Ethereum: DeFi sector grows, but is it enough?

- Ethereum consolidated dominance in DeFi with TVL and DEX growth.

- The NFT sector faced declining prices, however, validators remain interested.

Ethereum [ETH] has continued to assert its dominance in the crypto sector, particularly in NFTs and DeFi. Recent observations suggested that Ethereum was consolidating its position in the DeFi sector, which could be seen as a positive development for the network.

Is your portfolio green? Check out the Ethereum Profit Calculator

Growth in the DeFi sector

According to data from Messari, the Total Value Locked (TVL) in DeFi witnessed an increase during the market rebound, with Ethereum emerging as one of the most prominent players in this space.

TVL in DeFi increased during the market rebound, with @Ethereum, @BNBCHAIN, and @trondao being the dominant players.@Stacks and @Cardano had significant TVL growth.@Ethereum had a diverse DeFi ecosystem, while other networks had a more concentrated distribution. pic.twitter.com/N0o6xYCtzn

— Messari (@MessariCrypto) June 9, 2023

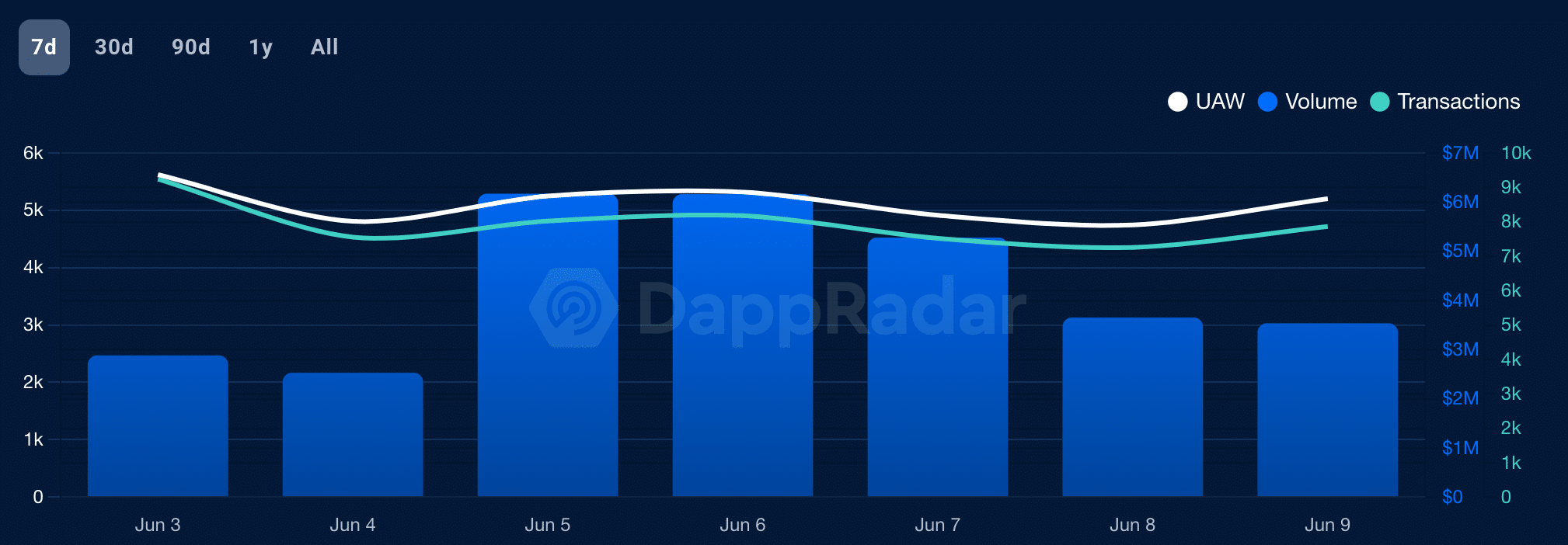

The rise in TVL can be attributed to the significant growth of Decentralized Exchanges (DEXes) operating on the Ethereum network, such as Metamask Swap, which experienced a substantial surge in unique active wallets within a 24-hour period.

Consequently, transaction volumes on the network registered a notable 9.12% increase during the same timeframe.

