Ethereum [ETH]: With the Merge just a few days away, here’s all you should know

With Ethereum 2.0 underway, the transition into a Proof-of-Stake Network for the Ethereum [ETH] blockchain is about to become a reality. Users and developers are excited over the developments this upgrade will usher into the network. With the merge on Ropsten scheduled for 8 June, the whales appear to be gearing up for a pump in price that might follow the merge.

According to data from Glassnode, the number of addresses holding 32+ Ether Coins just reached a 13-month high of 111,292 addresses. A previous 13-month high of 111,285 was observed on 3 June. This shows that as the day of the Ropsten merge draws nearer, more people continue to accumulate this altcoin.

At the time of press, data from the same source also showed that the number of addresses holding 1+ Ether Coins had taken on a steady increment since 31 May. At the time of writing, the figure stood at 1,485,908 addresses. This means that the big and small whales alike, continue to accumulate the token ahead of the merge.

What else do we know?

Still Below the $2K Position

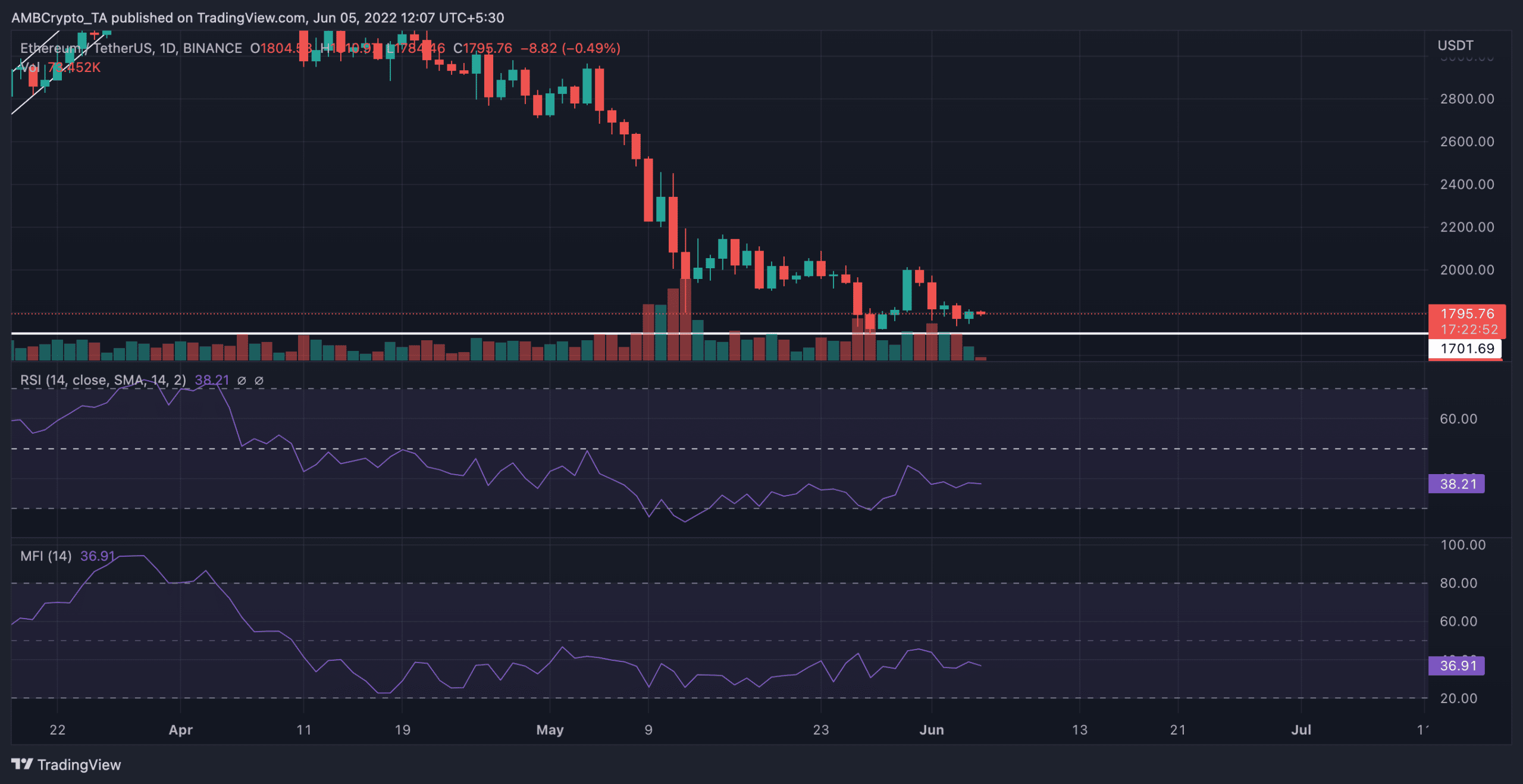

Few weeks ago, as the value of Bitcoin [BTC] fell and the largest cryptocurrency failed to hold its strategic $30k mark, the price per Ether token was terribly impacted as the coin also fell below its $2k position. With just a 1.28% spike recorded in the last 24 hours, the token exchanged hands at $1,794.24 at press time.

