Ethereum Classic: Why investors should consider this before going long

Disclaimer: The findings of the following analysis are the sole opinions of the writer and should not be considered investment advice

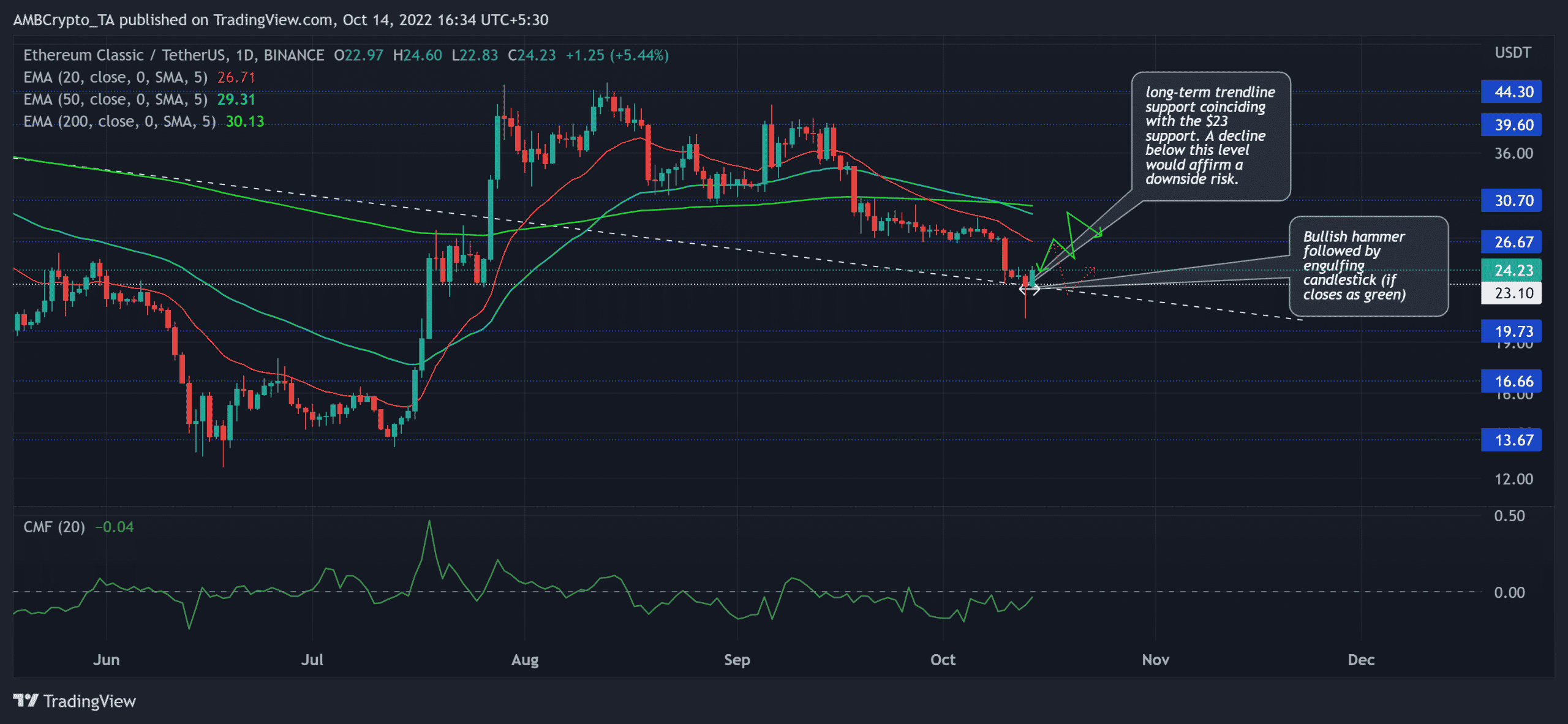

- Moving averages depicted a strong selling edge as the price action approached a support region.

