ETH might be due for a bullish bounce courtesy of this observation

- ETH’s pivot becomes more and more certain as the price falls into a long-term ascending support level.

- ETH maintains demand at lower price points as accumulation continues.

ETH bulls could be about to get another chance at a sizable uptick judging by multiple factors observed recently. Should you buy or wait for more clarity? Let’s dive in and see what the market has to say.

Read Ethereum’s [ETH] price prediction 2023-24

ETH bulls have been holding back lately, especially since mid-July when the price pulled back in favor of more downside. Its performance reflected the uncertainty and relative dormancy that prevailed in the market.

However, recent observations suggested that we might be about to see another bullish wave. The first major sign is that there is still demand in the market and it is starting to balloon.

According to the latest Glassnode alerts, Ethereum addresses holding at least 0.01 ETH just reached a new ATH. This means buyers in the retail segment are optimistic about ETH’s prospects.

? #Ethereum $ETH Number of Addresses Holding 0.01+ Coins just reached an ATH of 24,595,903

View metric:https://t.co/XXb0u19Wkf pic.twitter.com/8tJG7fpW9c

— glassnode alerts (@glassnodealerts) August 1, 2023

Unfortunately, the retail segment usually doesn’t have much of an impact on price. That is a luxury that often belongs to the whales. The latter are largely responsible for ETH’s downside considering that they have been selling.

Addresses with balances equal to or greater than 1,000 ETH and those with at least 10,000 ETH have been trimming their balances for the last four weeks now.

Note that the same address categories are now pumping the brakes on sell pressure. At least that was the case in the last few days and there has been some accumulation from the same categories.

ETH whales might start accumulating at a critical point

The accumulation observed in ETH’s whales might finally lend favor to the bulls. Especially if it continues. This observation comes at a noteworthy point in ETH’s price action because it recently retested a long-term ascending support level. It has so far bounced off the same support line multiple times in the past.

ETH bottomed out at $1,813 on the morning of 1 August after coming into contact with the ascending support line. A bit shy of its 200-day moving average, ETH exchanged hands at $1,847 at press time.

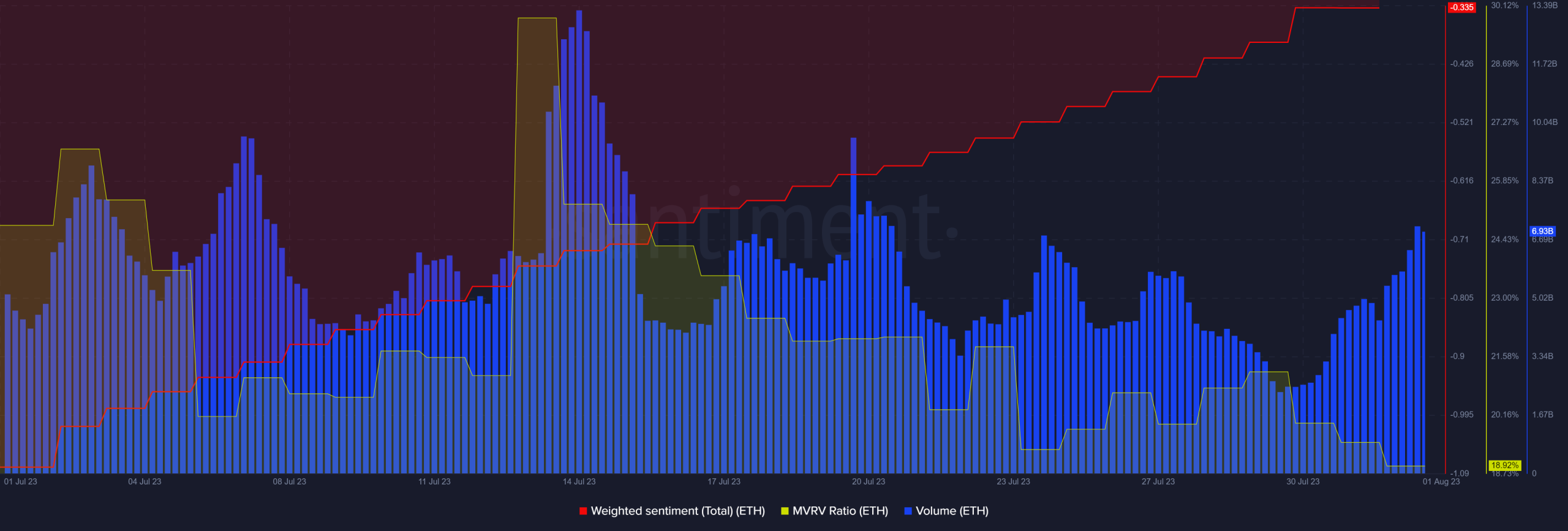

Some of ETH’s on-chain metrics collaborated with the bullish price forecast. For example, its on-chain volume has been rising for the last three days, thus recovering from its lowest point in the last four weeks. The cryptocurrency’s weighted sentiment metric also managed to reach a new monthly high.

Is your portfolio green? Check out the Etherum Profit Calculator

Despite the above findings, ETH’s Market Value to Realized Value (MVRV) ratio was down to the lowest level in the last four weeks. This may not necessarily be a bad thing.

It confirms that there are many buyers entering the latest lows that are yet to be in profit. These signs further indicate a potential bullish relief ahead. Still, caution is warranted considering that prices do break below support lines and in case market conditions disfavor the expected outcome.