EOS, Neo, Ethereum Classic Price Analysis: 02 March

EOS was trading within a descending channel, but an upwards breakout was predicted as trading volumes rose. Neo looked primed for a bullish reversal as the indicators flashed green signals at the time of writing. Finally, ETC awaited a broader market rally to break above its overhead resistance level

EOS

Source: EOS/USD, TradingView

EOS continued to move within a descending channel on the 4-hour timeframe after making a series of lower highs and lower lows. While there was a higher chance of a southbound breakout from this pattern, a pickup in trading volume countered bearish predictions. A rise above the upper trendline would present the next challenge for the bulls at the $4.14-resistance.

The Awesome Oscillator’s green bars moved about the half-mark as momentum rose on the buying side. However, the Stochastic RSI pointed to a reversal as the index was in the overbought region. While this does not necessarily mean a downwards breakout from the channel, it could work against a bullish outcome as well.

Neo

Source: NEO/USD, TradingView

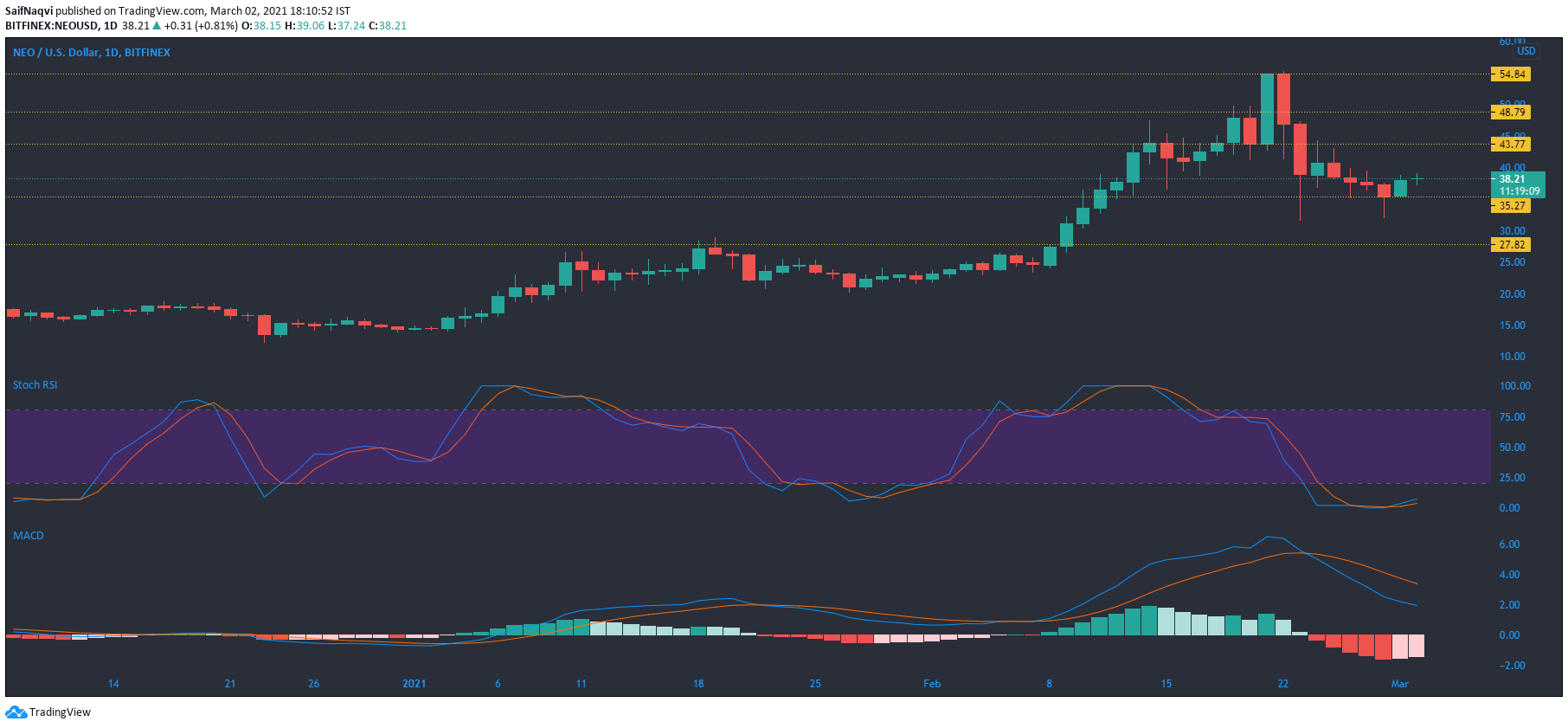

The appearance of a doji candlestick on Neo’s daily chart reflected some neutrality in the price after it held above the $35.27-support. However, the indicators backed the possibility of a bounce back towards the $43.7-resistance level.

The Stochastic RSI noted a bullish crossover in the oversold zone, while the MACD’s histogram saw weakening bearish momentum, even though the Signal line moved above the fast-moving line. Conversely, a pullback in the broader market would see the bulls lose out to the press time support level and challenge the next line of defense at $27.8.

Ethereum Classic [ETC]

Source: ETC/USD, TradingView

Since the Bollinger Bands on Ethereum Classic were compressed, volatility remained low in its market. The RSI rested around the 50-mark and slightly favored the buyers, but a sudden price hike was unlikely over the next few sessions.

The 24-hour trading volume did tick up slightly and closed on the $1 billion mark, but stronger cues were needed for a hike above the immediate resistance at $12.5. A rally in the broader market could trigger ETC’s northbound move on the charts. Without the rally, ETC could continue to trade sideways and within its present channel.