Ethereum burn rate falls as TVL tumbles 17% – What’s going on?

- The ETH burn rate has dropped to record lows amid a decline in Ethereum network activity.

- In contrast, Ethereum rival Solana has seen its DeFi TVL jump by nearly four-fold year-to-date.

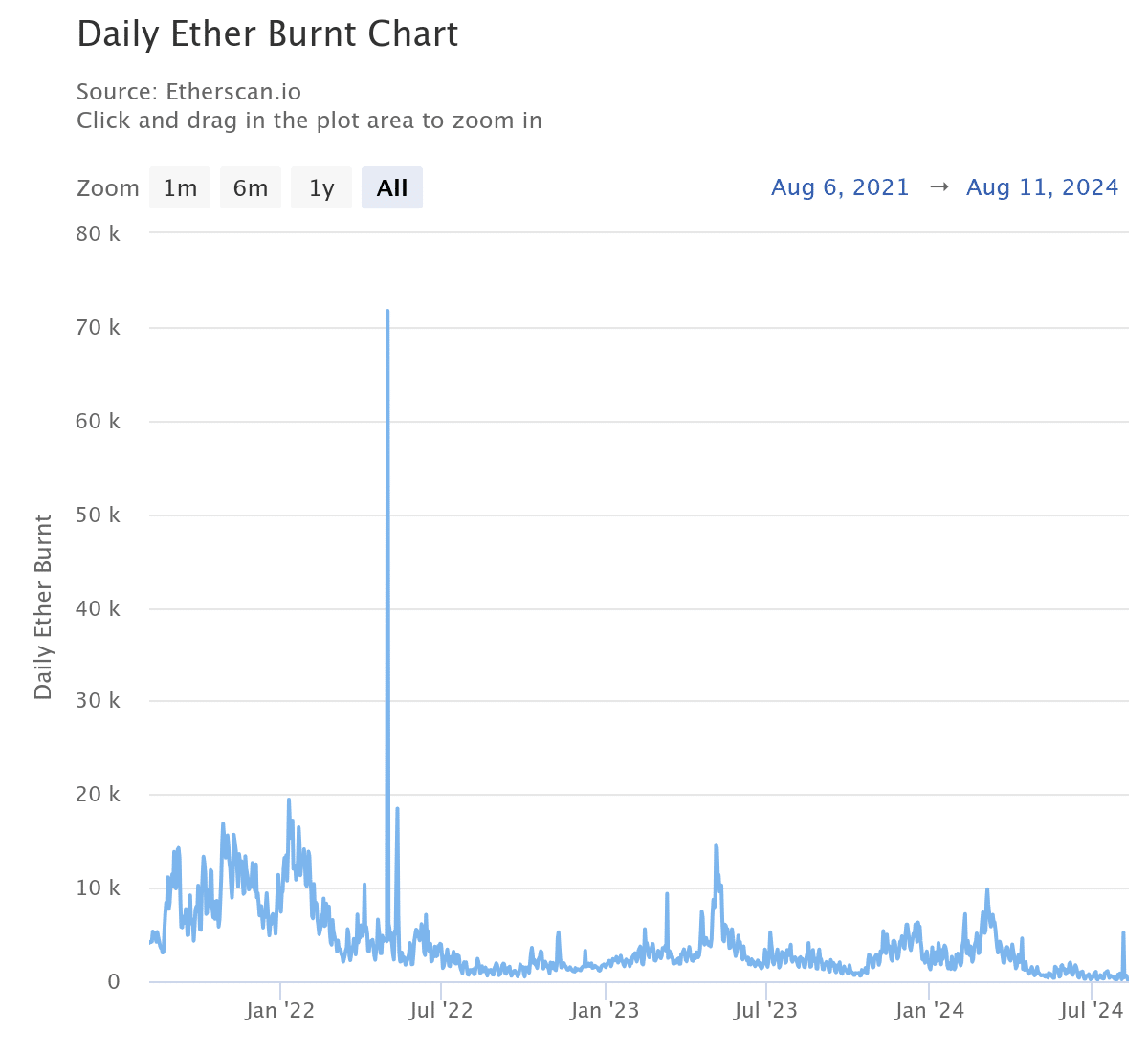

Ethereum’s [ETH] burn rate has dropped to record lows after 121 ETH tokens were burnt on the 10th of August, marking the lowest level since the implementation of the EIP-1559 upgrade.

