Ethereum ETF launch hype: ‘ETH pumping, altcoins following’ – But…

- Despite anticipation around the Ethereum ETF, ETH-based memecoins showed marginal gains.

- While some see bullish potential in Ethereum’s future, Andrew Kang predicted a possible price drop.

Due to the anticipated approval of the Ethereum [ETH] ETF, altcoins are enjoying a bullish surge, while Bitcoin [BTC] is hovering near the $60k mark.

This has also resulted in many foreseeing this as a bullish trend for July.

Impact on Ethereum’s price

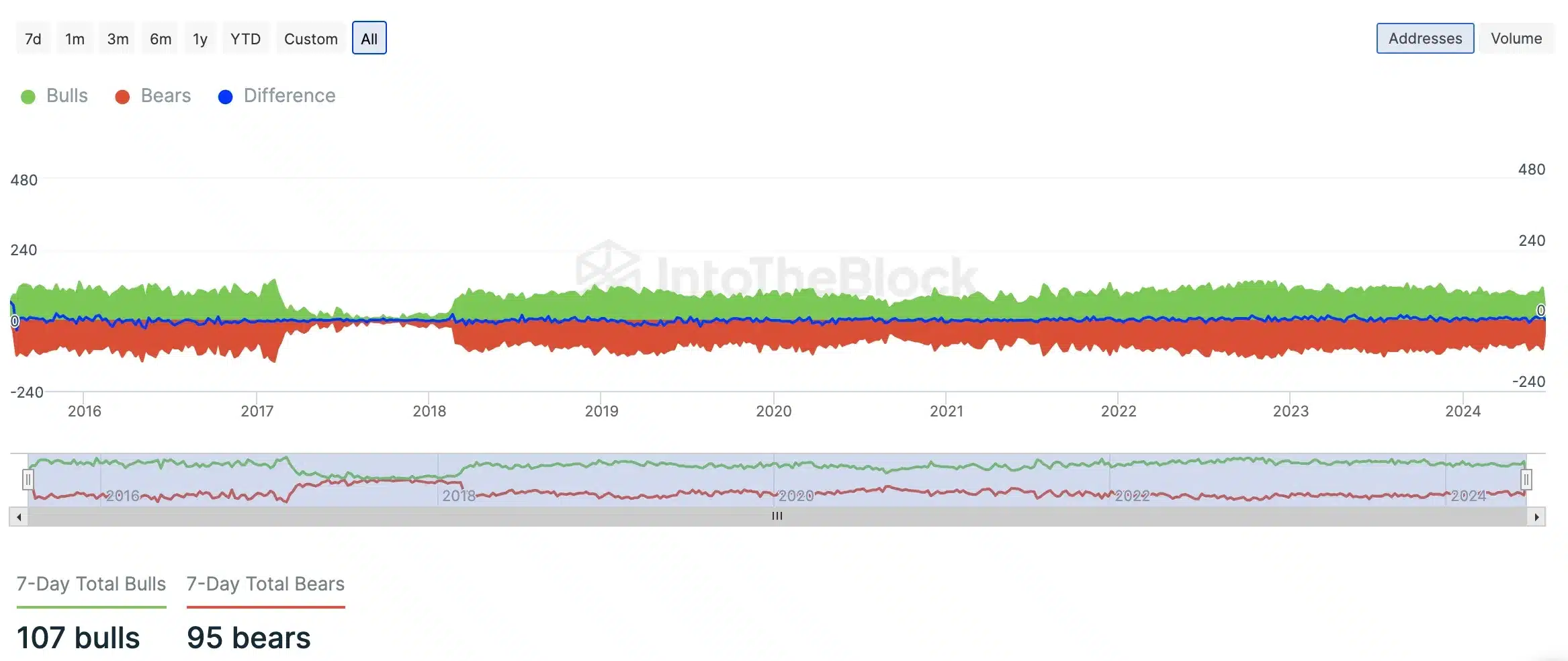

However, at the time of writing, Ethereum declined by 1.15%, showing red candles on the daily chart. But AMBCrypto’s analysis of IntoTheBlock data presented a contrasting view.

The data indicated that despite the price decline, bulls outnumbered bears with a 7-day average of 107 bulls compared to 95 bears, suggesting that buying pressure outweighed selling pressure at press time.

Impact on Ethereum-based memecoins

Contrary to expectations, the upcoming approval of the ETH ETF also did not lead to substantial gains in the memecoin sector.

While the top Solana memecoins surged by up to 14% in the last 24 hours, and the leading Base memecoins saw a 7.6% increase, ETH memecoins showed only marginal gains.

For an in-depth analysis, AMBCrypto examined the price action of Dogwifhat [WIF], a Solana [SOL]-based memecoin, Brett [BRETT], a Base blockchain memecoin, and Shiba Inu [SHIB], an Ethereum-based memecoin.

According to CoinGecko, WIF, and BRETT saw increases of 17.1% and 12.4% respectively, while SHIB was up by only 0.5%.

This disparity indicated that the positive market sentiment surrounding Solana and Base memecoins did not extend uniformly to Ethereum-based memecoins following the news of the ETH ETF approval.