With price marked by a red candle stick at the time of writing, the Relative Strength Index (RSI) and the Money Flow Index (MFI) for the Ether coin remained below the 50 neutral region. Delving into the oversold position, the RSI was on a downward curve at press time and was pegged at 38.16.

Similarly, the MFI also stood at 36.91 at the time of writing. It was interesting to note that both indicators have since been below the 50 neutral mark since 6 April following the commencement of the bloodbath that plagued the crypto market.

With a meager 1% spike in price in the last 24, trading volume within the same time frame dropped by 43.74%. This hints at increased distribution within the time under review and price may plunge further downwards.

At press time, the market capitalization for the Ether token stood at $217.36 billion. This represented a 50% drop from the $438.13 billion registered at the beginning of the year.

On-Chain Analysis

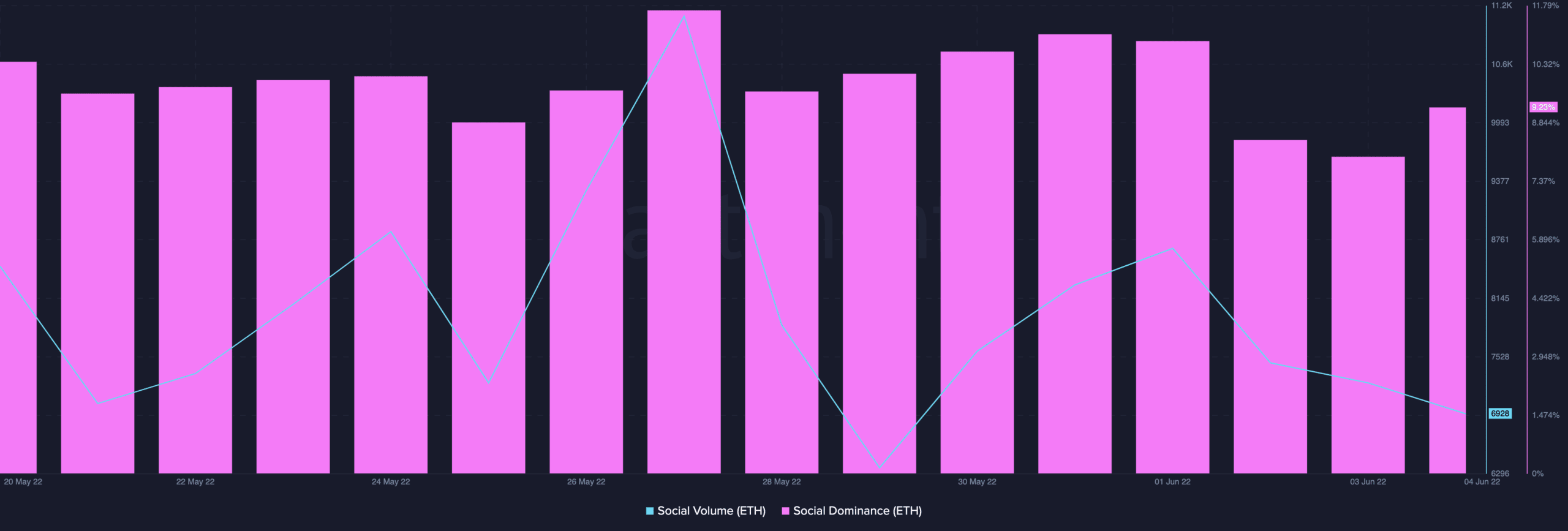

A review of more data from the chain as the talks of the coming merge get louder revealed that the Ether token is generating more buzz on the social front. The key metrics for measuring this – Social Dominance and Social Volume – have been recording high figures. At press time, the Social Dominance stood at 9.23%. On the other hand, the Social Volume marked its spot at 232.