The declining burn rate, as seen on Etherscan, comes as the network continues to lose its dominance in the decentralized finance (DeFi) market.

Declining activity on Ethereum

Ethereum still holds the giant share of the DeFi market, with a total value locked of $47 billion according to DeFiLlama.

However, rival networks such as Tron [TRX] and Solana [SOL] have been eating up its market share, causing a significant 17% drop in TVL since the 1st of August.

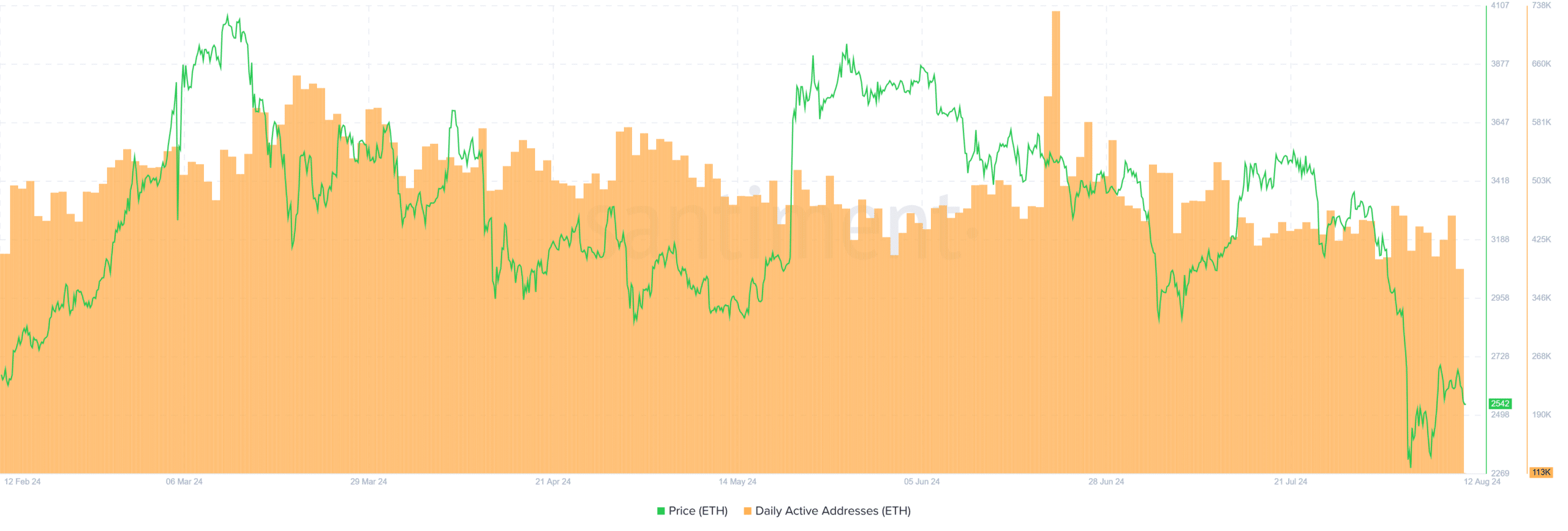

The waning DeFi activity has also led to a drop in the number of daily active addresses.

According to AMBCrypto’s look at Santiment’s data, Ethereum’s daily active addresses have dropped from 731,000 on the 22nd of July to around 386,000 on the 11th of August.

A decrease in TVL and user activity means fewer transactions, which impedes the gas fees collected and burned. This has seen Ethereum’s burn rate tank to the lowest level in years.

AMBCrypto’s look at Ultrasound Money data also showed that in the last seven days, 3,885 ETH tokens were burned while 18,000 tokens were issued.