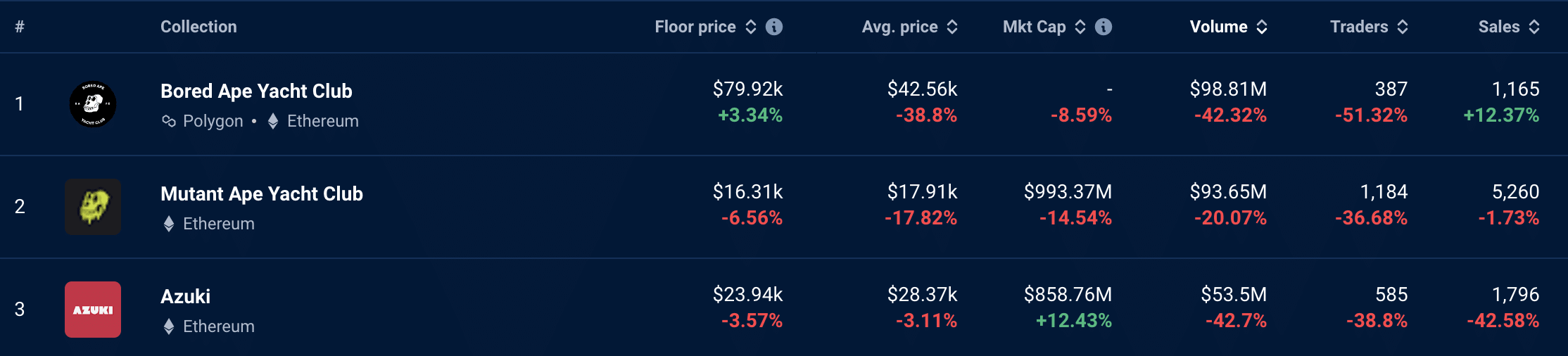

While Ethereum’s dominance in the DeFi sector remained strong, the same cannot be said for the NFT space. Over the past month, several blue-chip NFT collections on the Ethereum network saw falling prices, including Bored Ape Yacht Club (BAYC), Meebits, and Azuki.

Moreover, the number of traders involved in buying and selling these collections also witnessed a significant drop during this period.

