Earn yields via smart contracts with YieldFlow

While the blockchain space is built on the foundations of anonymity and decentralization, a lot of projects and services in the space are still entirely centralized. The bear market and subsequent issues with liquidity left many investors facing grave losses. Many companies and regulators did not face any liability due to the centralized nature of these agencies.

Decentralization of the blockchain space helps in the prevention of this scenario while also letting users regain control over their assets. While it offers a lucrative opportunity for users the decentralized space is technically complex and includes the risk of errors and loss of assets. Additionally, there is an upsurge of cryptocurrency projects that can be challenging for users to determine.

What is YieldFlow?

YieldFlow is a DeFi platform that offers a solution by removing technical complexity for users and helping them earn a passive income on their cryptocurrency investments. The platform is built on top of the Ethereum blockchain and makes use of smart contracts that would automate investment processes while also distributing rewards.

The platform aims to create a unique framework for decentralized services in the crypto space that enables true decentralization. The platform also plans to implement new pairings and technologies in order to make sure the users get maximum security, profitability, and anonymity.

YieldFlow reduces friction when the interaction between complex smart contract systems takes place, making the onboarding process simple and smooth for every user regardless of their prior blockchain and Web3 knowledge.

Lending, staking, and liquidity pools

Users and investors can lend their idle crypto tokens to other users through lending pools with the help of smart contracts. The platform offers lending tools through Aave using Synthetix and Tether. As borrowers need to provide collateral on Aave in order to take a loan, the lenders get an extra level of protection.

YieldFlow supports staking for various cryptocurrencies letting users avail a steady stream of passive income while also contributing their crypto funds to the platform’s staking pools. This will then be used for validating transactions on the blockchain. The current APYs offered range between 4.5% to 10.87% including staking for coins like Fantom, Aave, and Sandbox.

The platform has 11 liquidity pools that let investors deposit their funds including LINK-ETH, MATIC-ETH, PEPE-ETH, WBTC-ETH, SHIB-ETH, USDT-ETH, MANA-ETH, SAND-ETH, HEX-ETH, BAT-ETH and OCEAN-ETH. By providing liquidity to decentralized exchanges like Uniswap via YieldFlow, users can earn from 10-100% APY per year depending on the coin pair.

Offering a high level of security

Unlike centralized projects that store user information, YieldFlow does not store any user information or assets.

YieldFlow lets users create an account through Web3 login keeping their information anonymous and secure. Users only interact with smart contracts that are verified and audited through third parties and deal only with assets. Additionally, user assets are not shown on their public wallet address as the contract keeps them safe.

The platform guarantees complete anonymity and does not store, track or record any information and does not offer fiat getaways, and uses only cryptocurrencies, thereby omitting the need for KYC.

Tokenomics

$YFlow is the governance token of the YieldFlow protocol and gives holders an equal weight of proposal power depending on the number of tokens in their wallet. The token can also be staked in LP-staking or single-asset staking wherein stakers will earn yield in $YFlow in each staking pool. They will also have various options in the staking terms according to lockup periods with longer lockup periods resulting in higher yields.

The token will also be paired against ETH on Uniswap in order to create the first liquid AMM market with deep liquidity. The $YFlow Single Staking Contract or YSSC would be used to stake the tokens and generate yield. The users who stake their tokens will get fee reductions and the yield generated from the YF protocol smart contracts. The yield generated will vary depending on the lockup period with 3 options including a 6-month lock, 12-month lock, and no lockup staking options.

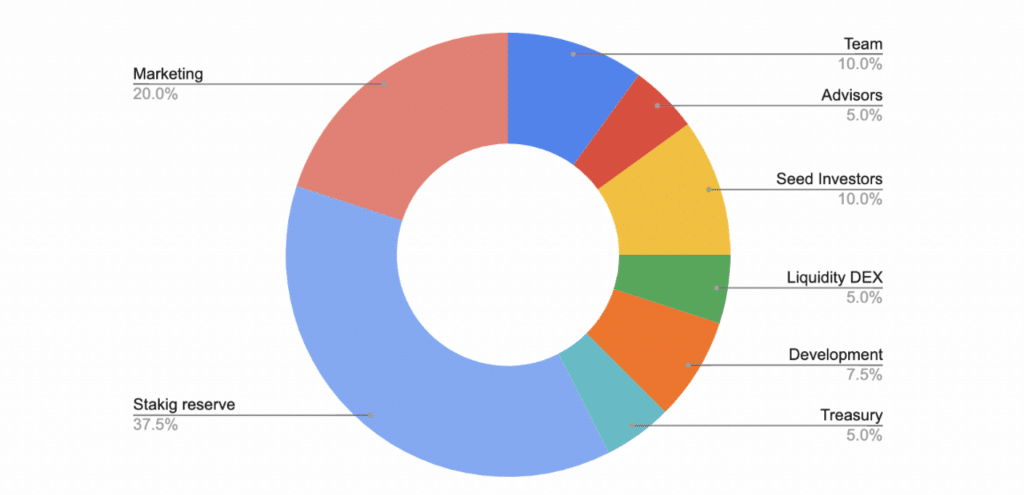

The token has a maximum supply of 50.000.000 with a 37.5% share going out to the staking reserve, a 20% share for marketing, a 10% share for the seed investors and team each, a 7.5% share for development and a 5% share for the advisors, treasury, and liquidity DEX respectively.

Final word

YieldFlow has a wide range of products that are designed to help investors optimize their returns while also minimizing risks. This is achieved by diversifying investments across multiple protocols and assets and using advanced analytics to identify high-performing opportunities and monitoring market conditions to make necessary adjustments.

Investment opportunities offered by YieldFlow include liquidity provision, yield farming, and staking. Users also get to earn rewards by staking their tokens to earn interest, participating in yield farming, and providing liquidity to various pools.

The platform’s focus on risk mitigation and insurance coverage makes it stand apart from other DeFi platforms making it an attractive option for those looking to earn a passive income on their crypto investments.

For more information on YieldFlow, please check out their official website.

Disclaimer: This is a paid post and should not be treated as news/advice.