Ethereum ETF inflows turnaround: ‘ETH is just getting started!’

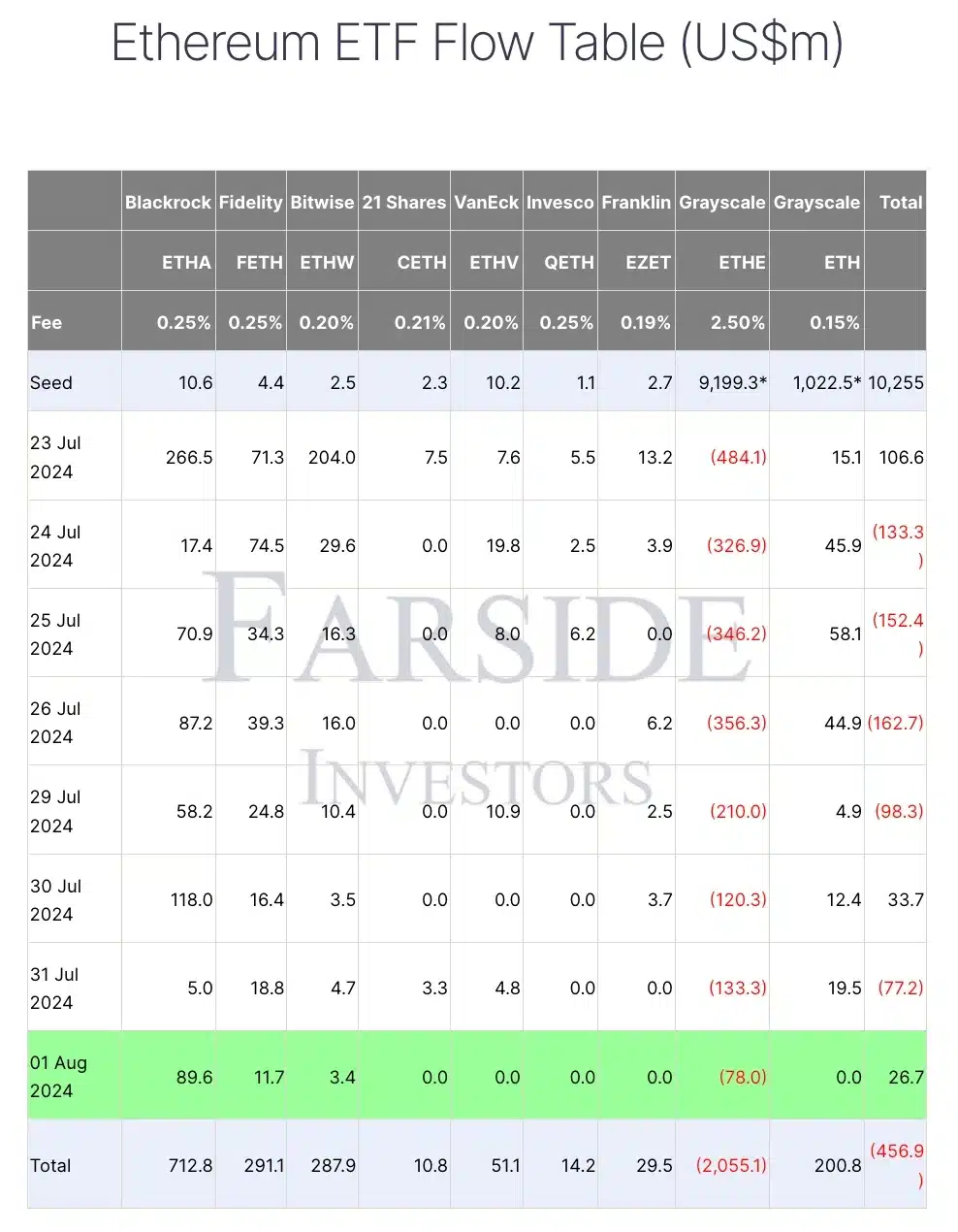

- The 1st of August saw a $26.7 million net inflow into U.S. Ether ETFs, led by ETHA.

- Grayscale Ethereum Trust (ETHE) faced $2 billion in outflows, marking a significant investor shift.

Despite ongoing cumulative outflows from the Grayscale Ethereum Trust (ETHE) surpassing $2 billion, recent trends in U.S. spot Ethereum [ETH] exchange-traded funds (ETFs) present a contrasting picture.

Ethereum ETF flow analysis

On the 1st of August, Ether ETFs recorded a notable turnaround with a net inflow of $26.7 million.

This positive shift was driven largely by a substantial $89.6 million inflow into BlackRock’s iShares Ethereum Trust (ETHA).

On the other hand, ETHE recorded inflows worth $78 million, according to data from Farside Investors.

Remarking on the same, Ted Pillows, a distinguished investor and entrepreneur, took to X and noted,

“Ethereum ETFs had a net inflow of $33,700,000. BlackRock bought $118,000,000 $ETH. ETH is just getting started, my bags are ready.”

Trend shift

This development is particularly remarkable given that Ether ETFs had primarily been recording outflows since their launch on the 23rd of July.