The NFT angle

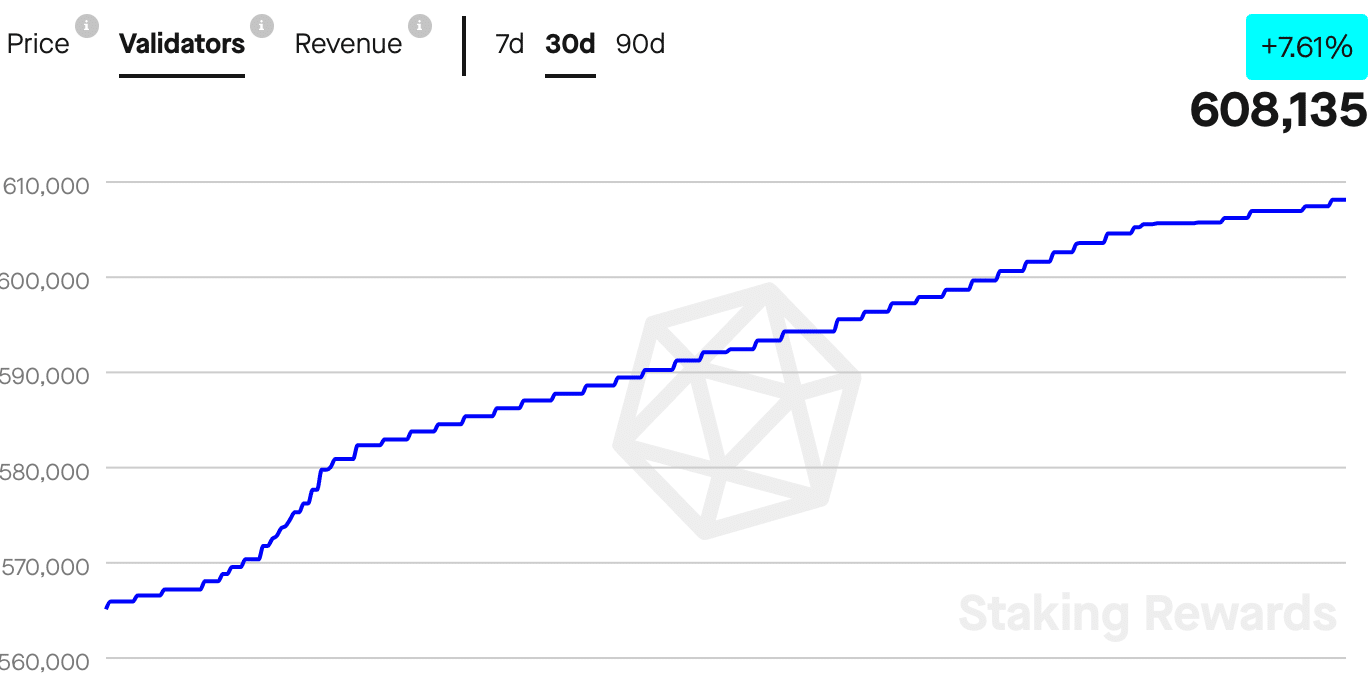

The declining interest in NFTs could potentially impact Ethereum, but despite this, the number of validators on the network continued to grow.

Data from Staking Rewards revealed a 7.61% increase in the number of validators over the past month, indicating ongoing participation and support for the network’s security.

Realistic or not, here’s ETH’s market cap in BTC’s terms

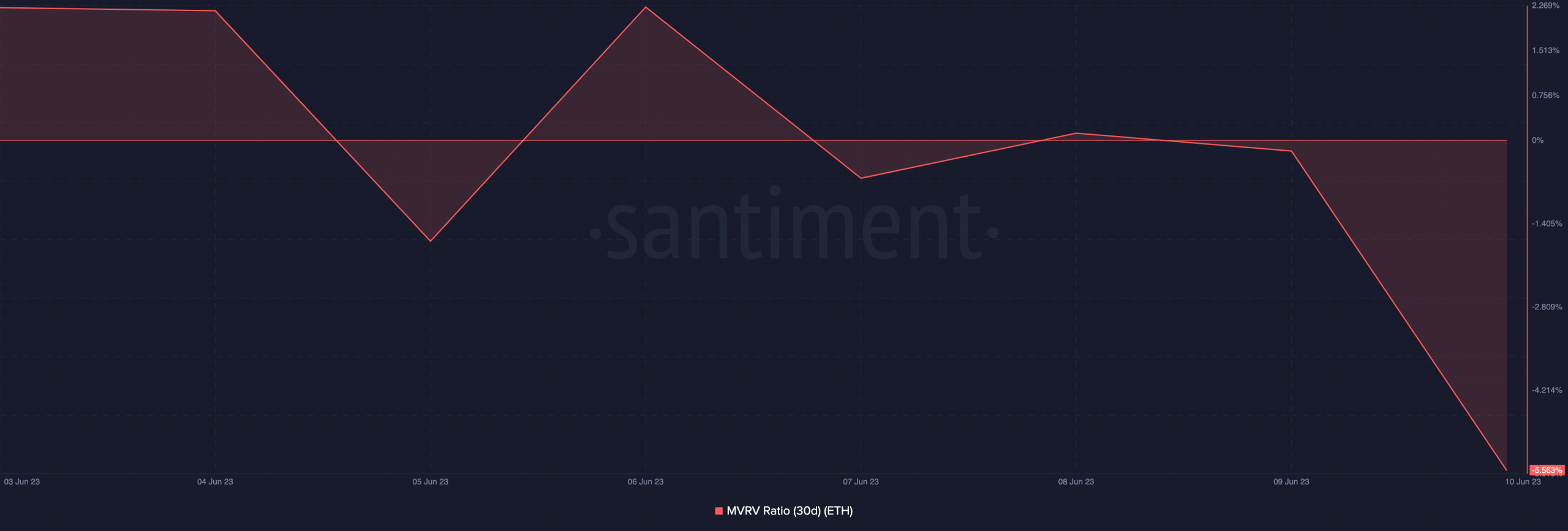

However, the MVRV ratio of Ethereum indicated that holders were not facing significant selling pressure at the time of writing.

Additionally, approximately 189,000 ETH options are approaching expiration, with a Put Call Ratio of 0.91, a maximum pain point at $1,850, and a notional value of $325 million. These factors reflected optimistic trader behavior and potential market expectations for Ethereum.