What caused Ethereum [ETH] to decouple from Bitcoin [BTC]? Details here

![What caused Ethereum [ETH] to decouple from Bitcoin [BTC]? Details here](https://ambcrypto.com/wp-content/uploads/2023/05/Bitcoin-and-Ethereum.jpg.webp)

- The correlation dipped below 80% over the week from ATH levels of 97% at the end of 2022.

- The recent price action of the two coins showed that both have moved on a similar wavelength.

Bitcoin’s [BTC] correlation with Ethereum [ETH] dropped to its lowest level since November 2021, indicating a significant divergence in the growth trajectories of the two blue chip cryptocurrencies in the market.

Read Bitcoin (BTC) Price Prediction 2023-24

Based on a 40-day rolling window, the correlation dipped below 80% over the week, according to market data provider Kaiko. This was a marked departure from the all-time high (ATH) levels of 97% seen during the end of 2022.

#BTC's rolling 30-day #correlation with #ETH fell below 80% this week for the first time since Nov 2021. pic.twitter.com/5DsXQAbexH

— Kaiko (@KaikoData) May 12, 2023

Is Shapella the reason?

As depicted, the correlation between the two cryptos has been falling since mid-to-late March. However, the rift widened after the much-awaited Shapella Upgrade went live in April, bringing some improvements unique to Ethereum.

Interestingly, a similar event in September 2022, known as the Merge, which kickstarted Ethereum’s transition to a proof-of-stake (PoS) blockchain, failed to bring about a considerable decoupling between the two assets.

But the recent Shapella Upgrade closed the loop on some of the key aspects of the transition that couldn’t make it to the Merge last year, thus positioning Ethereum as a full-fledged PoS network.

It is important to understand that both the assets function very differently from each other.

While Ethereum is often used as a platform for the development of decentralized applications (dApps) and smart contracts, Bitcoin is primarily used as a store of value and a means of payment.

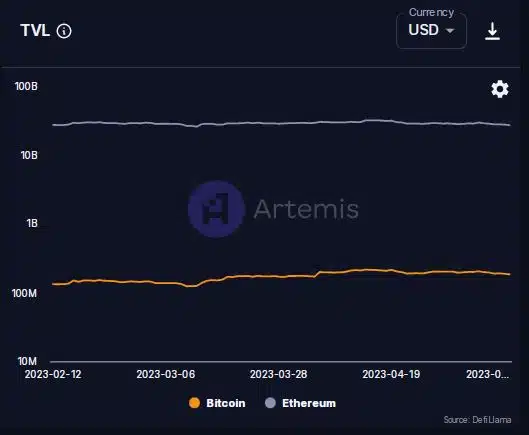

Infact, by virtue of being a chain which hosts numerous applications, the total value locked (TVL) on Ethereum was a whopping $27 billion at the time of writing. In contrast, Bitcoin held assets worth only $183 million.

What can be the implications?

As per a 21 April report by Coinbase, lower BTC-ETH correlation makes a case for portfolio diversification as holding both the assets can result in higher returns. As for institutional investors, the trend could impact their trading strategies like cross-hedging.

Read Ethereum (ETH) Price Prediction 2023-24

Having said that, recent price action of the two coins showed that both have moved on a near identical wavelength. Earlier this week, BTC’s crash fueled by a false rumor created ripples in the broader crypto market and ETH didn’t go unscathed.

According to CoinMarketCap, BTC was down 8.48% over the last week while Ethereum’s weekly losses were 6.44%.