ETH forfeits hold over $2000 as bears seize control, where will prices go next

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion.

- On-chain metrics highlighted the huge selling pressure over the past two days.

- Price action showed the bulls were not out of the fight yet.

The euphoria of Ethereum [ETH] holders after the breakout past $2000 did not last long. The recent sell-off forced ETH beneath the $1950 mark. In doing so, the impetus was handed to the sellers in the lower timeframes.

How much are 1,10,100 ETHs worth today?

However, as with many other altcoins, the higher timeframe structure of Ethereum remained bullish. It was imperative that the bulls defend the next support zone in order to preserve their chances of recovery.

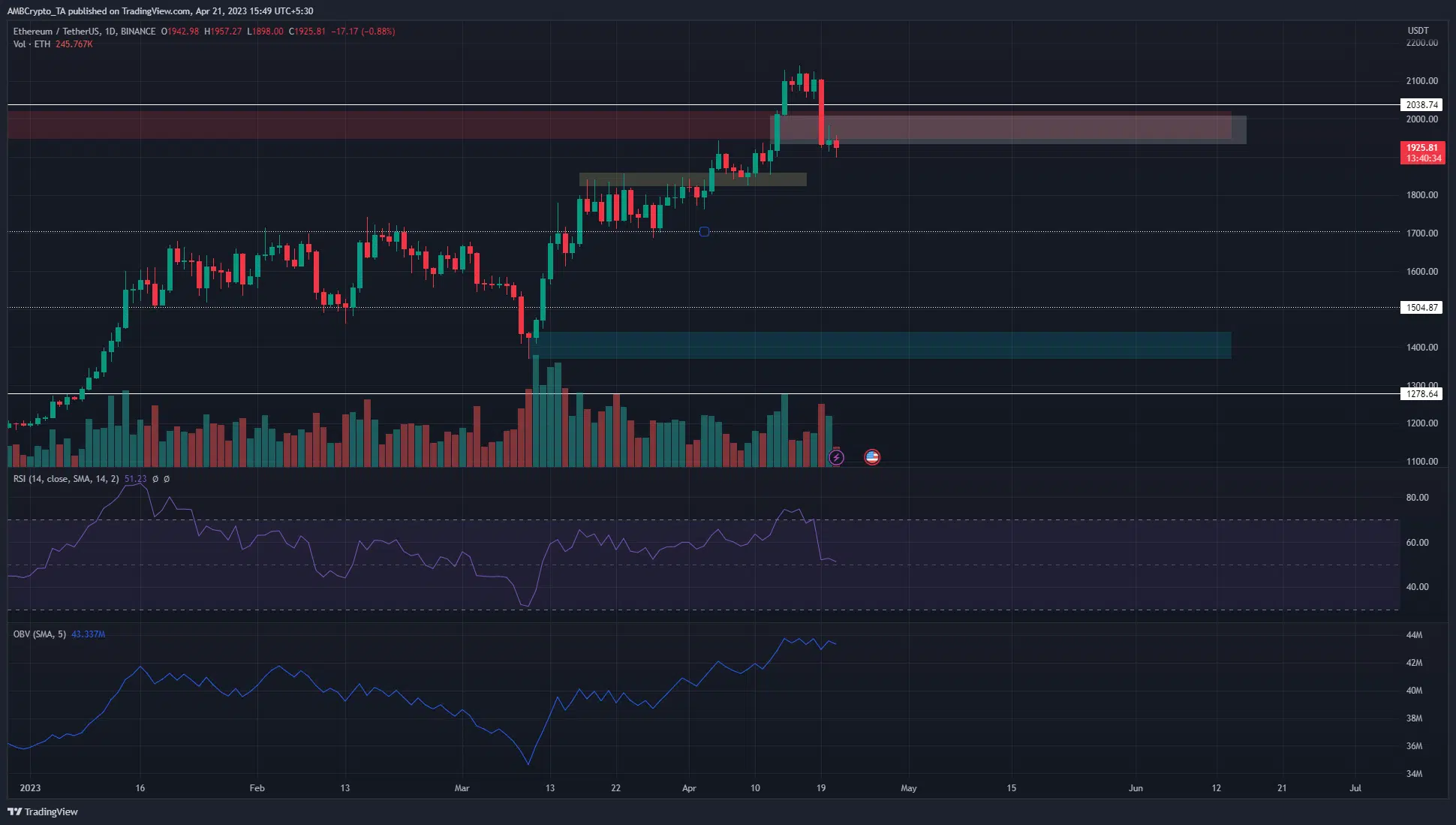

The breaker block was not defended and the lower timeframe support zone became vital

The red box highlighted a bearish order block on the daily timeframe from 13 August 2022. This was the first time Ethereum had closed a daily trading session above $2025 in eight months. Unfortunately for the bulls, they could not hold on.

