ENS soars by 63% after Vitalik Buterin calls it “super-important”

- ENS’ price has risen significantly in the last 24 hours.

- This was due to comments made by Ethereum co-founder Vitalik Buterin.

ENS, the governance token of the Ethereum Name Service project, climbed by 63% during the intraday trading session on 3rd January after Ethereum co-founder Vitalik Buterin stated that the domain name protocol is “super-important.”

All L2s should be working on (trustless, merkle-proof-based) CCIP resolvers, so that we can have ENS subdomains registerable, updateable and readable directly on L2s.

ENS is super-important, it needs to be affordable!https://t.co/Ice1lTttFE

— vitalik.eth (@VitalikButerin) January 3, 2024

In a post on X (formerly Twitter), Buterin said that Layer 2 (L2) platforms should prioritize building “trustless, merkle-proof-based CCIP resolvers.”

Cross Chain Interoperability Protocol resolvers (CCIP resolvers) are a key component of the Ethereum Name Service (ENS) that allows users to store and retrieve data associated with their ENS domains on other blockchains or off-chain storage solutions.

ENS gains, thanks to Buterin

After Buterin’s tweet, ENS soared by over 60%. While it has shed some of these gains in the last 24 hours, the token now trades at its highest price point since April 2023.

At press time, it exchanged hands at $13.75, seeing a 31% price rally in the last 24 hours, according to data from CoinMarketCap.

