Ethereum burn hits 2-month high thanks to these sources

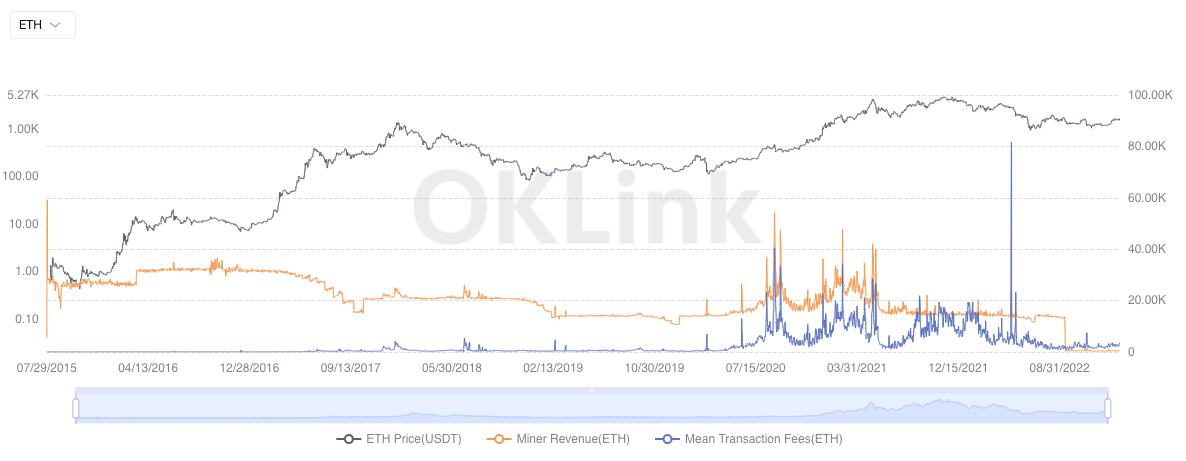

- There was a notable increase in the number of ETH burned, but miner revenue declined.

- Ethereum’s development activity prevailed in highs as Shanghai upgrade draws near.

The EIP-1559 proposal was approved as a solution to congestion of the Ethereum [ETH] network. Reportedly, the proposal will also help the blockchain with token deflation. The activity somewhat addresses the high gas fees with tips from transactions going to the miners.

Is your portfolio green? Check out the Ethereum Profit Calculator

Fire on the mine

However, Ethereum has had the habit of switching between inflationary and deflationary status‘ over the last two months. But as of 2 February, the amount of ETH burned hit its highest value since 10 November 2022.

The burning amount of Ethereum reached 3040 on February 2, reaching a new high since November 10 last year. The main burning sources are Uniswap and OpenSea. The cryptocurrency greed index has remained around 60 for several days. https://t.co/fT66f684lJ pic.twitter.com/uToCDwOYZt

— Wu Blockchain (@WuBlockchain) February 3, 2023

At press time, the total amount of ETH burned was 3040.83, according to OKLink. Interestingly, Uniswap [UNI] and NFT marketplace OpenSea contributed most of the ETH burned, as stated by the tweet above.

This may not be a surprise, especially as there has been an increase in Ethereum NFT volume. Also, Uniswap has also boasted of a consistent transaction increase in the last few weeks.

Following the increase, ETH block rewards improved for miners. However, it was not an all-round boost in the Ethereum ecosystem. Despite the burn hike, miner revenue remained flatlined — close to the region it was during the brutal 2022 market condition.

Usually, the impact on the increase would be for miners to receive block rewards. But miners’ revenue is not necessarily impacted. Sometimes, income may decrease because of the destruction of basic costs.

However, price action may be affected because ETH deflation could partially increase its value.

Gas down but ETH shoots

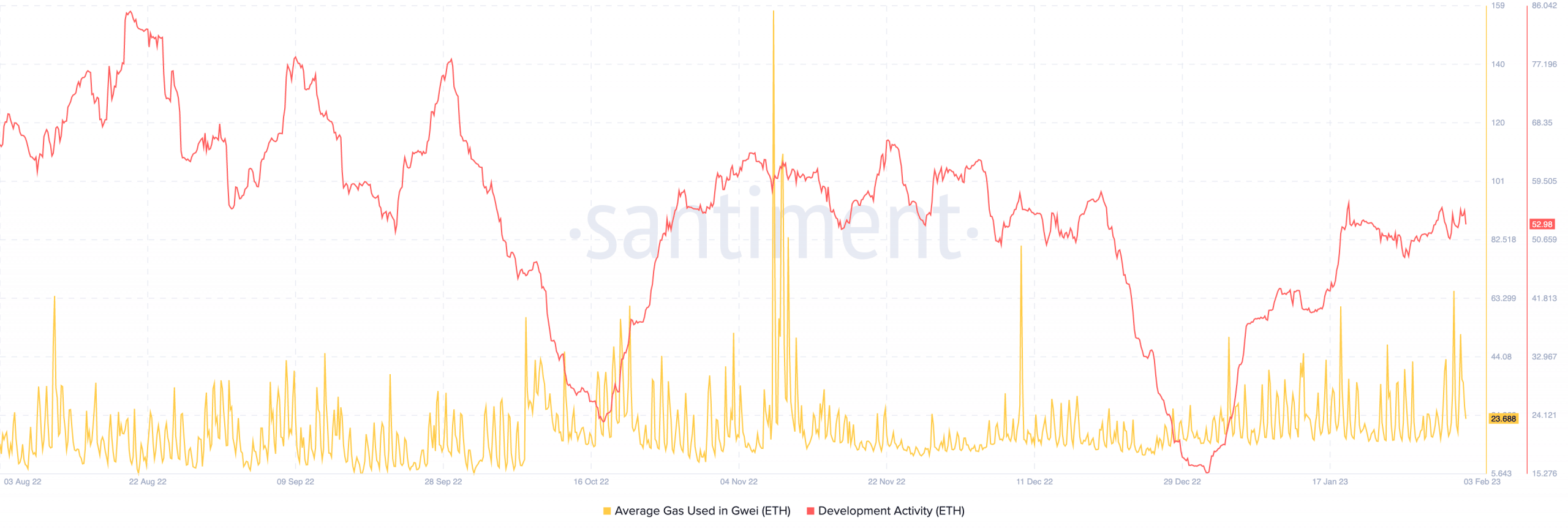

Concerning Ethereum’s gas fees, they were also at a low point. This was expected to be the case since an increase in EIP-1559 activity would lead to a reduction in gas prices.

According to Santiment, the average gas used, measured in Gwei, was 23.688. Compared to the spike of 1 February, this was a colossal drop.

Per its development activity, the on-chain information provider showed that Ethereum was at the pinnacle of control. At the time of writing, development activity had increased to 52.45. The development activity describes a project’s commitment to polishing its network.

How many are 1,10,100 ETHs worth today?

However, this metric was predictable, as the second-ranked crypt project has been leading upgrades since the September 2022 Merge. The forthcoming Shanghai upgrade also reflected how dedicated the Ethereum team remained to its enterprise.

In conclusion, the woes managed in some areas were balanced by advancement in other parts. According to Ultra Sound Money, Ethereum was sustainable despite the fact that the bull market is not fully blown yet.

Appreciate this graph? You're early!

→ Ethereum daily burn is uncapped ?

→ Ethereum daily issuance is capped ?

→ Ethereum is sustainable in a bear

→ Ethereum is ultra profitable in a bull??? is the ultra sound barrier pic.twitter.com/uvnrxbZhK1

— ultra sound money ?? (@ultrasoundmoney) February 3, 2023