Dormant Ethereum holder moves $5.8M in ETH – More profit-taking now?

- Stash was received during ETH’s ICO at 31 cents per token

- Investor would lock a humongous 950719% in profits if they decide to sell

In what was a development that caught the eye of the broader cryptocurrency market, an Ethereum [ETH] holder woke up after nearly 9 years of dormancy to transfer their entire holdings to another wallet on Thursday.

Old ETH on the move

According to on-chain data tracking platform Lookonchain, an early investor who received 1,969 ETH during Ethereum’s initial coin offering (ICO) was seen moving 1,960 ETH. The transferred supply was worth $5.8 million at prevailing market prices. The participant received the ETH at 31 cents per token as part of the ICO.

The purpose of the transfer was yet to be ascertained, at the time of writing. However, there could be several explanations behind the move, with the most dominant narrative being realization of profits. At current prices, the investor would lock a humongous 950719% in profits.

Other factors could be diversifying their portfolios for other tokens.

Not the first time

Similar instances of reactivation of old ETH received during Genesis were seen earlier in the year. On 24 March, for instance, a participant moved the entirety of their 2,000 ETH received during the ICO. Before that, a wallet transferred 1,732 ETH to crypto-exchange Kraken on 2o February.

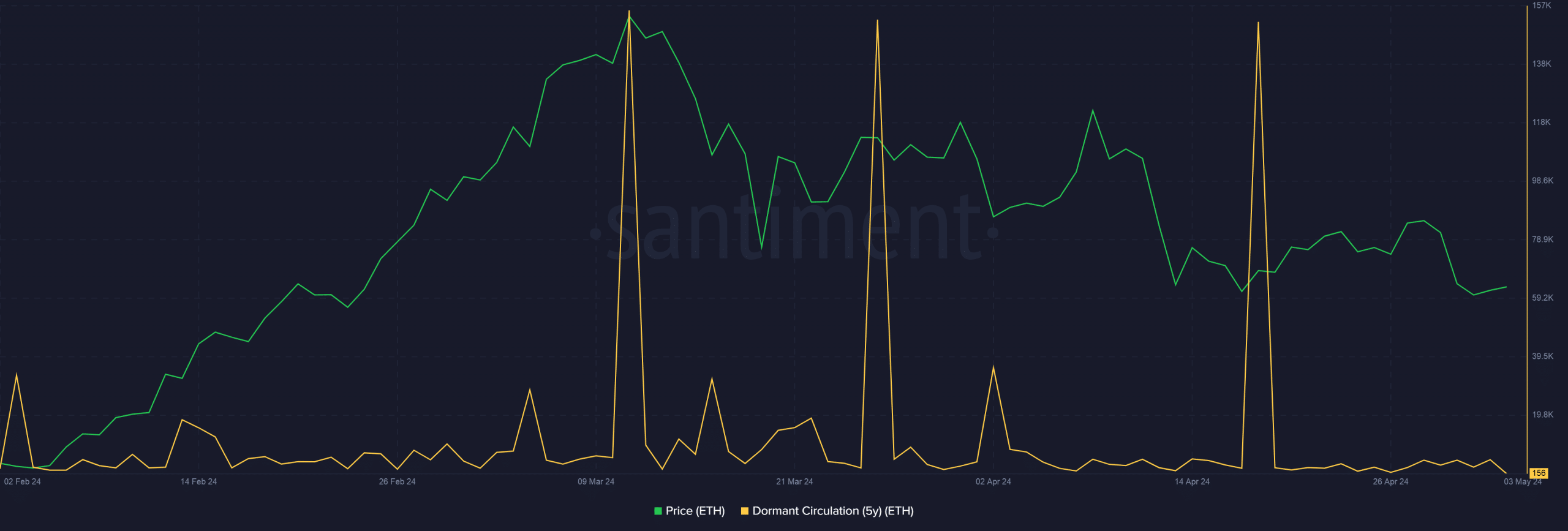

AMBCrypto investigated further using Santiment data and spotted sharp spikes in the movement of ETH that were inactive for more than five years. In nearly all the instances, the movement of dormant coins was followed by a price drop. This finding lends weight to the profit-taking theory discussed earlier.

Is your portfolio green? Check out the ETH Profit Calculator

How’s the sentiment around ETH?

At press time, ETH was wiggling in the range around $3,000, according to CoinMarketCap. The second-largest cryptocurrency seemed to be recovering from a rough last month during which it plummeted by nearly 10%.

Over the last 24 hours, sentiment around the coin in the Futures market shifted dramatically too. The number of traders shorting ETH increased vis à vis those longing it, as per AMBCrypto’s analysis of Coinglass data.