Ethereum [ETH]: Bears and bulls tussle for $1800 – what is the way ahead

![Ethereum [ETH]: Bears and bulls tussle for $1800 - which way for ETH?](https://ambcrypto.com/wp-content/uploads/2023/05/image-1200x900-5-1.png)

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion.

- ETH dropped below 50-EMA but was checked by 100-EMA.

- A positive CVD spot could offer bulls slight hope.

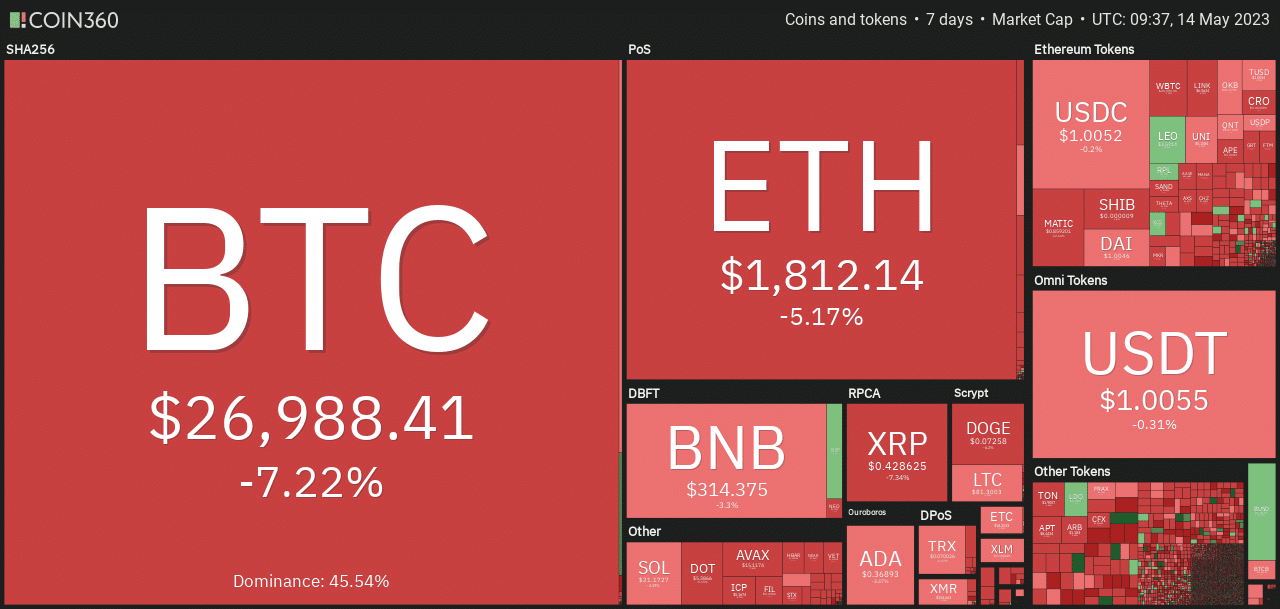

The second largest digital asset based on market cap, Ethereum [ETH], is weathering the current strong macro headwinds better than Bitcoin [BTC]. For perspective, ETH’s weekly loss was about 5% at press time, according to CoinMarketCap.

Is your portfolio green? Check ETH Profit Calculator

In the same period, BTC depreciated by about 7%; thus, the king coin was hammered more than the ETH – further reinforcing ETH’s decoupling from BTC. But Binance Coin [BNB] outperformed both assets on the weekly front.

Despite the corrections, the Crypto Greed and Fear index was “neutral” with a value of 48 at press time, compared to the “greed” position last week (7-14 May).

Will bulls continue defending $1800?

