Ethereum Classic surges >6% amid Cardano founder’s mockery. Assessing…

The price of Ethereum Classic [ETC] increased by 6.71% despite Charles Hoskinson throwing tantrums over the coin’s Twitter account suspension. The controversial Cardano [ADA] founder tweeted his observation of the suspension. He opined that the social media blackout would have translated to ETC losing users.

This just crossed my desk a few minutes ago. Did the @eth_classic twitter handle seriously just get suspended? So after all this drama, the users would have been lost regardless? pic.twitter.com/30NL7aLOv9

— Charles Hoskinson (@IOHK_Charles) October 22, 2022

Here’s AMBCrypto’s Price Price Prediction for Ethereum Classic

However, it seemed that Hoskison was late to the party. This was because an evaluation of the ETC social media platforms showed that the verified account had been down since 6 October. Still, it did not stop Hoskinson from adding to his mockery.

I'm sure they will get a 70 paragraph email

— Charles Hoskinson (@IOHK_Charles) October 22, 2022

A blackout is not the end

With the Twitter ousting, the crypto community might have expected a glaring ETC price decrease. However, it was not the case as only Aptos [APT] and Huobi Token [HT] seemed to surpass its 24-hour increase out of the top 50 cryptocurrencies.

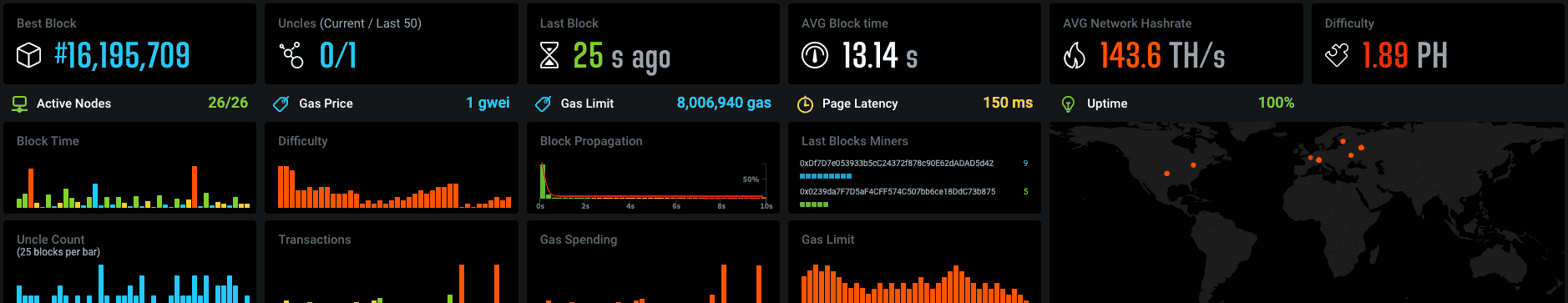

On the other hand, ETC might have its network statistics to thank for the uptick. According to 2Miners.com, the ETC network had maintained a 100% uptime. Hence, this made sure that block mining was less difficult, coupled with an average block time of 13.14 seconds.

Although ETC’s network maintained a positive stance, it was not an all-round activity. This was because the hashtrate at 143.6 TeraHash per second (TH/s) was much lower than the point it was as of 22 October. This implied that the computation power in hashing ETC blocks was not operating at full capacity even with the active nodes in full functionality.

However, the price uptick didn’t seem to bother the ETC derivatives market traders. According to Santiment, the Binance funding rate was neutral at 0%. This indicated that the surge hadn’t triggered traders to increase their interest in trading ETC via futures or options. It was a similar situation with the FTX funding rate at at-0.001%.

To maintain the status quo or not?

While investors might expect a further increase in price, the possibility could be either ways. Further indications showed that despite a volume increase to $458.74 million, deep-pocketed investors didn’t consider ETC worthy enough to accumulate largely. At press time, the whale supply had decreased to 41.20. So, ETC might need the help of these whales if there was to be a long-period rally.