The OBV slid slightly downward over the past ten days, but has been in a strong uptrend over the past month. The selling pressure of the past few days was very small in comparison. However, the RSI was forced to retreat to the 51 level. This indicated that momentum was neutral.

Ethereum bears won the battle above $2000 and forced the prices to fall beneath the bearish order block. This quickly invalidated its flip to a bullish breaker. A retest of the fair value gap (white) could see a bounce in Ethereum prices. Further south, another zone of support was present in the $1840 area. A fall beneath $1830 will flip the daily structure to bearish.

Is your portfolio green? Check out the Ethereum Profit Calculator

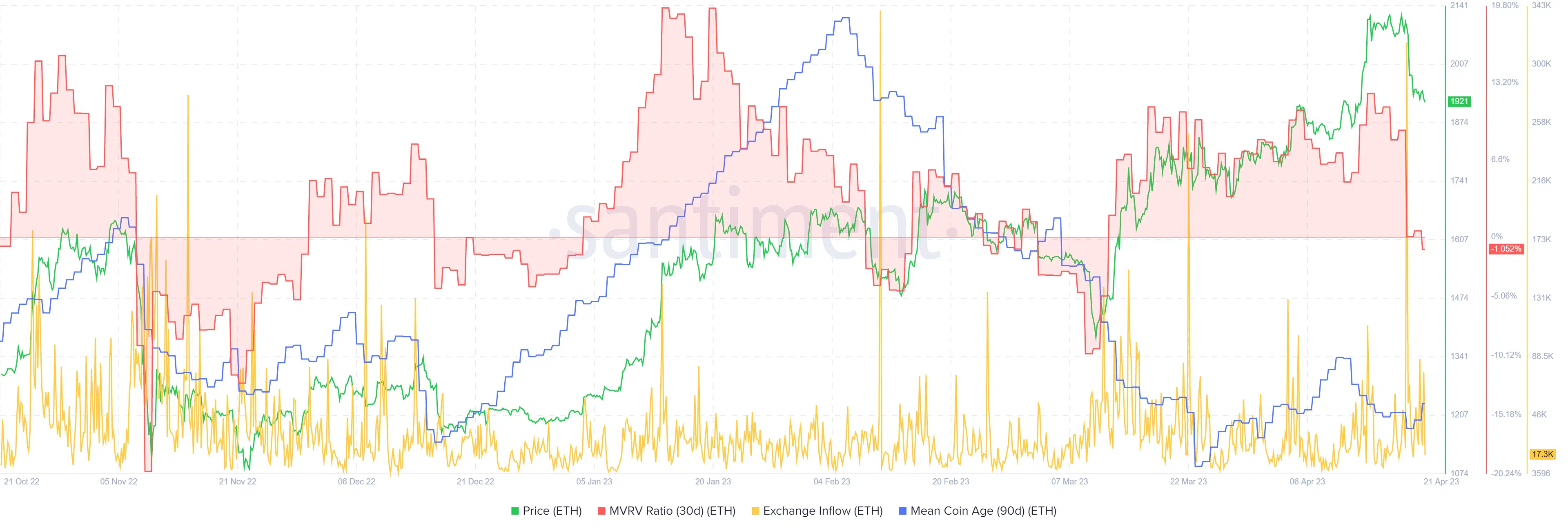

Exchange inflow saw a huge spike as selling pressure intensified

Source: Santiment

The 30-day MVRV ratio experienced a freefall in the past two days. It fell from 9.15% to 0.03% on 19 April, and was accompanied by a massive inflow of ETH into exchange addresses. It measured 316.8k ETH, and the price plunged beneath the $2000 mark soon afterward.

The mean coin age had also been in a downtrend over the past two weeks. Taken together, the metrics showed strong selling pressure, and holders stood at a loss.