With the exceptions of the 23rd of July, the 30th of July, and the 1st of August, the trend had been predominantly negative.

Notably, while the Grayscale Ethereum Trust (ETHE) experienced the largest outflows since the inception of ETH ETFs, the inflows around the 1st of August into BlackRock’s iShares Ethereum Trust (ETHA) successfully surpassed these outflows, marking a significant shift in the ETF landscape.

It’s crucial to highlight that, unlike the eight-spot Ether ETFs introduced as “newborn” funds on the 23rd of July, the Grayscale Ethereum Trust (ETHE) was an established trust offering institutional exposure to Ether.

Prior to its recent conversion, ETHE held a substantial $9 billion in Ether.

However, by the 1st of August, outflows from ETHE had exceeded 22% of its initial value, underscoring a significant shift in investor sentiment despite the overall positive movement in Ether ETF inflows.

Dedic’s unique perspective on Ether

Despite the recent positive shift in ETH ETF performance, not all investors are satisfied. Reiterating the same, Simon Dedic, Founder and CEO of Moonrock Capital, remarked,

“Despite the ETF going live, $ETH has been the worst performing asset MTD of the whole Top 50.”

But he further suggested that, given the current poor performance of ETH, this situation might present a compelling buying opportunity.

“Turn off your emotions for a second and then tell me this isn’t one of the easiest buys you’ve ever seen.”

On the price front at press time, ETH was trading at $3,143.34, reflecting a 1.67% decline over the past 24 hours.

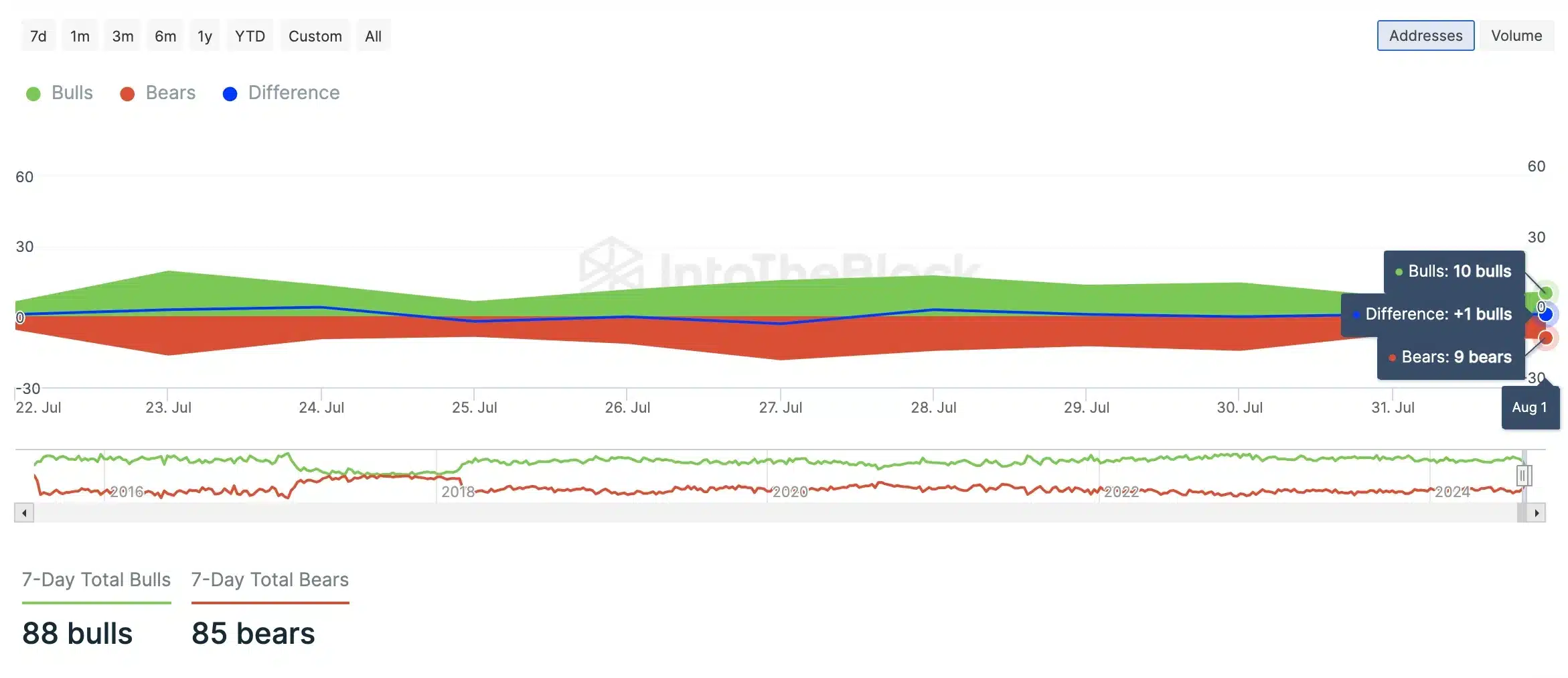

However, despite this drop, an analysis by AMBCrypto, using data from IntoTheBlock, indicated that bullish sentiment was outpacing bearish sentiment.