Ethereum Classic: Will Sept. hashrate boost help ETC do well in Q4

Ethereum Classic [ETC] received a lot of attention before the Merge due to miner migration. Its strong price action in the weeks leading up to the main event was a reflection of the attention.

This interest has since died down, resulting in a selloff. But there is one other growth metric that is of interest for ETC’s long-term performance.

ETC’s performance in the last few weeks was not just about the price action. Its hash rate was one of the most important metrics that savvy investors observed.

As expected, ETH’s migration to Proof of Stake (PoS) forced miners to shift to other PoW networks. ETC was one of the best candidates for this transition.

Furthermore, ETC’s hashrate unsurprisingly, grew from as low as 38.12 TH/S at the start of September, to as high as 222 TH/S. It has since leveled out to 140 TH/S at press time, which was three times more than its hash rate before the start of September.

The importance of the hashrate

A higher hash rate is considered healthy for a PoW network. This is because it increases the network’s resilience against a 51% attack.

In addition, it boosts the network’s efficiency. These benefits are important, especially for a network achieving more growth in terms of utility.

We are yet to see whether ETC’s network demand has increased. Such a favorable outcome would match the hashrate growth and generate more demand, as well as value for ETC.

That being said, on 29 September, the alt was trading at $27.53 after a 35% drawdown from its $42.39 September top.

As far as ETC’s short-term performance was concerned, it might be due for a bullish bounce. This was because it traded within the 0.382 Fibonacci level as of 29 September.

The bearish performance observed in the last two weeks slowed down at the same Fibonacci level last week.

A failed rally attempt in the last few days ensured that the price remained within the same level. While this signified bearish weakness, it also indicated the lack of enough buying pressure to support a strong bounce back.

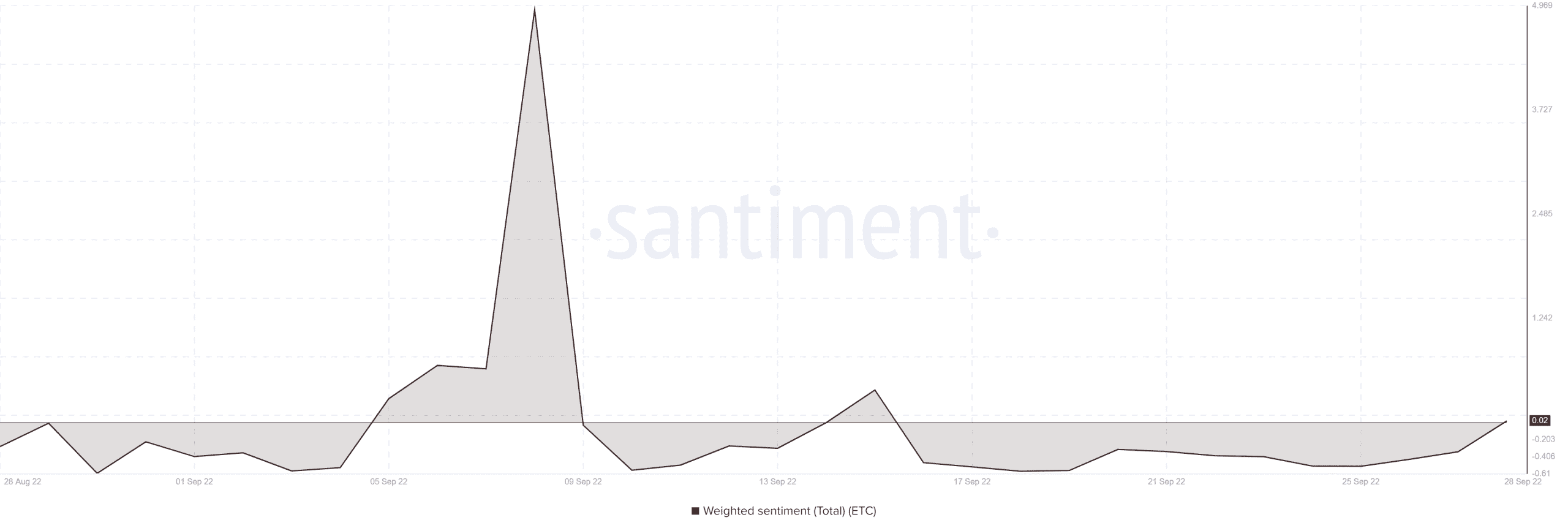

Nevertheless, ETC’s weighted sentiment improved in the last few days.

The sentiment shift signified that investors were warming up to Ethereum Classic after the latest discount.

This means that ETC might be off to a bullish start in the first week of October. ETC’s social dominance had also recovered as of 29 September.

The alt’s recovering social dominance and weighted sentiment pointed towards a potential bullish outcome.

Investors should proceed cautiously despite these signs because there is still a risk of more downside.