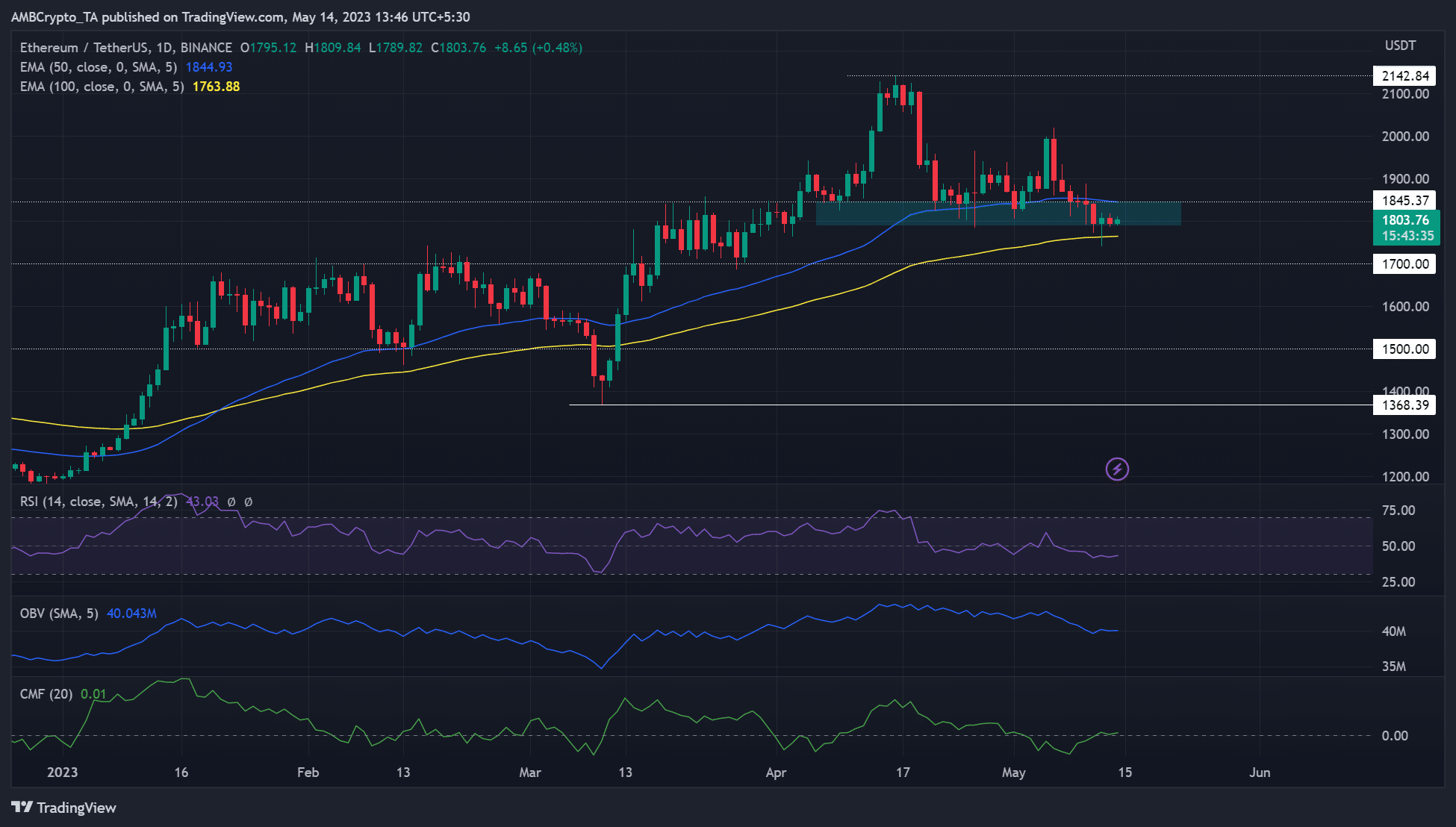

A short-term downside couldn’t be overruled with price action below the 50-EMA (Exponential Moving Average) and the RSI hovering below the 50-mark.

Notably, short-term holders could panic-sell their ETH holdings if market sentiment deteriorates in the coming days/weeks.

ETH’s market structure’s first sign of weakness will be a breach and daily session close below the 100-EMA of $1764 (yellow line). Such a downswing could sink ETH to $1700. The second telltale sign of weakness will be a close below $1700, which could depreciate ETH to $1500.

On the upside, bulls could feel relieved if they push ETH above the 50-EMA of $1845 (blue line). Such a move could fuel hopes of reclaiming the $2000 psychological level and dent any prevailing bearish sentiment.

Meanwhile, CMF (Chaikin Money Flow) hovered near zero after retreating from the negative zone – capital inflows improved but wavered in the past few days. Similarly, the OBV was also flat, meaning demand wavered – suggesting a likely short-term consolidation.

