Don’t SOL yourself short with inflows of around $3.7M

A bullish investor waking up this morning to check their portfolio probably encountered scenes of extreme [financial] violence as jagged red lines dominated the charts and even Bitcoin crashed below $40,000.

However, the main question now is how the alts are faring. While some have praised their resilience, others might just see their once favorite coins bleeding out their own value.

In particular, let’s take a look at Solana [SOL]. Once touted as the “Ethereum Killer,” the crypto had fallen behind Ripple’s XRP and was the seventh biggest crypto by market cap at press time. SOL was changing hands at $102.06, having fallen by 8.15% in the past day and losing 23.44% of its value in a week.

All heart but no SOL?

Coinshares’ weekly flows report revealed a total of around $134 million in outflows, making it the second-largest this year. While Bitcoin made up most of the outflows, the report observed,

“Altcoins (ex-Ethereum) and multi-asset investment product flows were in stark contrast to Bitcoin and Ethereum with inflows totalling US$6m and US$5m respectively.”

Solana was one of those which defied expectations and saw inflows of around $3.7 million, indicating selling activity. So, that brings us to an essential question – are Solana investors panicking?

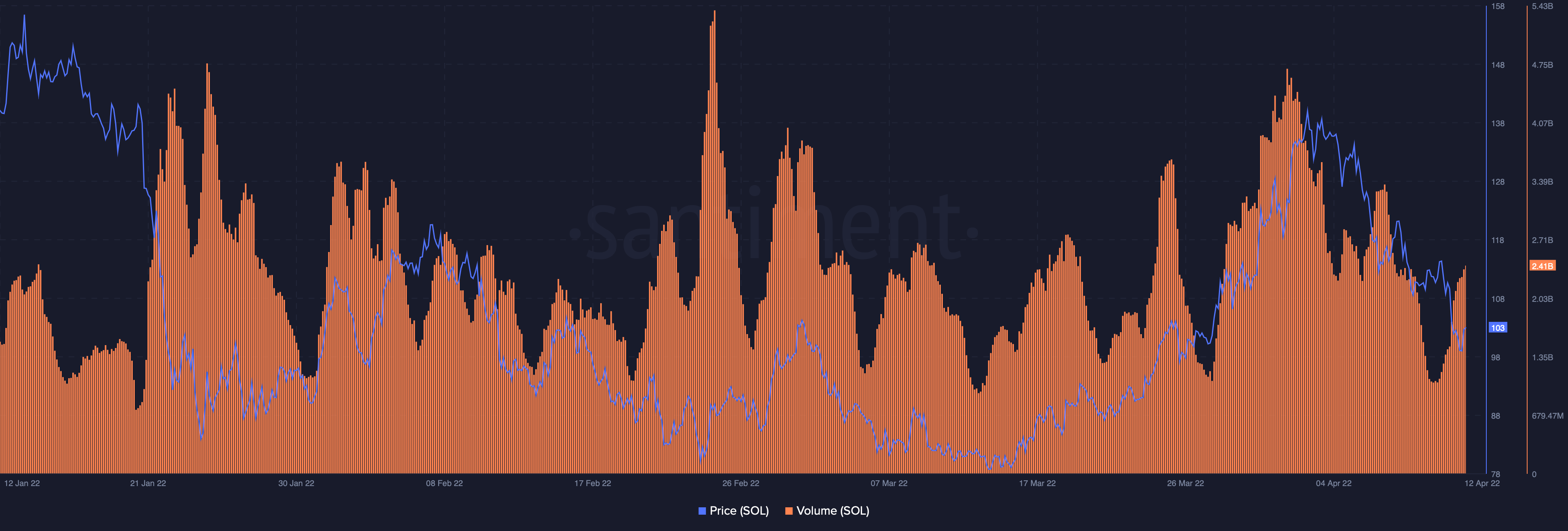

A look at trading volumes for the asset on Santiment showed that while the latest peak of transactions was shorter than those preceding it, transaction volumes actually picked up from around 10 April – even as the asset was falling.

Source: Santiment

One pertinent question here is – how much of this could be because of the NFT marketplace giant OpenSea announcing that it would list Solana NFTs this month? After all, data from CryptoSlam revealed that after Ethereum, Solana saw the highest NFT sales volumes in the last month.

Source: CryptoSlam

However, it’s still possible that crypto traders are panic selling their SOL. When considering the level of SOL inflows that exchanges saw this week, and Solana’s market cap rank slipping by one place, this becomes even more plausible.

Don’t SOL yourself short

If Solana isn’t doing what you expected it to, don’t lose heart just yet. According to analyst Spencer Noon, there’s reason to place Solana over most other L1 chains. Why, you ask?

Noon reported that out of 50 tokens hoping to be welcomed by Coinbase, 45 belonged to Ethereum, and five belonged to Solana. Between them, they pushed out all other L1 rivals.

Out of the 50 tokens under consideration to be listed on Coinbase, 45 are $ETH ERC20 tokens and 5 are $SOL SPL tokens. No other L1s received even a single token. Given how liquidity profile is important to protocol developers, this is a win for @solana vs other alt L1 ecosystems. pic.twitter.com/6Wx1aFyPh1

— Spencer Noon ? (@spencernoon) April 12, 2022