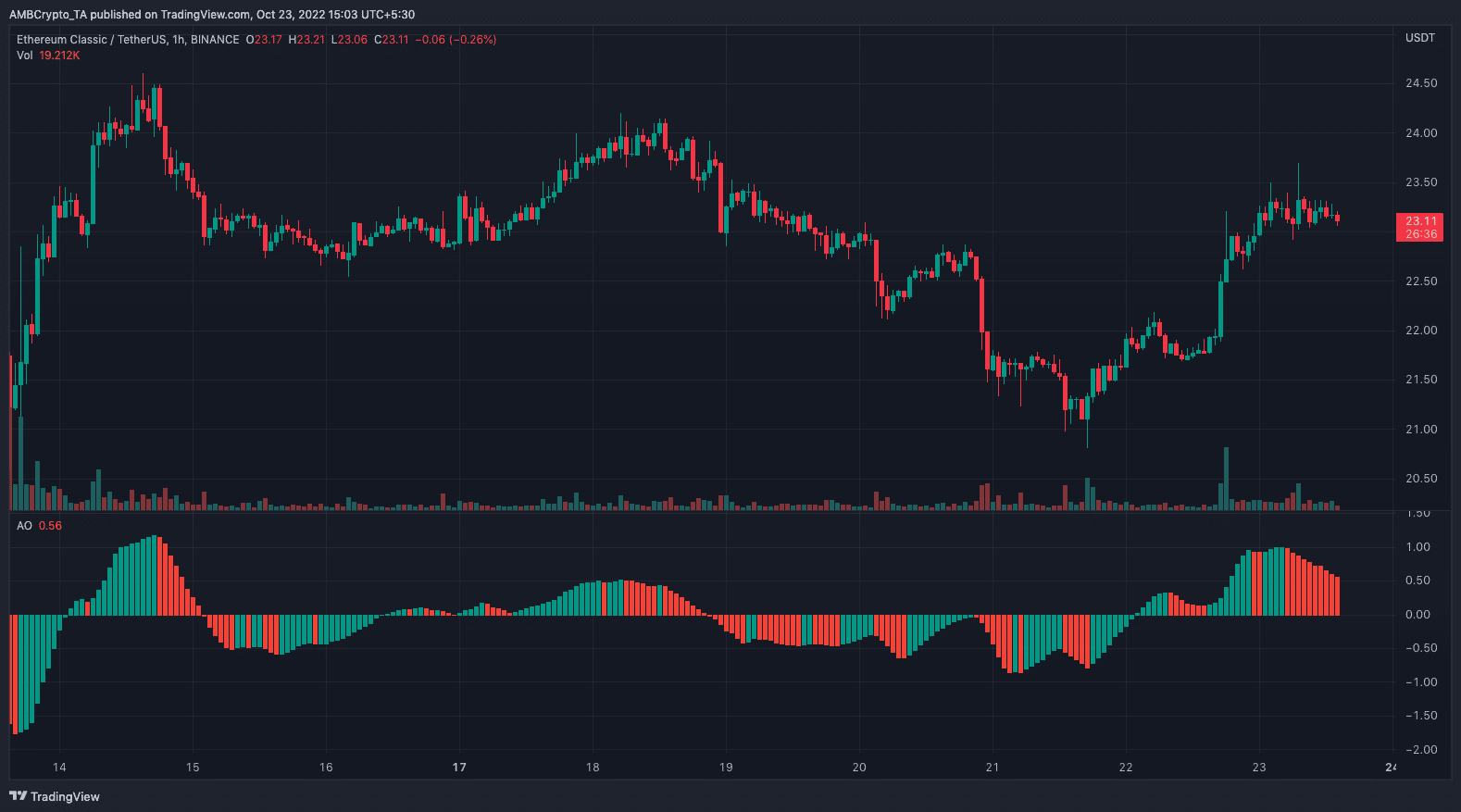

However, the momentum on the charts had a different standing. In evaluating the Awesome Oscillator (AO), it was observed that ETC had maintained a bullish edge for a while. Nevertheless, the signals from the 0.56 reds value above the histogram equilibrium indicated that ETC could fall to a bearish twin peak. In conclusion, ETC was less likely to rise above $23.10 in the short-term.