Ethereum: Traders are betting big on ETH, BUT there is a risk

- ETH’s funding rates have risen to a two-year high.

- Demand for the altcoin persists in the spot market.

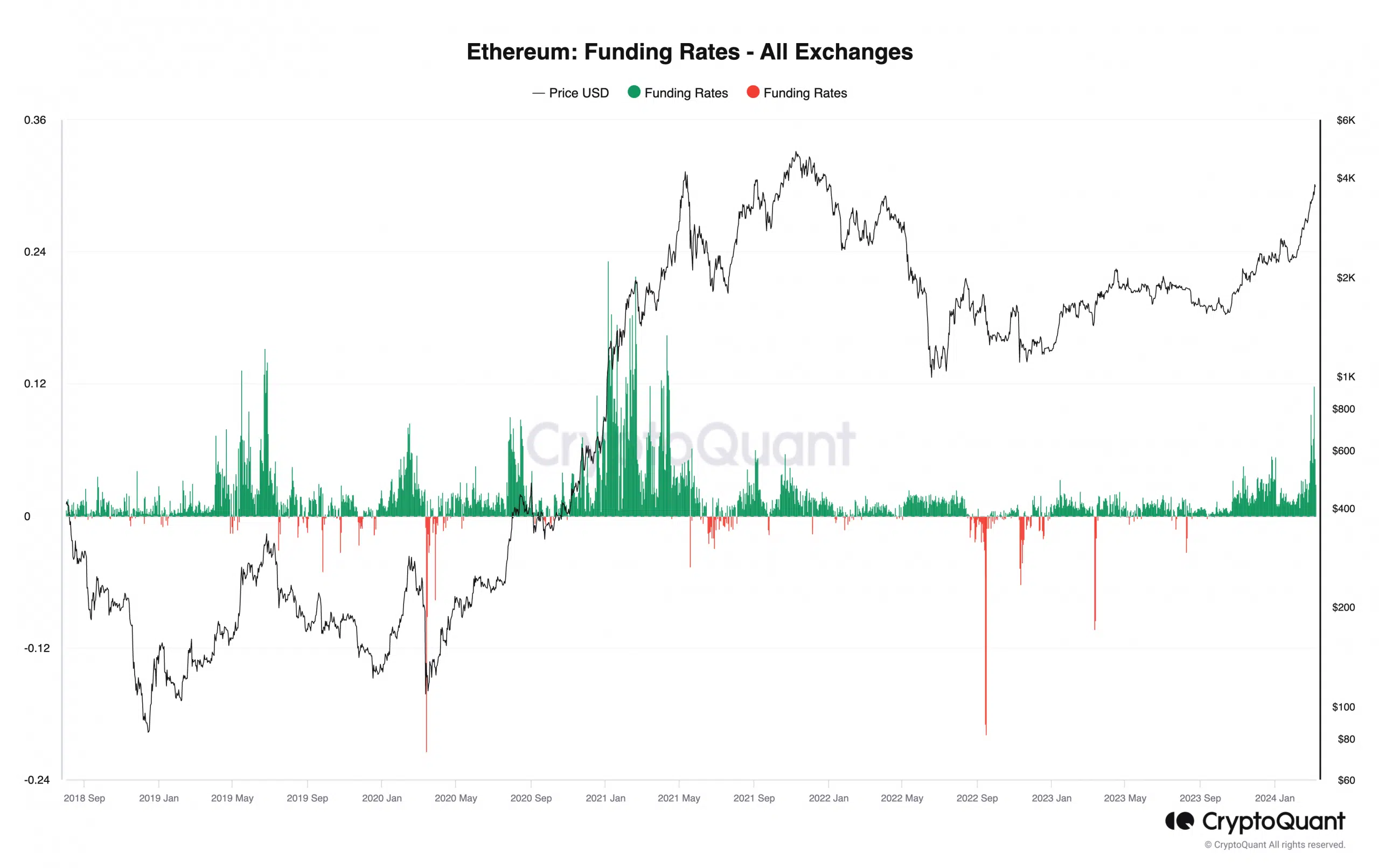

Ethereum’s [ETH] recent rally above the $3700 price mark has been accompanied by a rise in the coin’s funding rates across cryptocurrency exchanges. According to a pseudonymous CryptoQuant analyst this mirrors the events leading up to the 2021 price boom.

When an asset’s futures funding rates witness a surge and are significantly positive, it suggests that there is a strong demand for long positions. It is considered a bullish signal and a precursor to an asset’s continued price growth.

ETH’s value has increased by 59% in the last month. At press time, the altcoin exchanged hands at $3753, its highest price point since December 2021, according to CoinMarketCap’s data.

Data from Coinglass showed that the recent uptick in the altcoin’s value has caused its futures open interest to climb to a 27-month high. As of this writing, ETH’s open interest was $12.2 billion, rising by 71% in the last month.

When a coin’s open interest witnesses this kind of growth, traders are either opening new positions or maintaining existing ones, and the market is seeing an influx of liquidity.

A rising open interest paired with positive funding rates suggests significant bullish activity. It means that market participants continue to place bets in favor of a price rally.

However, this has its risks. According to the CryptoQuant analyst:

“However, while rising funding rates typically accompany a bullish market sentiment, excessively high values can be dangerous. Elevated rates increase the risk of long liquidation cascades, which may result in heightened market volatility and unexpected corrective movements.”

This played out on 5th March, after ETH climbed above $3800 before plummeting to $3400. According to Coinglass data, long liquidations on that day totaled $135 million.

ETH on the spot market

On the spot market, ETH accumulation steadied above sell-offs. The coin’s key momentum indicators were spotted above their respective neutral lines at press time. For example, ETH’s Relative Strength Index (RSI) was 76.50, while its Money Flow Index (MFI) was 80.16.

Read Ethereum’s [ETH] Price Prediction 2024-25

Further, its Awesome Oscillator, which helps to measure market trends posted mostly green upward-facing bars at press time.

When an asset’s Awesome Oscillator returns green, upward-facing bars in this manner, it suggests strengthening bullish momentum in the market.