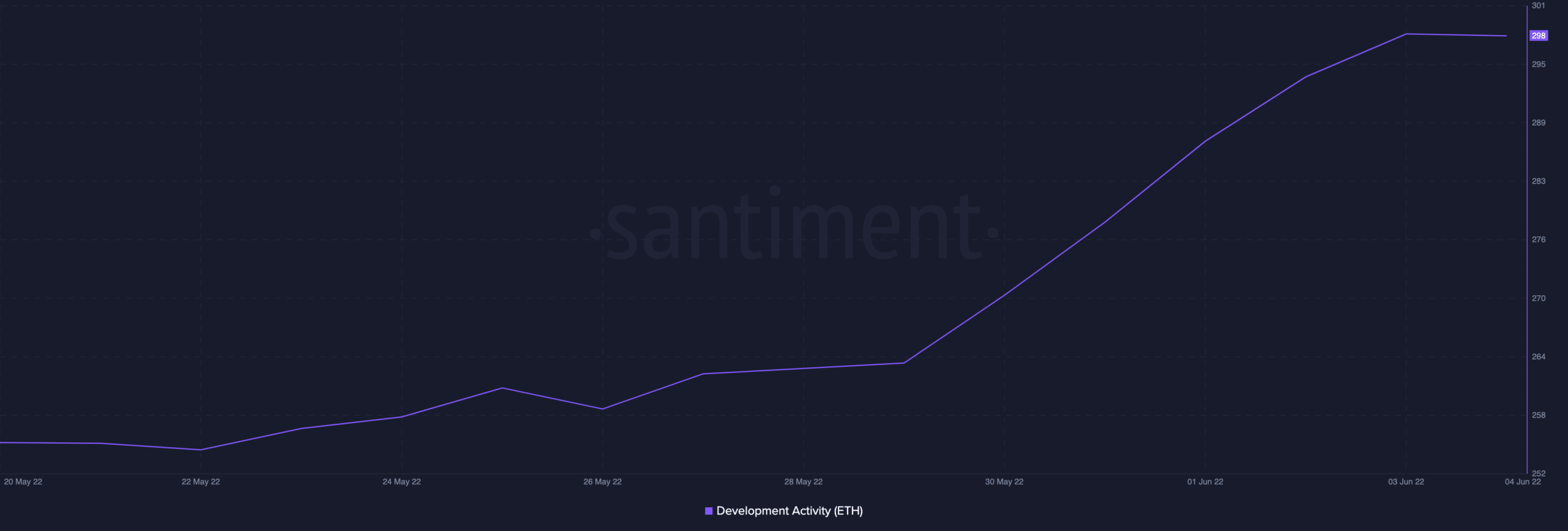

Similarly, standing at 51 at press time, the index for Development Activity for the coin has been on a steady rise since 31 May.

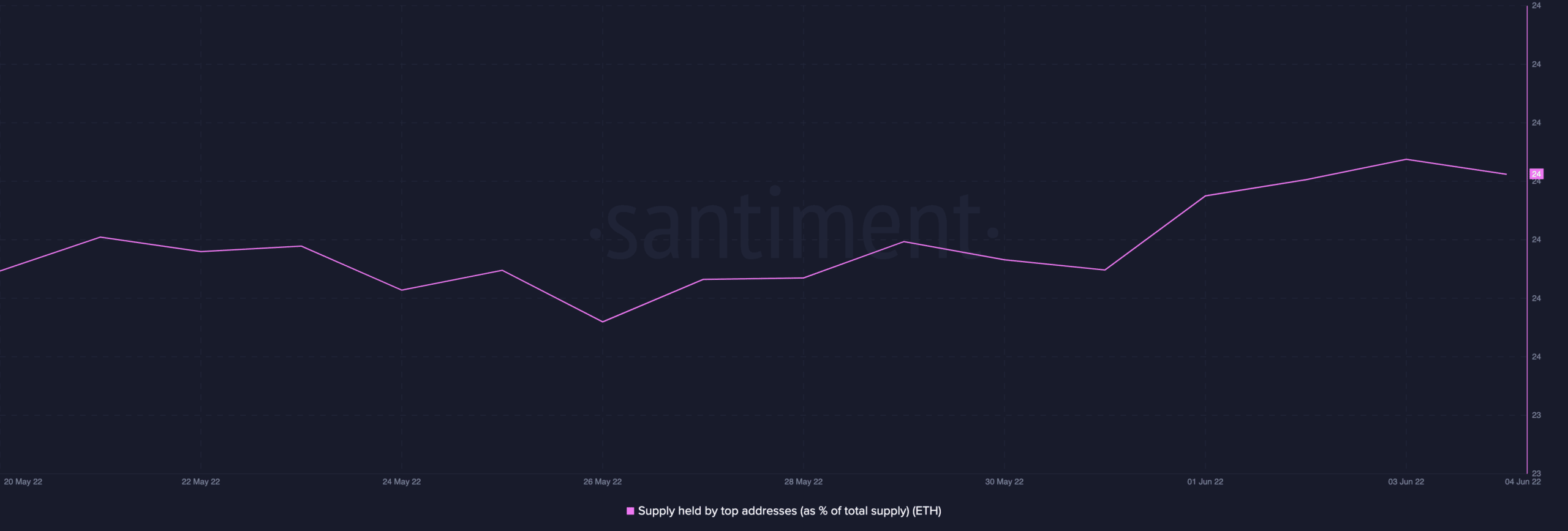

In addition to this, as the merge draws nearer, the percentage of the total number of Ether tokens held by 10 top addresses on the network was also on a steady rise. At the time of press, this was pegged at 24% of the Ethereum’s total circulating supply.