Ethereum Classic: Should you be bullish on the altcoin?

- Ethereum Classic could be a good candidate for a bullish bounce as it retested the long-term support range.

- ETC struggled to secure strong bullish volumes, although derivatives demand could be making headways.

Is Ethereum Classic [ETC] still worth trading or investing towards the end of 2023? Well, the altcoin’s bulls have really struggled to secure dominance during the crypto winter. But should anyone expand their portfolio for the short-term and long-term with ETC?

Is your portfolio green? Check out the ETC Profit Calculator

The good news is that the choice is not that difficult for Ethereum Classic. The ideal portfolio should be diverse and consist of cryptocurrencies from different segments. For example, it could contain cryptos of promising Proof-of-Stake (PoS) networks, as well as Proof-of-Work (PoW) networks.

ETC is one of the few coins that are native to a PoS network.

Of course, ETC has something else going for it. It is affiliated with Ethereum, one of the most popular blockchain networks in the world. This alone could encourage many to scoop up some ETC during the next bull run.

However, these are still within the realm of speculation, and may not exactly represent the current status quo.

Can ETC attract significant buy pressure?

Ethereum Classic could potentially benefit from robust demand in the future, but it was lacking at press time. The cryptocurrency has been on an overall decline since the start of 2023, maintaining the same trend that we saw in the previous year.

ETC’s price action suggested that we might see the bulls attempt to challenge the bears from its press time level. The cryptocurrency traded at $14.94 at the time of writing. This was noteworthy, because it was still within the same low range that acted as a long-term support.

A key point here is that the same support level has been retested multiple times in the past. This means it is highly likely that the price could bounce back from the same level for the next short-term rally. The same could be said about its long-term potential.

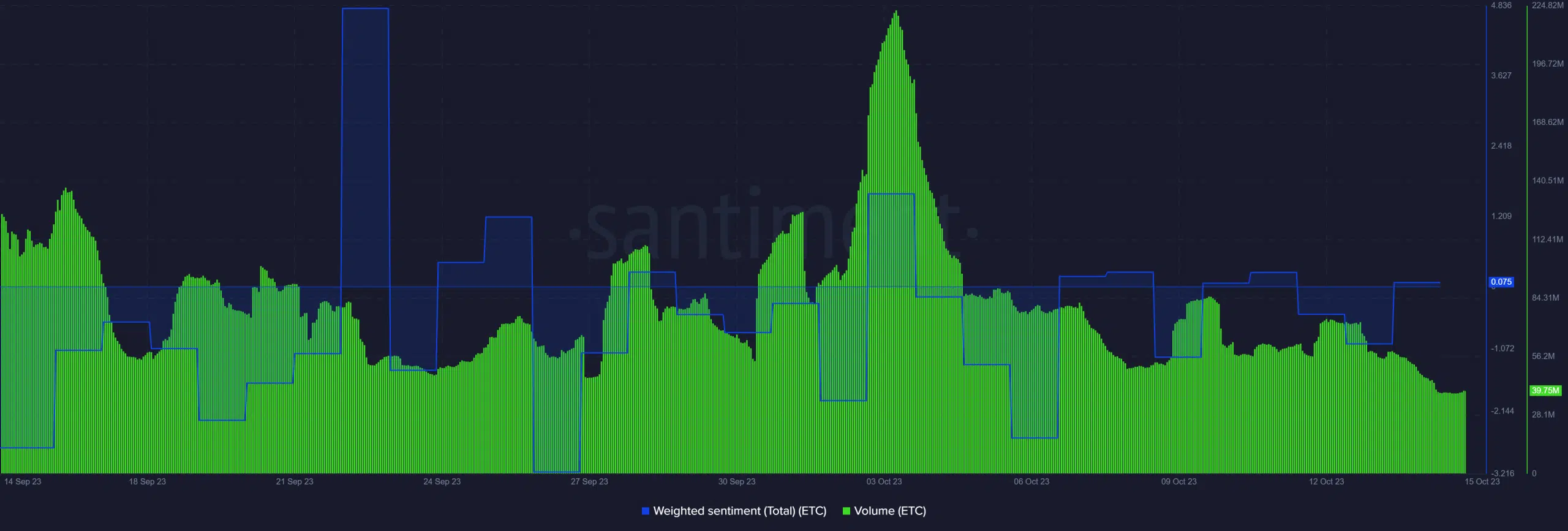

But could Ethereum Classic bounce back from the same support level? At the time of writing, the Weighted Sentiment showed some improvement from the lowest price level since the start of October. However, it also highlighted a lack of strong interest.

ETC’s Volume metric also reflected the lack of excitement in the cryptocurrency. The press time on-chain observations revealed that Volume fell to its lowest in four weeks.

Read Ethereum Classic’s [ETC] Price Prediction 2023-24

On the other hand, its Binance Funding Rate was back to the positive side of things, suggesting that Ethereum Classic’s demand was growing in the derivatives market.

While the positive funding rates may point to recovering demand, it was clear that spot demand was still quite low at the time of writing. As such, there is a chance that short-term price action might remain bearish.