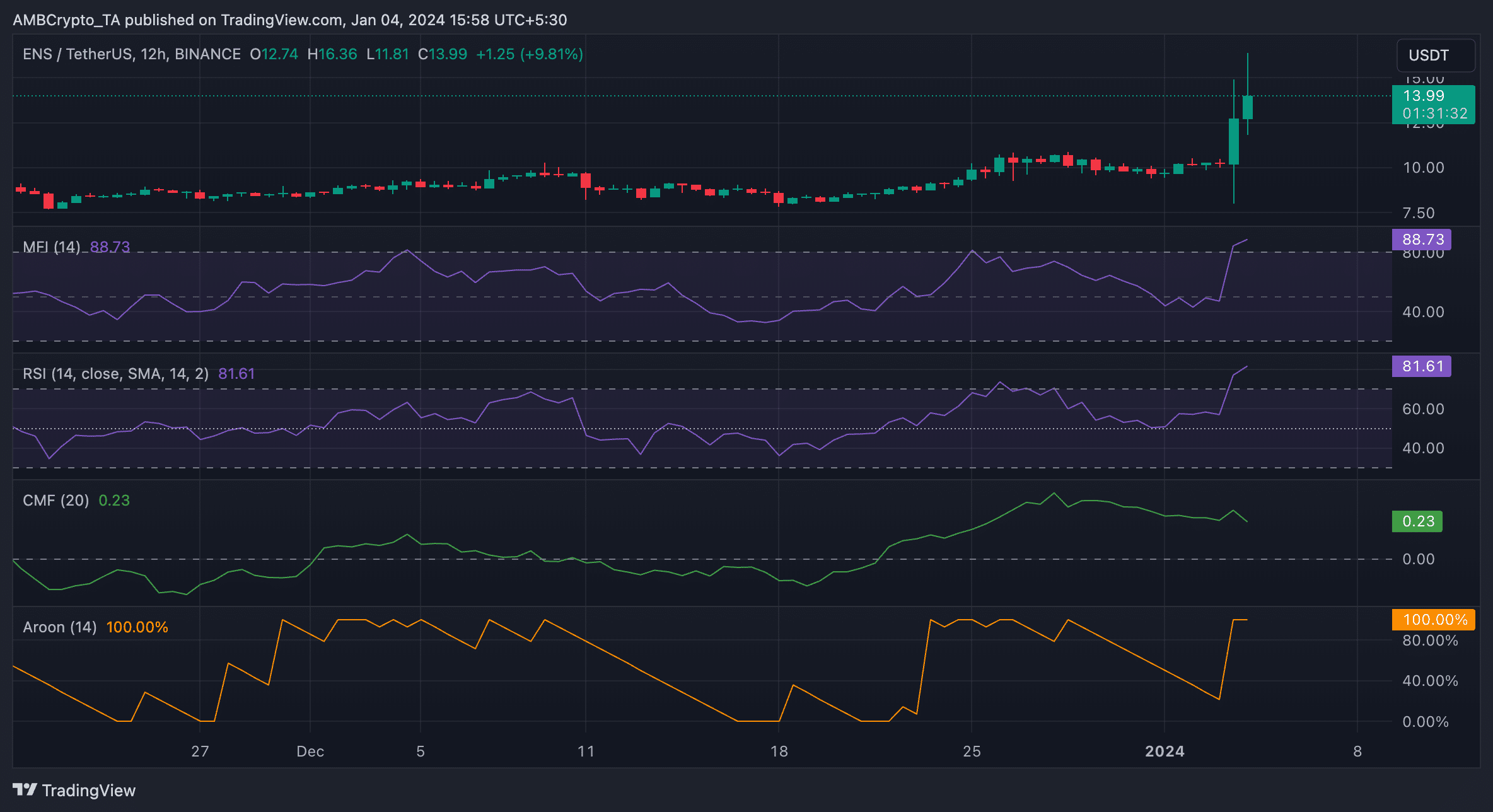

Its price movements observed on a 12-hour chart showed an uptick in key momentum indicators. For example, the token’s Relative Strength Index (RSI) was 81.10, while its Money Flow Index (MFI) was 88.64.

While the values of these indicators showed that ENS’ accumulation significantly outpaced sell-offs, they also signaled that the market was overheated. At those levels, buyers’ exhaustion is common, hence a retraction might occur.

Confirming the surge in liquidity inflow into the ENS market, its Chaikin Money Flow (CMF) rested at 0.22 at press time. When an asset’s CMF is above the zero line and in an uptrend, it means that there is steady capital inflow. This has been known to help sustain an asset’s price rally.

Likewise, ENS’ Aroon Up Line (orange) was at its peak at press time. At 100%, it showed that the uptrend was strong and that the most recent high was reached relatively recently.

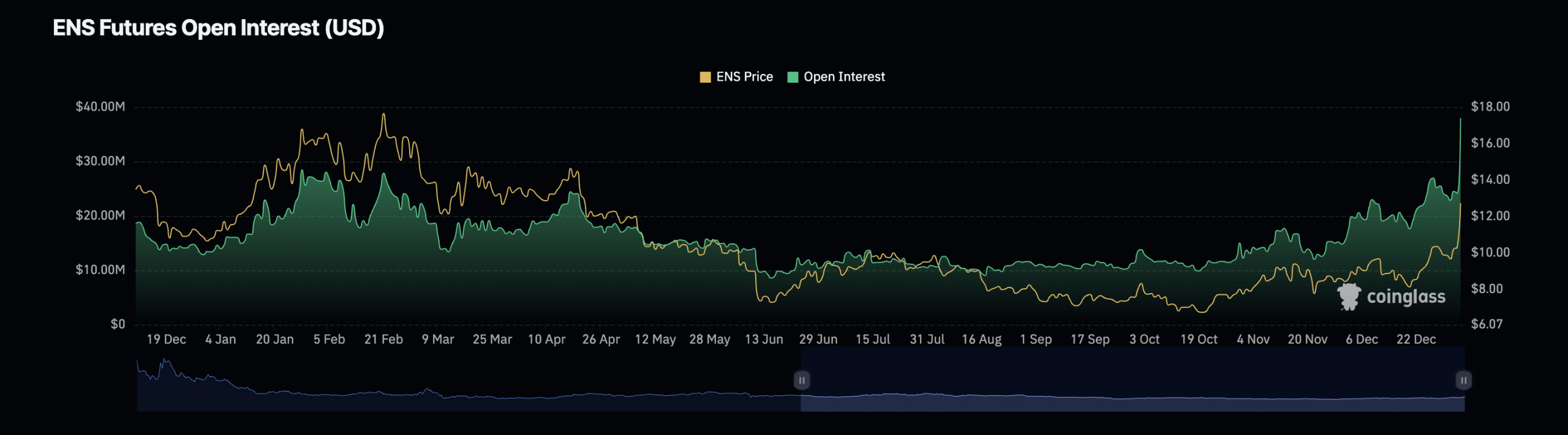

In the token’s derivatives market, trading volume was up by over 3000% in the last 24 hours, data from Coinglass showed. With a 114% surge during the same period, ENS’ open interest rested at its highest level since October.