However, this did not diminish investor interest in the largest altcoin as underlined by Anomander, Founder at Legion Ventures, who said,

“Obviously, the crypto market has topped on the Ethereum ETF approval. Keep blaming low-tier celebrities for launching their memecoins.”

Sharing a similar line of thought, and drawing a comparison between BTC and ETH’s price action, crypto analyst, Michaël van de Poppe took to X and noted,

“Bitcoin dominance continues to peak at 58%. In that regard, it seems likely that we’ll be having more eyes on Ethereum rather than Bitcoin in the upcoming period due to the Ethereum ETF.”

Ethereum ETF launch, not a good sign?

However, not everyone was optimistic about the ETH ETF’s impact on Ethereum.

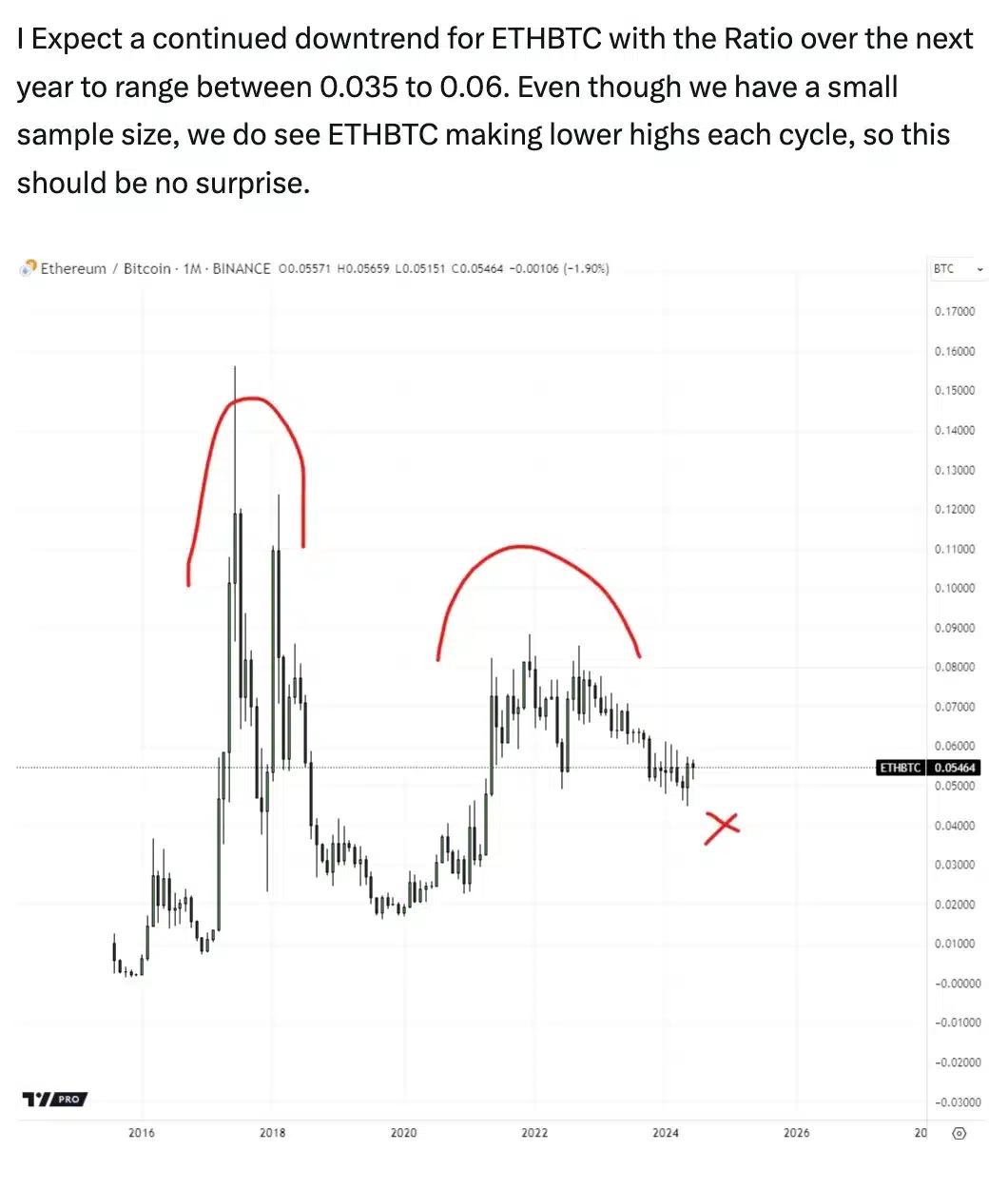

Andrew Kang of Mechanism Capital, in his recent post, speculated that the introduction of spot Ethereum ETFs may kick ETH’s price down to $2,400.

He said,

Further in his analysis, he pointed out that while there is potential for growth in ETH futures, the current lack of interest from savvy traders could signal concerns about the performance of ETH ETFs in the near future.

“The BTC ETFs opened the door for many new buyers to make bitcoin allocations within their portfolio. The impact of ETH ETFs is a lot less clear-cut.”

All in all, these analyses suggest that the market is not as bullish on ETH ETFs as it was on BTC ETFs, potentially leading to less dramatic price movements for Ethereum.