Ethereum DeFi gives off concerning signals, details inside

- Ethereum’s DEX volumes began to decline.

- Interest in NFTs remained consistent as gas prices fell.

Ethereum [ETH] has been dominant in both the DeFi and NFT sectors for a long time. However, with rising competition in the ecosystem, Ethereum’s DeFi activity started declining.

Is your portfolio green? Check out the Ethereum Profit Calculator

Volume gets turned down

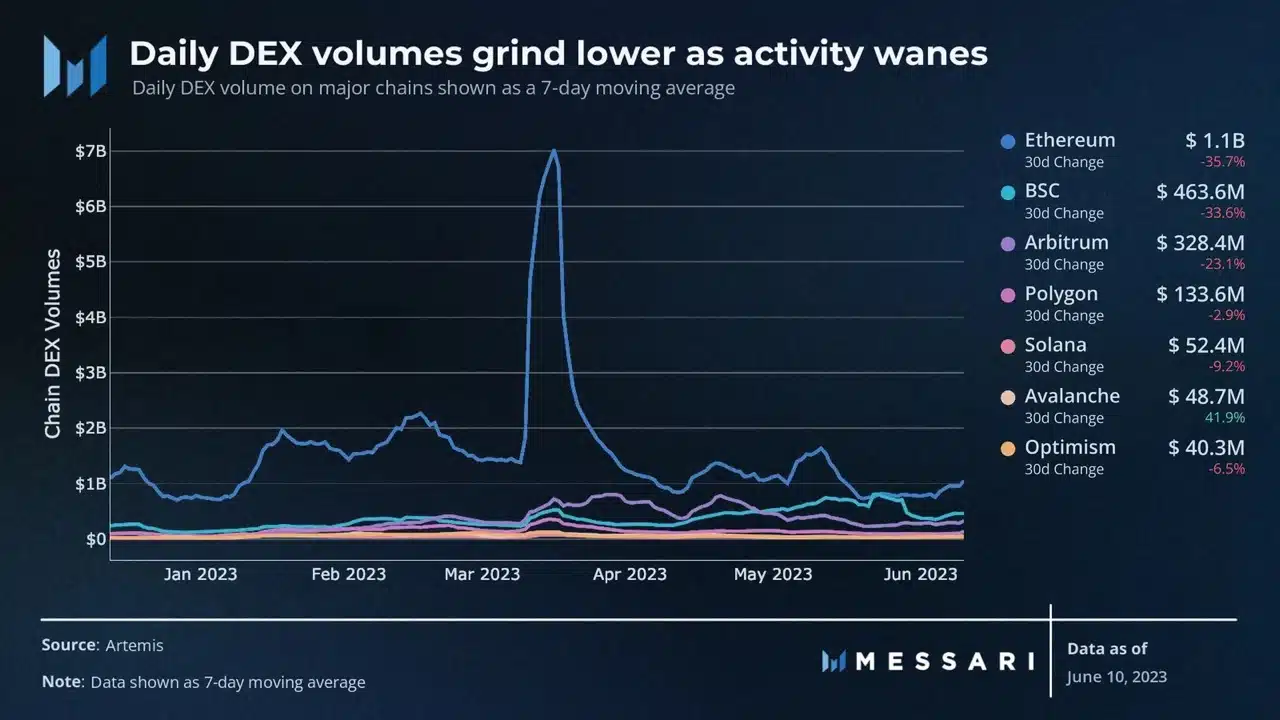

According to Messari’s data, overall trading volumes on decentralized exchanges (DEX) showed a slight decline across major blockchains at press time. Notably, Ethereum’s daily DEX volume decreased by 35% over the course of the last month.

But despite the declining DEX volume, Ethereum’s TVL surged, indicating that dApps and protocols on the network helped sustain value on the protocol.

It is pertinent to note that one indicator of high activity on Ethereum has been consistent gas usage, which showed that the declining DEX volumes had little impact on the network’s overall activity. According to Glassnode’s data, at press time, Ethereum’s gas prices reached a 5-month low.

In the NFT sector as well, the number of trades saw a spike.

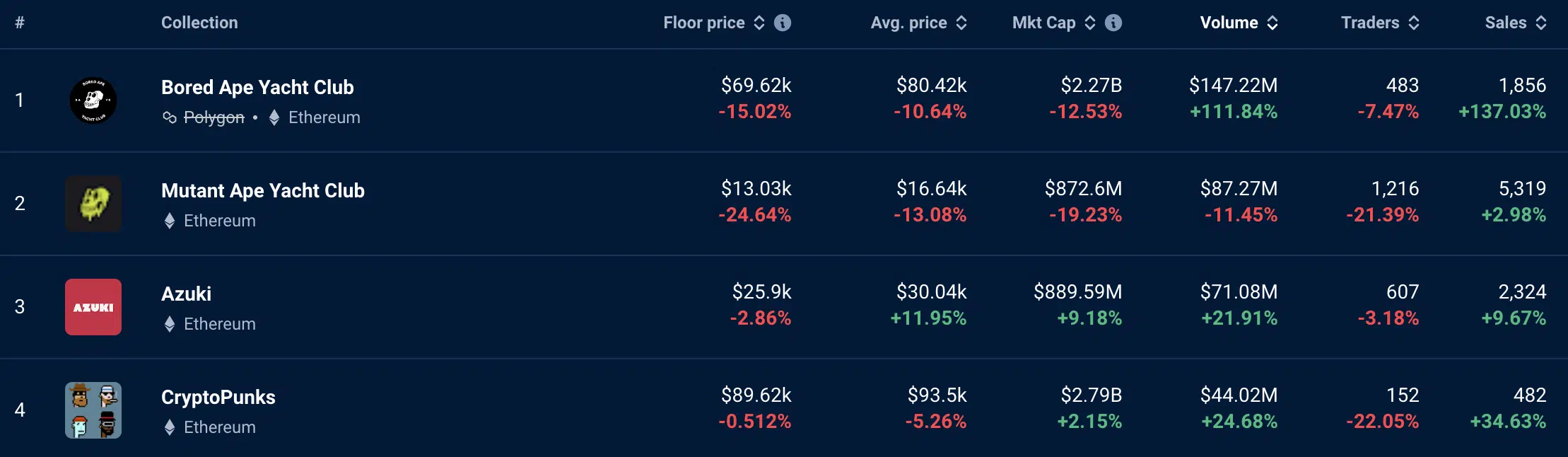

However, regardless of low gas prices, interest in blue-chip NFTs declined significantly. According to data provided by Dapp Radar, blue chip NFT collections such as Axuji, Crypto Punks and Bored Ape Yacht Club [BAYC] witnessed a decline in volume and sales over the last month.

Coming to ETH, the price of the currency continued to surge over the last week. This spike in price has led traders to make some interesting decisions.

Traders react

According to GreeksLive’s data, 180,00 ETH options were about to expire at the time of writing. The Put Call Ratio for ETH stood at 0.86, suggesting a relatively higher demand for calls. This suggested increasing bullish sentiment among traders.

The Max Pain point was set at $1,750 at press time, which could be a level of interest for market participants as well.

Realistic or not, here’s ETH’s market cap in BTC’s terms

Moreover, the notional value of ETH options amounted to $340 million, indicating significant value at stake. Additionally, the positive market sentiment, fueled by the news of Blackrock’s ETF, has contributed to a surge in the market, with ETH also experiencing gains.

ETH’s options market exhibited clear IV inversions, making cross-currency IV arbitrage an appealing strategy. It is important to note that the sustainability of ETH’s lower implied volatility at press time, compared to BTC, may come into question in the long term.