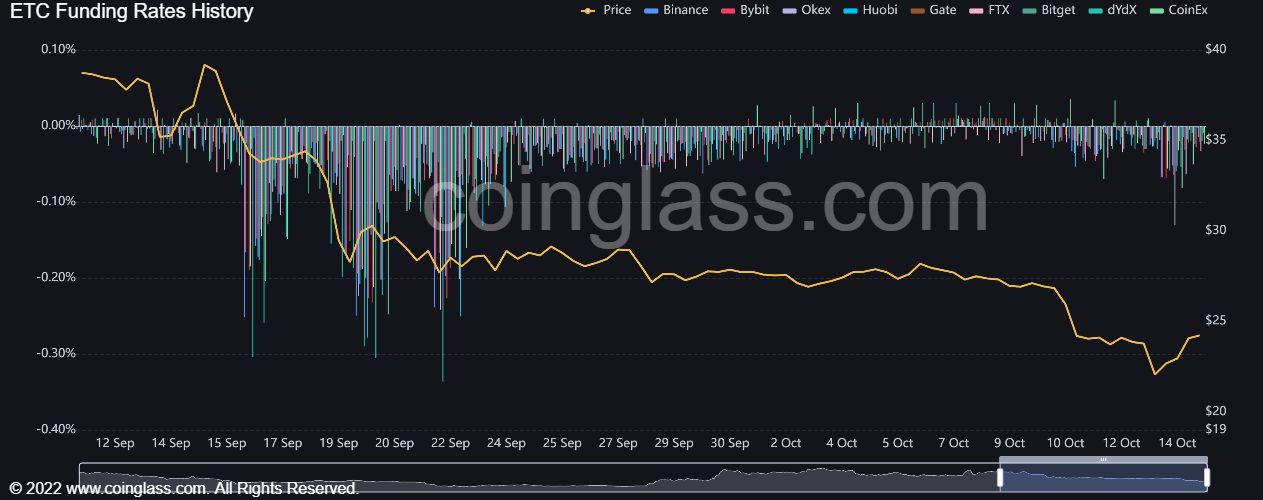

- Ethereum Classic’s funding rates showed slight improvement but were yet to turn positive.

After a steep uptrend for over a month, Ethereum Classic’s [ETC] price was relatively dull over the last two months. The selling re-emergence pulled the altcoin below the daily 20/50/200 EMA to reveal a robust bearish edge.

Here’s AMBCrypto’s price prediction for Ethereum Classic [ETC] for 2023-24

The altcoin’s press time march toward the confluence of trendline support (white, dashed) and the horizontal baseline could halt the streak of red candles in the coming sessions.

At press time, the altcoin was trading at $24.23, up by nearly 13.86% in the last 24 hours.

Can a death cross on EMAs set the stage for bears?

ETC marked a non-linear ROI of over 240% from its mid-July lows. As a result, it hit its four-month high on 13 August.

Over the last two months, ETC expedited its selling pressure and correlated with Bitcoin’s decline during the same time. This selling comeback helped the bears find a close below the 20/50/200 EMAe.

Meanwhile, the long-term trendline support (yellow, dashed) and the $23 baseline coincided and offered rebounding grounds for ETC.

However, with the recent death cross on the 50/200 EMA, the bears would aim to maintain their edge. The close above the 20 EMA can aid buyers in retesting the $30 ceiling before a plausible reversal.

Should the wider market conditions continue to fuel the bearish narrative, a slip below the $23.1 baseline would expose ETC to major downside risk. In these circumstances, the sellers could aim to test the first major support level in the $19 zone.

Additionally, the Chaikin Money Flow (CMF) registered higher troughs to affirm a bullish divergence with the price action.

Funding rates improved, but still negative

An analysis of ETC’s funding rate history over the last week across various exchanges revealed that the sentiment is still slightly skewed in favor of the sellers.

At press time, the rate stood negative in all of the exchanges. However, over the last 24 hours, these readings have displayed a consistent uptick. A continued incline into the positive zone can aid ETC to clinch in near-term gains.

Given the crypto’s confluence of multiple support levels alongside the bullish divergence on the CMF, ETC could see a near-term revival before falling back into its bearish track. The targets would remain the same as discussed.

Finally, broader market sentiment and other on-chain developments would play a vital role in influencing future movements.