Positive aggregated CVD means …

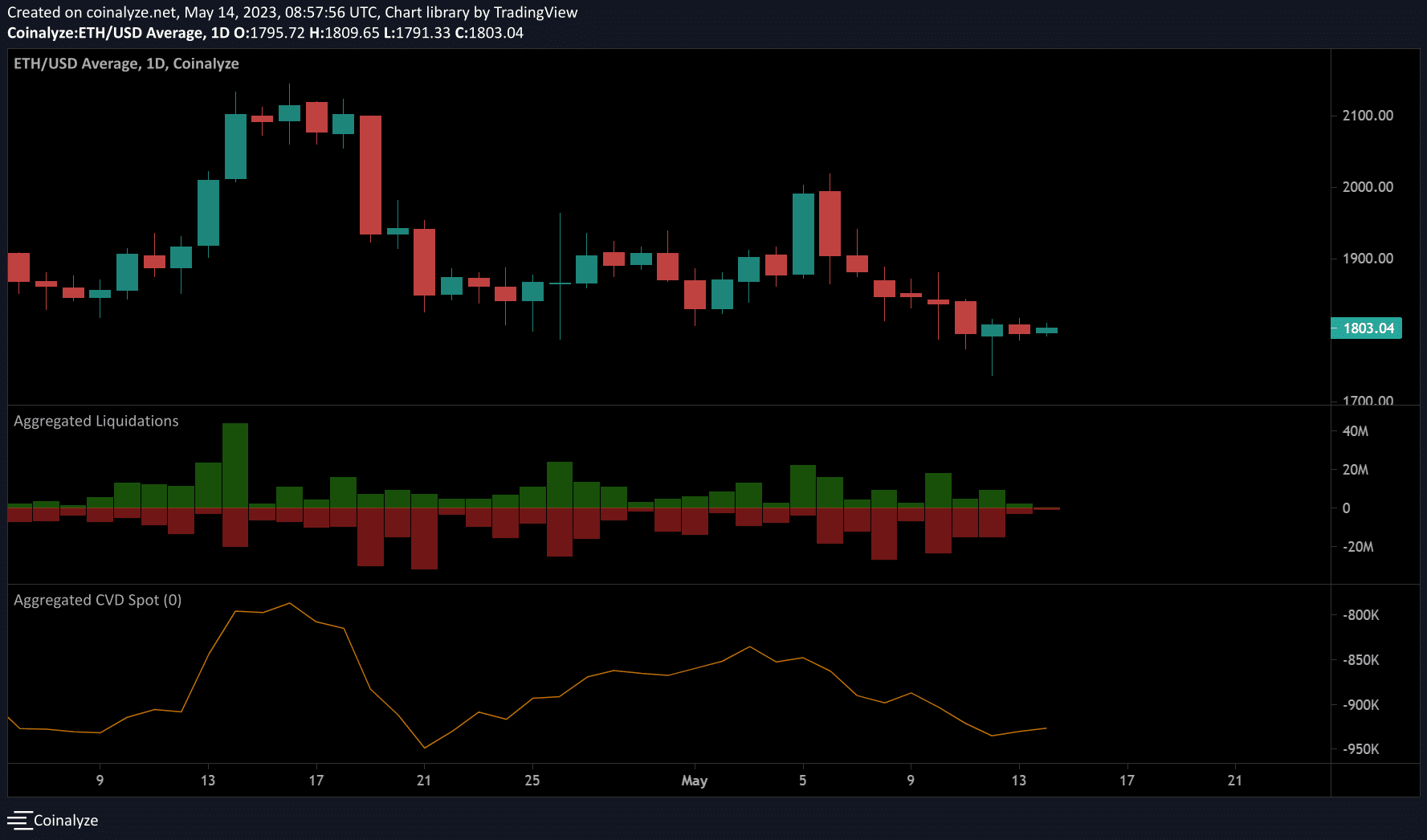

According to Coinalyze, the aggregated CVD (Cumulative Volume Delta) spot, which tracks buyer/seller activities alongside overall sentiment, was positive.

The metric has been negative since 3 May, but flipped to positive on 12 May after the price hit the $1800 support level. It shows buyers have been in charge for the past two days.

How much are 1,10,100 ETHs worth today?

On the liquidation side, long positions worth $2.5 million were wrecked in the past 24 hours, compared to $1.9 million in short positions. This development depicts a mild bearish sentiment that could undermine a strong ETH recovery.

Macro traders following ETH/USDT would want to watch out for the US debt ceiling woes alongside the US Retail Sales data scheduled for Tuesday (16 May), which will affect all USD/USDT pegged assets/pairs.