Ethereum, Dogecoin, XRP Price Analysis: 28 March

Ethereum bounced strongly off the $1550 region and could flip the $1700 to demand in the coming hours. XRP displayed neutral momentum in the markets but had strong support at $0.53, while Dogecoin saw buyers step in at $0.049 and could be headed back toward $0.062.

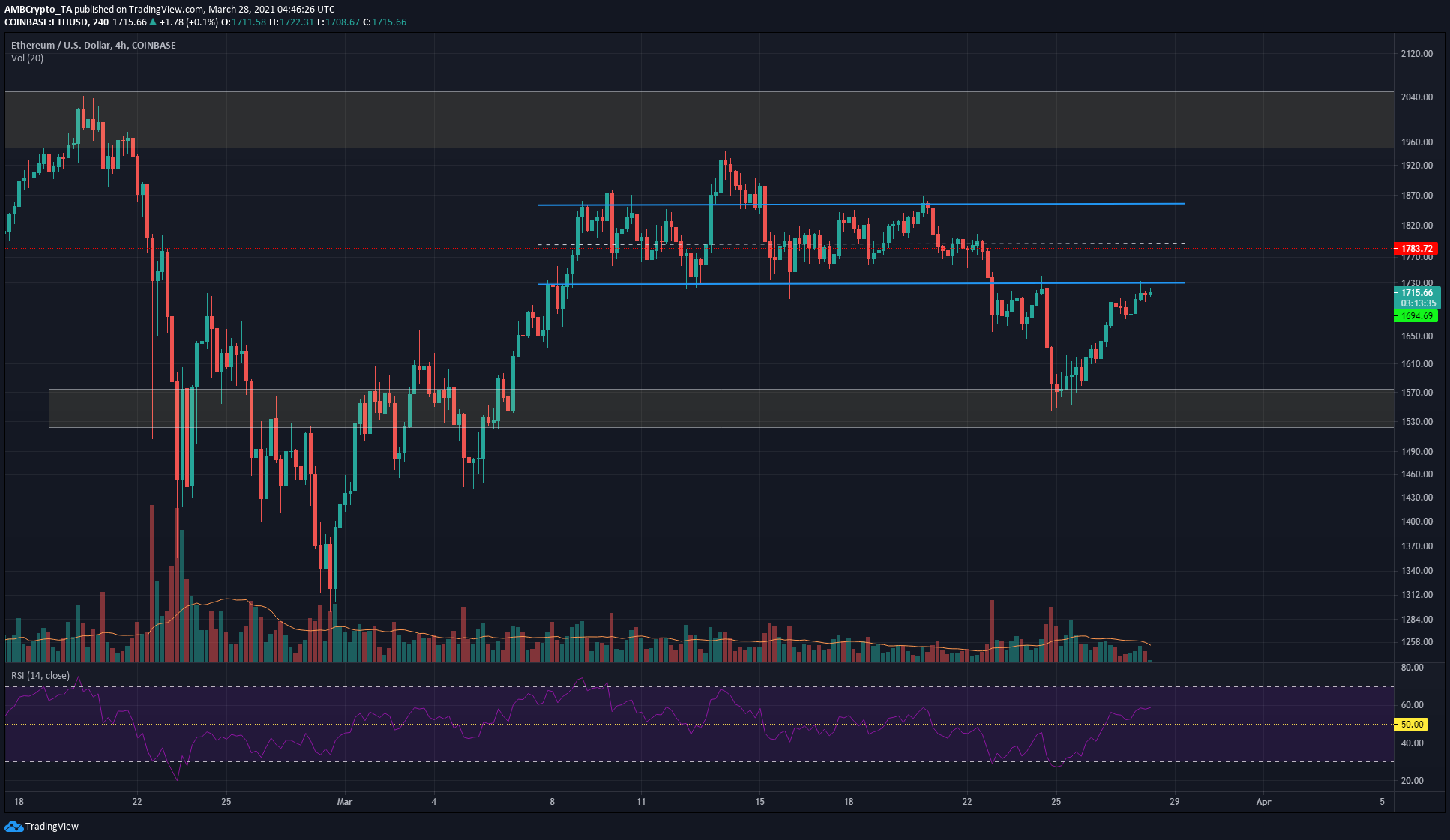

Ethereum [ETH]

Source: ETH/USD on TradingView

ETH showed signs of buyer dominance in the market. The $1550 area saw a strong bounce, and the $1720 area was tested. ETH then saw a minor dip to $1670 before climbing above the $1700 mark.

A move above $1730 can be used to enter a long position with a stop-loss of $1680 and a target of $1850.

XRP

Source: XRP/USD on TradingView

The confluence between Fibonacci retracement levels for different price moves marked the $0.53 level as an important support level. The shorter-term Fibonacci levels showed XRP had recovered well, and XRP has also climbed past the $0.52-$0.528 area.

OBV showed that there was a lack of buyers behind XRP; the drop from $0.58 to $0.48 had a greater selling volume than the buying volume that has pushed the price back to $0.55. MACD also showed that recent hours saw momentum grind to a halt.

This spelled uncertainty for XRP in the short-term. On a longer-term outlook, the recent drop was only a minor setback for XRP bulls, who effected a breakout from a descending channel and had a target of $0.63.

Dogecoin [DOGE]

Source: DOGE/USDT on TradingView

DOGE suffered a near 20% drop over the past two weeks as it fell from $0.062 to $0.049, but saw a strong bounce off the support level to trade at $0.054 at the time of writing. These two levels have remained intact since mid-February when DOGE dropped from $0.085 to consolidate at $0.05.

At the time of writing, Awesome Oscillator showed a shift in momentum to bullish as the histogram crossed over above the zero line. The Aroon indicator had seen a dominant Aroon down (blue) in recent days, but that has changed as well.

The trading volume was average at best and did not hint at an imminent major move.