Thus, Ethereum has turned inflationary, with a net total of 14,206 ETH entering the circulating supply.

Is ETH losing to SOL?

As Ethereum struggles with declining network activity, its top rival, Solana, has recorded a notable rise in DeFi TVL.

Solana’s TVL was $4.72 billion at press time, representing a nearly four-fold increase from around $1.4 billion on the 1st of January.

Solana was also outperforming ETH in terms of price. While Ethereum has gained 39% over the past year, Solana has seen a staggering 487% increase.

ETH was trading at $2.581 at the time of writing after shedding 13% in the last two weeks.

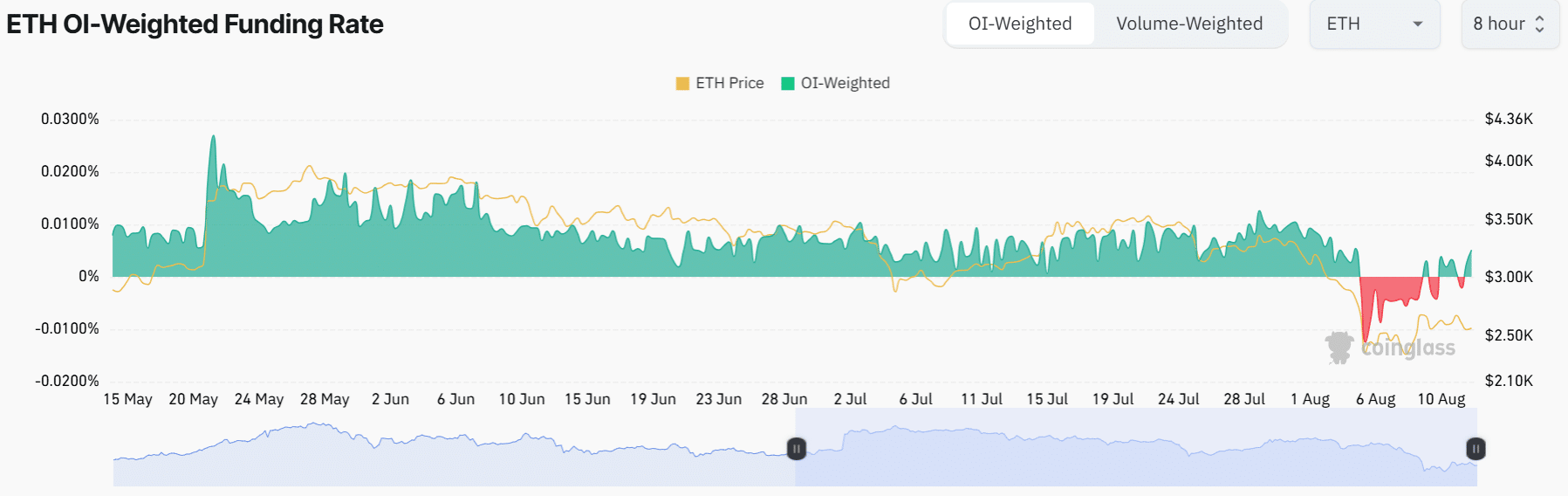

However, traders were betting on a positive price action, as Ethereum’s Funding Rate flipped from negative to positive at the time of writing.

This indicated that more traders are taking long positions, suggesting a flip to a bullish sentiment.

Demand driven by spot Ether exchange-traded funds (ETFs) is also a catalyst for further gains.

Read Ethereum’s [ETH] Price Prediction 2024-25

Since the 23rd of July, Wall Street giants BlackRock and Fidelity have purchased $761 million and $282 million worth of Ether respectively for their ETH ETFs, according to SosoValue.

Ethereum also saw the highest inflows last week of $155 million, according to a recent report by Coinshares.

![Polygon's [POL] short-term momentum faces strong resistance HERE](https://ambcrypto.com/wp-content/uploads/2025/03/Polygon-Featured-400x240.webp)