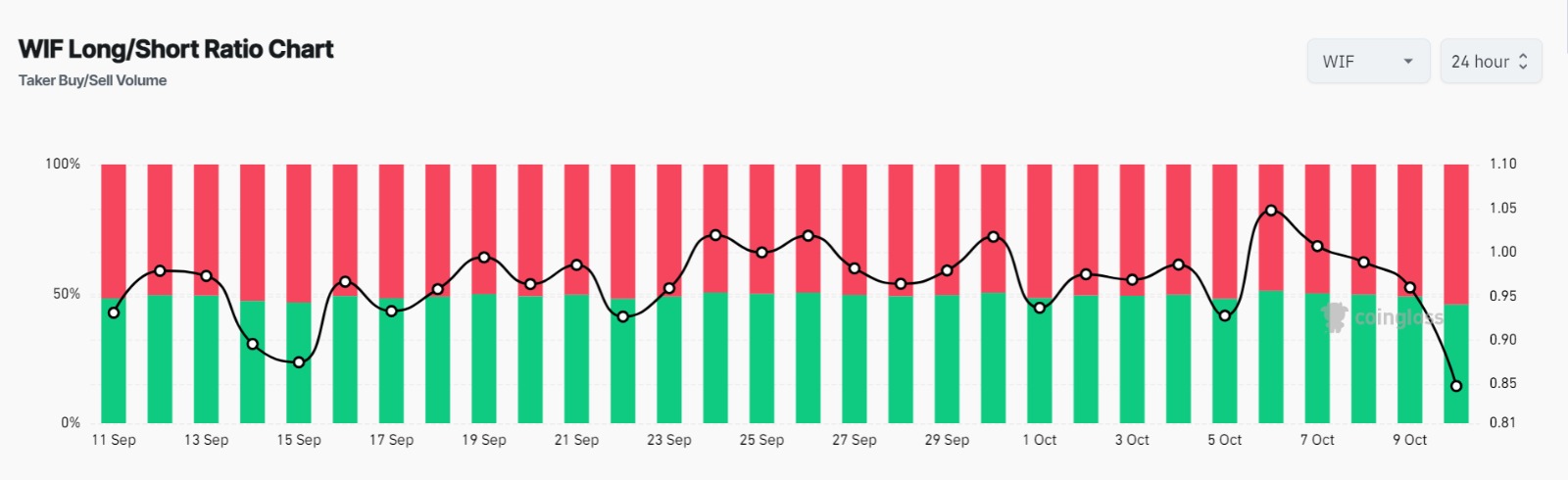

Finally, dogwifhat’s Long/Short Ratio has declined over the past three days from a high of 1.0072 to 0.8477. Thus, short position holders were dominant, suggesting that more sellers are bearish.

Read dogwifhat’s [WIF] Price Prediction 2024–2025

Simply put, although WIF is currently in an overall bullish phase, the last days signal an upcoming correction. As such, if bearish continually persists, WIF will find its next support at $2.03 in the short term.

However, if the bulls take back the market after this retrace, it will attempt to challenge the stubborn resistance level at $2.8. If the prices break above this level, WIF will surge to a 4-month high of around $3.5.