Ethereum’s potential December drop – Can whales turn things around?

- Ethereum mirroring past patterns is an indication of a potential drop.

- More than 73% of ETH whales are still holding their positions.

Ethereum [ETH] has been mirroring past market patterns as the end of 2024 approaches, with traders watching closely for any potential price drops.

In 2016, ETH saw significant drops in April, August, and December.

This year, the cryptocurrency has already experienced declines in April and August, leading analysts to speculate that a similar drop could happen before year-end, possibly in December.

While patterns suggest a dip, the key level to watch is $2,800. If Ethereum can break and holds above this, a deeper dip may be avoided.

However, failure to move towards the $2800 level could see ETH test the $2300 mark then $2000 before year-end.

ETH/BTC pair’s inability to break above the 50-day SMA

Another key factor is the ETH/BTC pair’s inability to break above the 50-day simple moving average (SMA).

In previous cycles, once ETH/BTC moved above this SMA, a strong bullish move followed. This hasn’t happened yet, which suggests the low might not be in place.

Past patterns support the idea that traders are often too eager to flip bullish without waiting for confirmation.

Currently, competition from other platforms like Solana and inherent ecosystem challenges are adding bearish pressure on Ethereum.

Based on the current price action, Ethereum may have further downside ahead.

Traders looking to capitalize on this could consider short positions, as more declines seem likely.

At the same time, the Ethereum Foundation has continued to take profits, with recent sales of 100 ETH contributing to the bearish sentiment.

Whales remain long

Despite these similarities, Ethereum has undergone major changes since 2016, including the Merge and 4844 upgrade, making it fundamentally different.

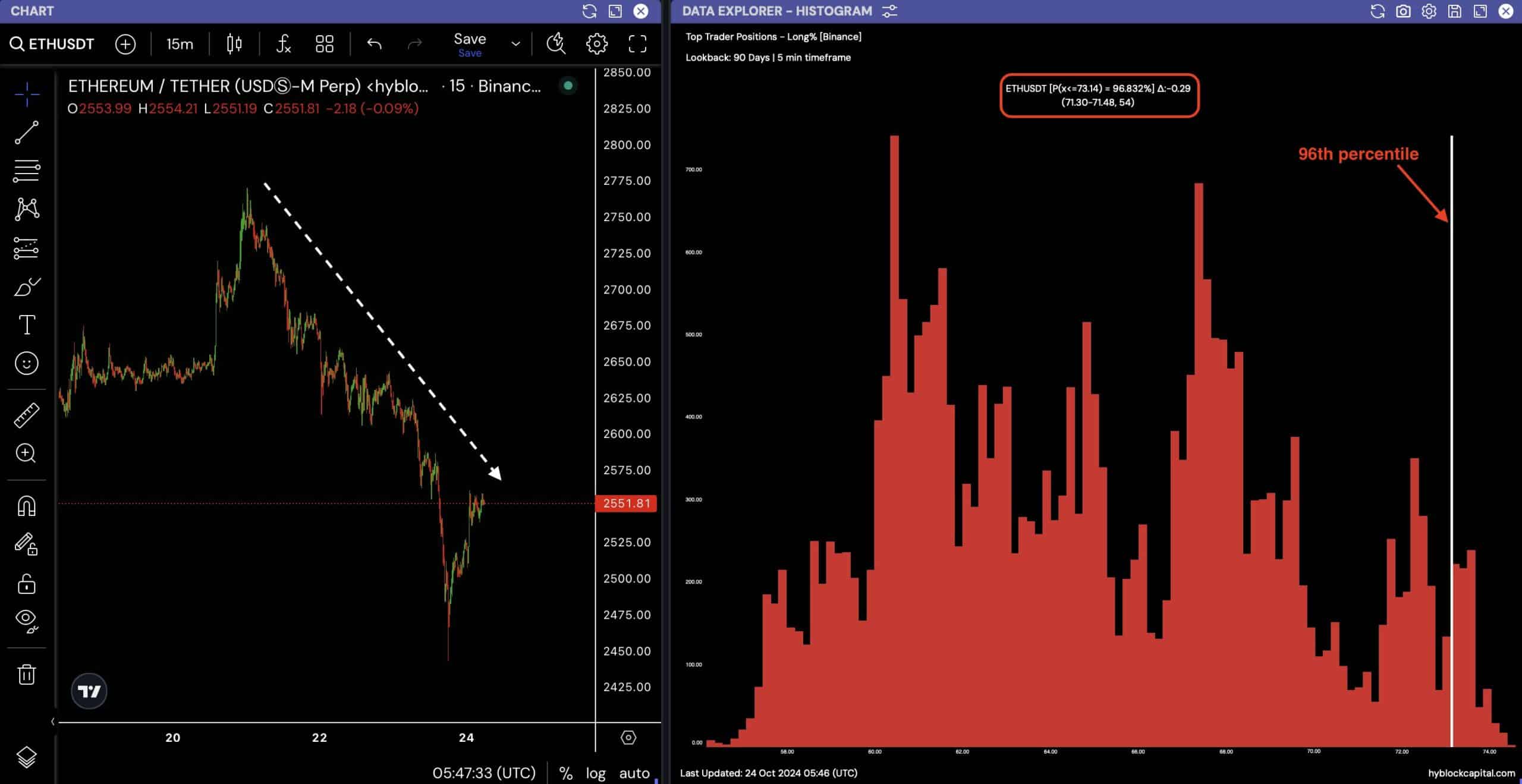

Despite the ongoing downtrend, whale activity shows little change.

Data from Binance indicates that 73.14% of accounts still hold long positions on Ethereum, reflecting confidence in its long-term prospects.

While the short-term outlook may be bearish, these large holders suggest that there is still belief in a recovery.

Once the price stabilizes and both ETH/USDT and ETH/BTC establish their bottoms, traders could find strong buying opportunities for the long term.

While Ethereum may face one more drop before the end of 2024, its long-term outlook remains optimistic.

Read Ethereum’s [ETH] Price Prediction 2024–2025

Traders should stay cautious in the short term, but the potential for a recovery offers promising opportunities for those looking to go long once a confirmed bottom is in place.

ETH’s price trajectory remains one of the most closely watched in the crypto space as the year winds down.